U.S. Economy: This Time Is Different - Is It?

In our analyses, we regularly examine current movements, identify possible influencing factors and assess the general market situation. However, these are not recommendations, but merely opinions and food for thought.

Hello dear readers!

The stock market wants lower interest rates - or rather, it has been expecting them for months. Justified? The US economy looks very robust, so higher interest rates would actually be the order of the day.

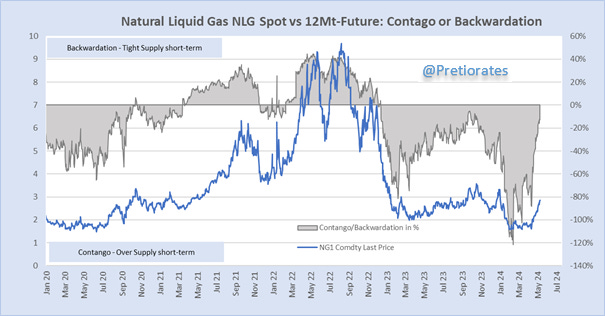

Energy prices give a very good impression of how strong the economy is. The price of gas on the futures market is currently heading into backwardation, which indicates tension on the spot market. The fact that supply is currently rather tight could have something to do with the sanctions against Russia....

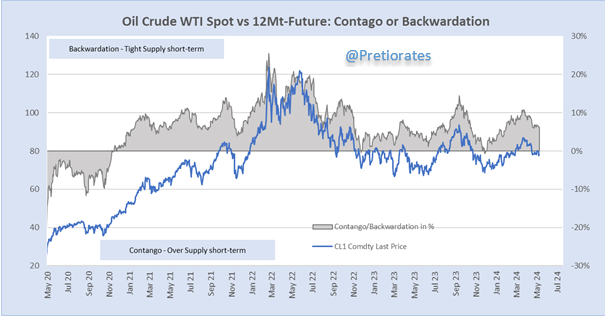

Or the oil market: It is already in backwardation, which shows how tight supply is at the moment. However, OPEC is also artificially limiting supply. This does not give us a reliable indication…

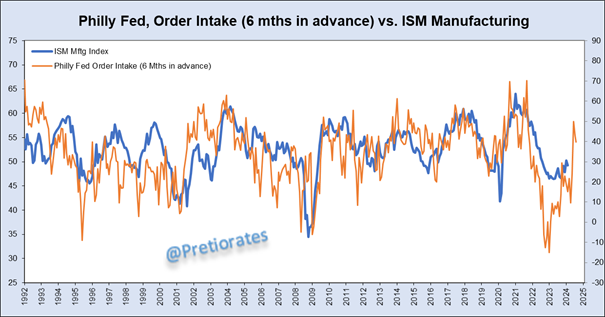

The ISM Manufacturing Index is a closely watched indicator. This has recently stabilized at a low level and is likely to be published in the first few days of June. A leading indicator of the ISM Manufacturing Index is the Philly Fed Order Intake. This recently indicated a strengthening economy - which would not speak in favor of lower interest rates...

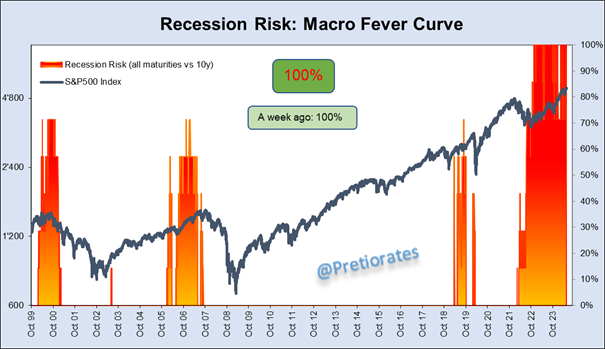

Several numbers of economic data are summarized in our 'Macro Fever Curve' and this continues to point to a 100% risk of a coming recession...

Several indicators with short term inputs are summarized in the 'Heart Beat'. This shows that the risk of recession has recently risen again from 83% to 86%... check the history of this indicator…

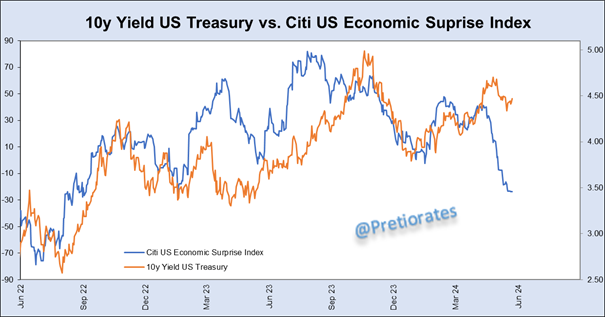

Indeed, the sharp fall in the Citi Economic Surprise Index points to downside risks to Treasury yields. This index gives us the information that the most recently published economic figures were weaker than expected...

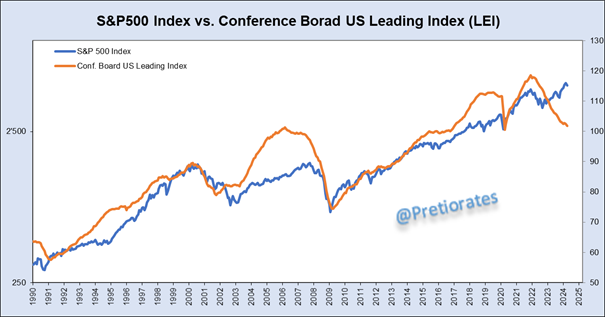

Another economic indicator with a long-term perspective is the 'Conference Board US Leading Index' or 'Leading Economic Index (LEI)', which is calculated from ten different economic key figures and indicates important turning points in the economic cycle. The Biden administration is unlikely to be pleased with its development in the run-up to the elections. Wall Street is still (?) ignoring its development...

One gets the impression that the long-term accurate indicators are giving the wrong inputs this time. But is it really different this time?

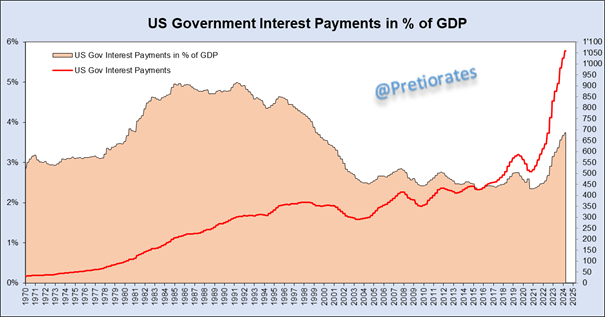

Speaking of the Biden administration: interest payments on the new government debt are exploding. In relation to GDP, however, they are still clearly lower than 50 years ago...

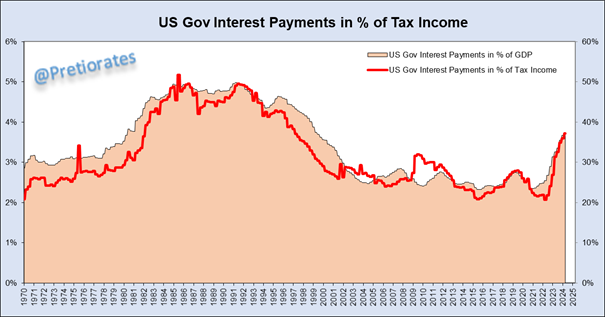

Even in relation to US tax revenues, they have not yet reached the level of the 1980s... there is still upside potential...

More By This Author:

The Futures-Market Tells Us A Long StoryPrecious Metals And Base Metals Out Of Control

Chapter 2 Should Start With Precious Metals

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more