US Budget Deficit Soars 77% As Federal Interest Expense Hits Record High

Another month, another frightening jump in the US budget deficit.

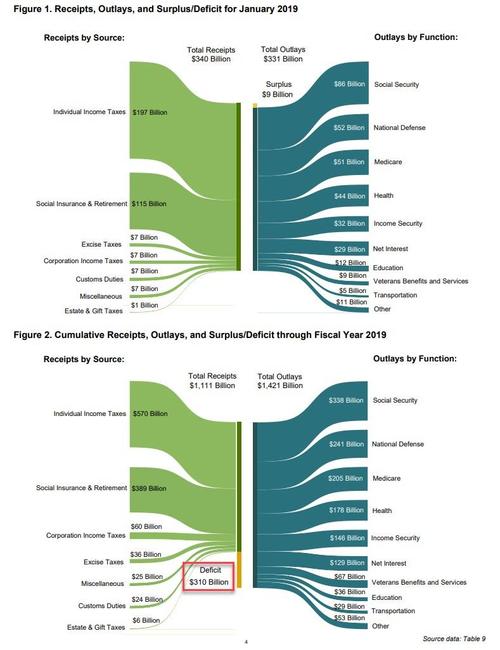

According to the latest Treasury data, the US budget surplus in January - traditionally one of the few surplus months of the year due to its tax receipts timing - was only $9 billion, badly missing the $25 billion surplus expected, and far below the $49 billion surplus recorded last January; it was the smallest January gain since 2015.

As a result, the budget deficit for the first four months of the fiscal year, widened to $310 billion, a whopping 77% higher than the $175.7 billion reported for the same period last year, largely the result of the revenue hit from Trump's tax cuts and the increase in government spending. The deficit was the result of a 2% drop in fiscal YTD receipts to $1.1 trillion, while spending jumped 9% to $1.4 trillion.

(Click on image to enlarge)

The jump in the deficit was despite the bump in customs duties, which almost doubled to about $24.5 billion this fiscal year from $12.6 billion a year ago, reflecting the Trump administration’s tariffs on Chinese imports.

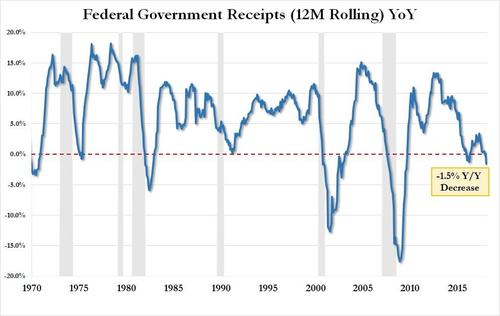

What was more concerning perhaps is that rolling 12-month receipts declined 1.5% Y/Y, after posting a 0.4% drop last month which marked the first decline since March 2017. Worse, the absolute drop in tax receipts, which declined for both corporations and individuals, was the biggest since the financial crisis; and, as shown in the chart below, every time that receipts have posted an annual decline, a recession either followed shortly or had already arrived.

(Click on image to enlarge)

Unfortunately, since receipts are set to decline even more in the coming months, the overall budget deficit is set to widen further in the coming years as the Republican tax cut package and increased spending for defense and other priorities boost government outlays. Some policymakers and economists are flagging concern about the growing debt burden, saying it risks America’s credit quality among borrowers, while other economists see more room to run.

According to the CBO, the budget deficit in fiscal 2019 will widen to $897 billion, up by $118 billion from a year earlier; any economic recession will result in a far greater number.

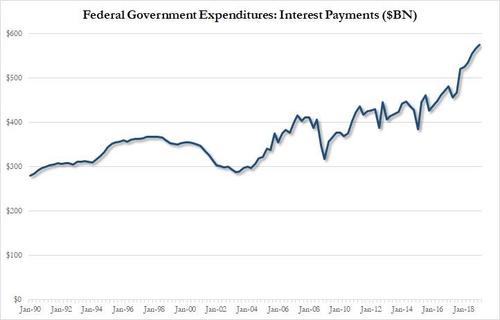

Finally, and perhaps most concerning, is that for the first four months of this fiscal year, interest payments on the U.S. national debt hit $192 billion, $17 billion, or 10% more than in the same four-month period last year and the most interest ever paid in the first third of the fiscal year. As Reuters' Jeoff Hall points out, annualizing the $192BN interest expense means that the interest on U.S. public debt is on track to reach a record $575 billion this fiscal year, more than the entire budget deficit in FY 2014 ($483 BN) or FY 2015 ($439 BN), and equates to 2.7% of estimated GDP, the highest percentage since 2011.

(Click on image to enlarge)

And since total debt, which recently surpassed $22 trillion is only set to keep rising - once the latest pesky debt ceiling issue is resolved in a few months - expect interest on the debt to keep rising, especially if the Fed reverts to its tightening trajectory, and hit $1 trillion per year in a few years, making it one of the biggest spending categories, and on pace to surpass total US defense spending (roughly $950BN per year) in dollar terms in just a few years.