U.S. Dollar Index Takes A Step Down After FOMC Rate Hold

Image Source: Pixabay

The US Dollar Index (DXY) whipsawed on Wednesday after the Federal Reserve's (Fed) Federal Open Market Committee (FOMC) kept interest rates unchanged, as investors had broadly expected. The Greenback continues to churn in a long-tailed midrange near the 98.60 region as traders await Fed Chair Jerome Powell's upcoming press conference and follow-up Q&A session.

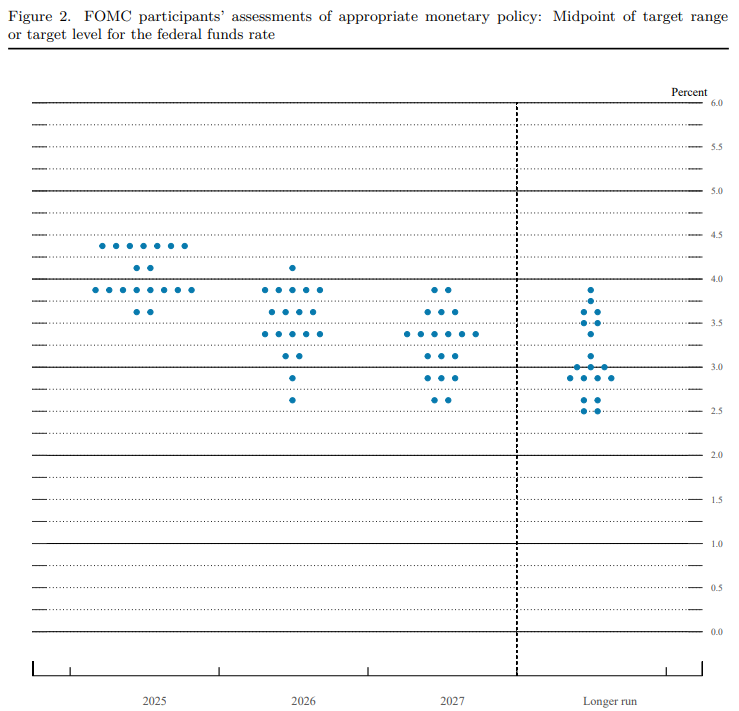

The Fed still sees an average of 50 basis points in interest rate cuts by the end of the year, following closely with what is priced in according to the CME's FedWatch Tool; however, ongoing trade policy uncertainty has pushed the spread of policymaker rate expectations wider, with some Fed personnel seeing higher year-end rates compared to the previous Summary of Economic Projections (SEP).

(Click on image to enlarge)

Market reaction

The US Dollar Index is slightly lower following the FOMC's rate call and dot plot update. US Dollar positioning overall is largely unchanged on the day as investors await Fed Chair Powell's press conference and the following Q&A session.

Dollar Index 5-minute chart

(Click on image to enlarge)

More By This Author:

Canadian Dollar Finds Yet Another Eight-Month Peak As Greenback Recedes Further

Canadian Dollar Continued To Ride Greenback Weakness To New Highs

GBP/USD Taps Fresh 40-Month High On Renewed Greenback Softness