US Corn Stocks Are Lower & Beans Are Higher But Weather Is King

Market Analysis

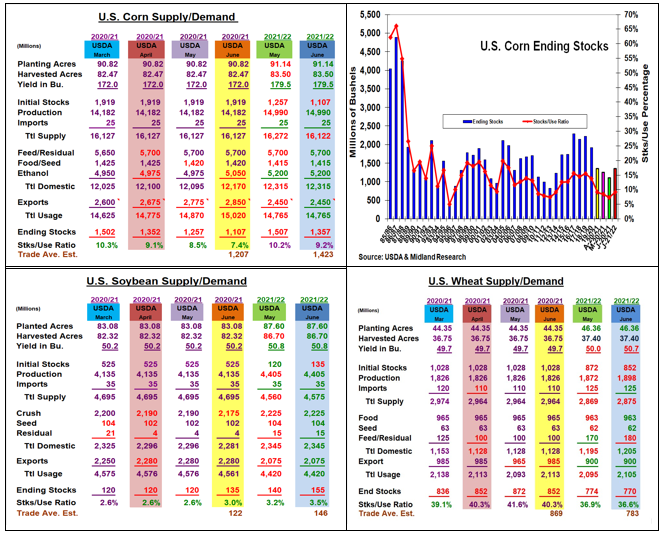

The USDA’s latest monthly crop and supply/demand reports had some curves. The World Board didn’t adjust corn or soybeans 2021 US areas or yields which is normal, but they did make some old-crop demand changes that were a bit more dramatic than expected. Brazil’s 2021 corn output was cut, but their decline was only 3.5 mmt vs ideas of 5-6 mmt change because of the past month’s dry weather in the Center-West regions of the country. June’s 26 million bu. higher US winter wheat output didn’t startle this market, but no change in the US spring wheat size did catch some off guard given the N Plains drought. Normally, this crop’s yield & area don’t change until after the June 30 US acreage updates each year.

Image Source: Unsplash

The USDA did up corn’s 2020/21 ethanol June demand, but the amount was 75 million bu. to 5.05 billion. They also increased overseas demand by 75 million bu. which cut corn’s ending stocks by 150 million to 1.107 billion bu., 100 million less than expected. Interestingly, corn’s current old-crop stocks-to-use level slipped from 8.45% to 7.37% this month. This is slightly less than 2012’s final level of 7.41%. These smaller ending stocks also impacted corn’s 2021/22 stocks by a similar amount to 1.357 billion bu.

Recent sluggish US crush activity did prompt the USDA to cut this demand of 15 million bu. However, the World Board also left the US bean exports unchanged when they upped Brazil’s crop by 1 mmt to 137 mmt this month. This prompted these oilseed stocks to increase to 135 million bu: small size but larger than expected.

Higher Hard red yields (lead by a 4-bushel jump in KS) advanced this variety’s output by 40 million to 771 million this month. Soft red’s yields in ECB were slightly higher while the SE had lightly lower yields resulting in this variety being up just 3 million bu to 335 million. The year’s PNW dryness cut white wheat’s crop by 18 million to 202 million, the low- est output since 2015’s 185 million bu. crop. Old crop’s ex- ports were also upped by 20 million bu. compensating for this month’s 26 million larger overall US crop.

What’s Ahead

June’s 2020/21 USDA balance sheet changes have impacted corn & soybean prices. However, the market’s focus will quickly return to the weather in WCB and US Plains, Canada and the Black Sea given the importance of the crop prospects in these areas. Hold old-crop corn & bean sales at 90-95% & new-crop at 20-25%. Up wheat sales to 35% at $7.20 & $6.60 July prices in Chicago & KC.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more