US Bonds Rise As Risk-Off Sentiment Strengthens

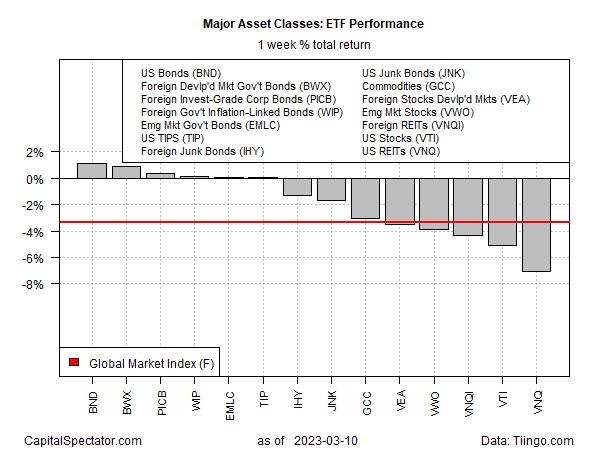

Government bonds recovered last week, leading the risk-off trade in global markets amid the second-largest bank failure in US history on Friday.

The collapse of Silicon Valley Bank (SIVB) raised the appetite for safe havens, led by US bonds, the top performer for the major asset classes, based on a set of ETFs through last week’s close (Mar. 10).

Vanguard Total US Bond Market Index Fund (BND) rose 1.1%. The ETF, which holds roughly two-thirds of its portfolio in government securities, is up for two straight weeks–the first back-to-back rally since January.

Demand for government bonds is expected to remain strong this week after a second bank was closed by regulators on Sunday. Two days after SVB was shut down, regulators seized New York regional bank Signature Bank, which is the third-largest bank failure in US history.

Risk assets generally lost ground last week. The biggest setback: US real estate shares. Vanguard Real Estate Index Fund (VNQ) tumbled 7.0%, reversing all of the ETF’s year-to-date gains and more.

The Global Market Index (GMI.F) declined last week, falling 3.4% — the third weekly decline in the past four. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

All the major asset classes remain in the red for the trailing one-year trend. The deepest one-year loser: global real estate shares ex-US via Vanguard Global ex-US Real Estate Index Fund (VNQI), which closed down 19.6% on Friday vs. the year-ago level after factoring in distributions.

GMI.F is also in the red with an 8.2% loss over the past 12 months.

Comparing the major asset classes through a drawdown lens continues to show relatively steep declines from previous peaks for markets around the world. The softest drawdown at the end of last week: US inflation-indexed Treasuries (TIP), which ended the week with an 11.3% peak-to-trough loss.

More By This Author:

Median US GDP Estimate For Q1 Ticks Slightly Positive

The Best Solution For Reducing Noise In Recession-Risk Estimates

Markets Continue To Flirt With Risk-On Signals

Disclosure: None.