US Dollar, Gold, Crude Oil In Focus With Volatility On The Rise

Market volatility looks rekindled as the VIX soars and stocks drop sharply. Climbing measures of cross-asset volatility highlight how trader sentiment has started to show signs of deterioration. This follows the latest FOMC announcement, which was accompanied by a cautious tone from Fed Chair Powell, particularly when the central bank head discussed the risk that the labor force likely faces lasting structural damage amid 20-plus million Americans unemployed abruptly.

Appetite for risk has also softened considerably alongside a re-acceleration in the trend of new coronavirus cases and hospitalizations. If sustained, governments might threaten to impose strict lockdown measures again and consumer confidence could collapse again. These recent developments have presented bullish tailwinds to popular safe-haven assets – like the US Dollar.

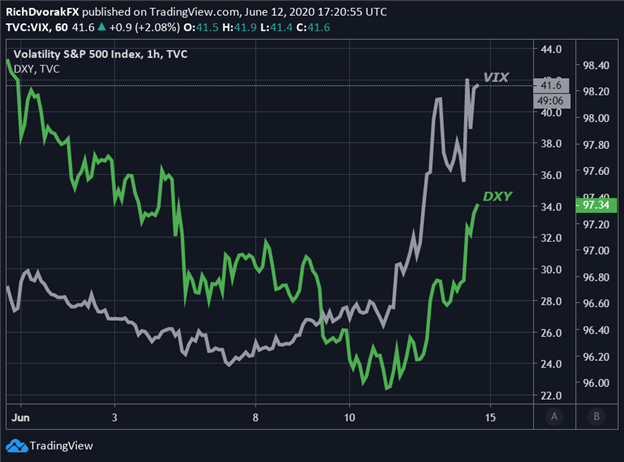

VIX INDEX & US DOLLAR PRICE CHART: 1-HOUR TIME FRAME (29 MAY TO 12 JUN 2020)

Chart created by @RichDvorakFX with TradingView

The US Dollar has ricocheted higher by about 1.5% over the last two trading sessions. As indicated by the DXY Index, US Dollar price action has rebounded broadly and follows skyrocketing measures of volatility such as the VIX Index. The US Dollar reversal higher could gain pace if risk aversion intensifies and currency volatility continues to climb.

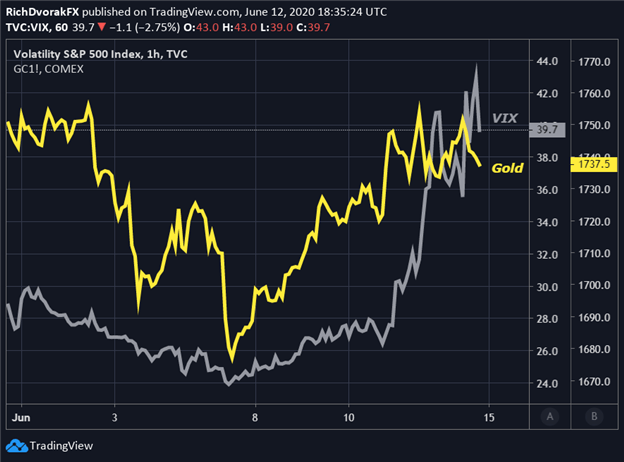

VIX INDEX & GOLD PRICE CHART: 1-HOUR TIME FRAME (29 MAY TO 12 JUN 2020)

Chart created by @RichDvorakFX with TradingView

Gold prices have similarly enjoyed the latest return of risk aversion. The precious metal also likely benefits from central bank interest rate outlook anchored to zero for the foreseeable future. Cracking market sentiment and soaring cross-asset volatility could steer investors toward bullion and help bolster the price gold.

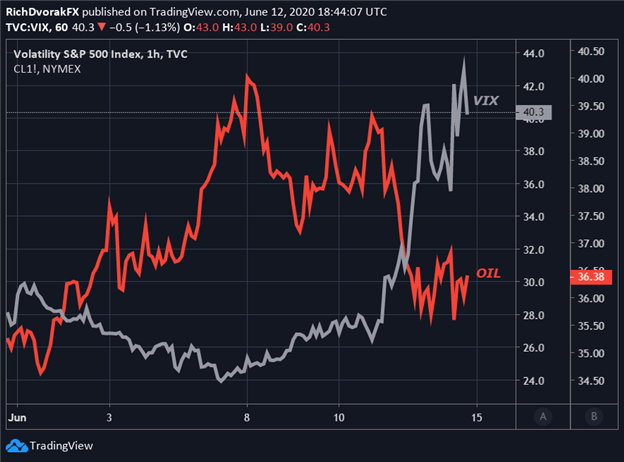

VIX INDEX & CRUDE OIL PRICE CHART: 1-HOUR TIME FRAME (29 MAY TO 12 JUN 2020)

Chart created by @RichDvorakFX with TradingView

Crude oil price action has crumbled nearly 10% since the commodity hit resistance the 40.00-handle earlier this week. The price of crude oil, which is generally sensitive to risk sentiment and global GDP growth expectations, tends to hold an inverse relationship with market volatility.

Correspondingly, crude oil bulls have struggled to maintain a bid under the pro-risk commodity. The direction of crude oil might continue mirror the VIX ‘fear-gauge’ and provide a bellwether for safe-haven demand in turn.