US Beef Prices Hit Record High As Nation's Cattle Herd Expected To Shrink Through 2025

Brazilian processor Marfrig Global Foods SA warned the US cattle herd will continue shrinking through the midpoint of the decade. Less supplies will pressure meatpackers and keep the prices of steak and hamburgers at elevated levels.

During a conference call, Tim Klein, the head of Marfrig's North American operation, explained the availability of fattened animals for meatpackers to slaughter and process should trough between 2025 and 2026. He said this is because ranchers have not yet started keeping cows for breeding.

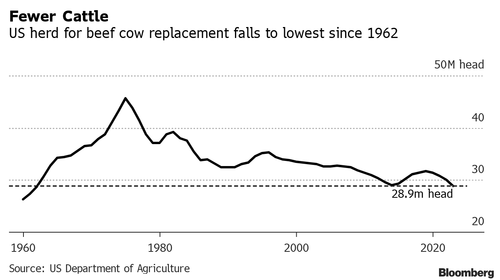

As we've noted, years of drought and high feed costs forced ranchers across the Midwest to send the cows to slaughterhouses, leading to a sharp reduction in the nation's overall herd size. In January, the beef cow herd size was the smallest since 1962.

Tight supplies of cattle have hurt the profits of meatpackers, including Tyson Foods Inc. and JBS SA:

National Beef Inc., Marfrig's US unit, saw adjusted earnings before items such as taxes and interest more than halve in the third quarter from a year ago to $150 million, according to a statement from the company on Monday. Tyson Foods Inc. and JBS SA posted results earlier that were largely affected by lower profits in their US beef operations. -Bloomberg

Declining cattle numbers also sent US beef prices at the supermarket to record highs.

Also, US beef exports are forecasted to slide 14% this year from 2022 to 3 billion pounds, the lowest since the early days of the Covid pandemic when plant closures crushed meatpackers. The USDA warned US beef production is expected to decline further next year.

Last week, Pete Bonds, a Texas-based cattle producer, told Reuters, "The future of this industry is not here in the United States."

Food inflation remains sticky. And soon, beef will be a luxury only the rich can afford. As for the working poor, Tyson plans to build a new insect plant in 2025.

More By This Author:

Lucid Lost $227,000 Per Car Sold In Q3Bonds & Stocks Shrug At Moody's USA Credit Rating Downgrade, Oil & Gold Bounce

US Consumers Trim Inflation Expectations, Turn Most Bearish On Stocks In One Year

Disclosure: None