U.S. Banks: The Good And The Bad

Emergency Fed support for banks is at Great Financial Crisis proportions on some measures. Deposit flight from smaller banks remains a worry to boot. It should not be, but is. That said, there is wider evidence pointing to no material rise in angst at a regional level in the past week. It's early days, and things can still turn sour. But a silver lining it is.

![]()

It’s been two weeks since Silicon Valley Bank went down. The question now is where are we? And more importantly, where are we going to?

When Lehman Brothers went down on 15 September 2008 we were already at a deep stage of the subprime crisis. The troubled Bear Stearns had been taken out by JP Morgan six months prior to that, and the Federal Reserve was already in rate-cutting mode. Here, we are at the early stage of some banking sector naval gazing at a minimum, and facing worries on the stickiness of deposits in the smaller banks. If we add all those small banks up they quickly become systemic, which is why they have our full attention. Which is why their deposits are now implicitly insured. But if there is deposit flight regardless, then such banks will (have to) disappear. Not our base case, but that would be a painful process, effectively a managed crisis.

Silicon Valley Bank, while not small, was nowhere near as systemic as Lehman’s was. It’s balance sheet was also far less complex, and counterparty linkages less damning. The same can be said of First Republic Bank, which has received a dig-out deposit boost from the larger US banks but remains under considerable pressure. Deposit flight is a risk for most banks, and especially for the smallest ones right now; significant flight has already been seen.

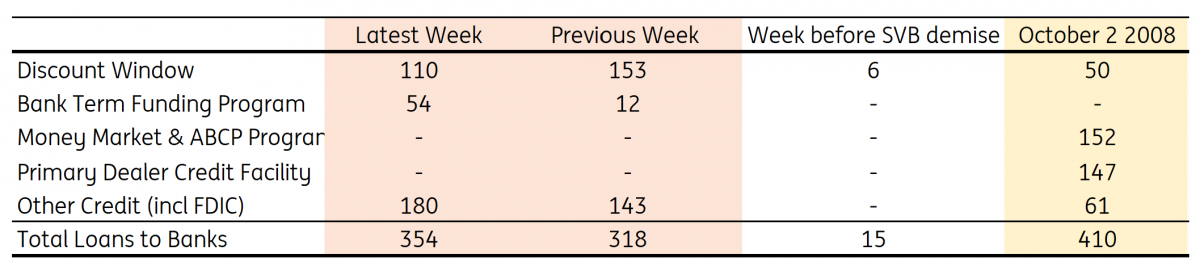

While we can hypothesize on what’s to come (and we will), let’s first look at the evidence coming from take-up of the Fed’s exceptional liquidity measures. Here, there is good news and bad news. Let’s take the bad first. Data released on Wednesday show that loans provided by the Fed to banks rose to US$354bn. That’s up from US$15bn before Silicon Valley Bank went down. It’s also historically high, comparing with a peak of US$440bn seen during the Great Financial Crisis.

There are also some differences versus 2008. Back then, most of the loan support was through the Primary Dealer Credit Facility (which provided overnight liquidity to primary dealers) and the Money Market Mutual Fund Facility (basically helped money market funds meet some redemptions and boosted liquidity in the asset backed commercial paper market). Here the focus was on the functioning of the repo and money market funds. The very heartbeat of the system was in threat. A very different dynamic to today.

Federal Reserve support almost as high as during the Great Financial Crisis (US$bn)

(Click on image to enlarge)

Source: Macrobond, Federal Reserve, ING estimates

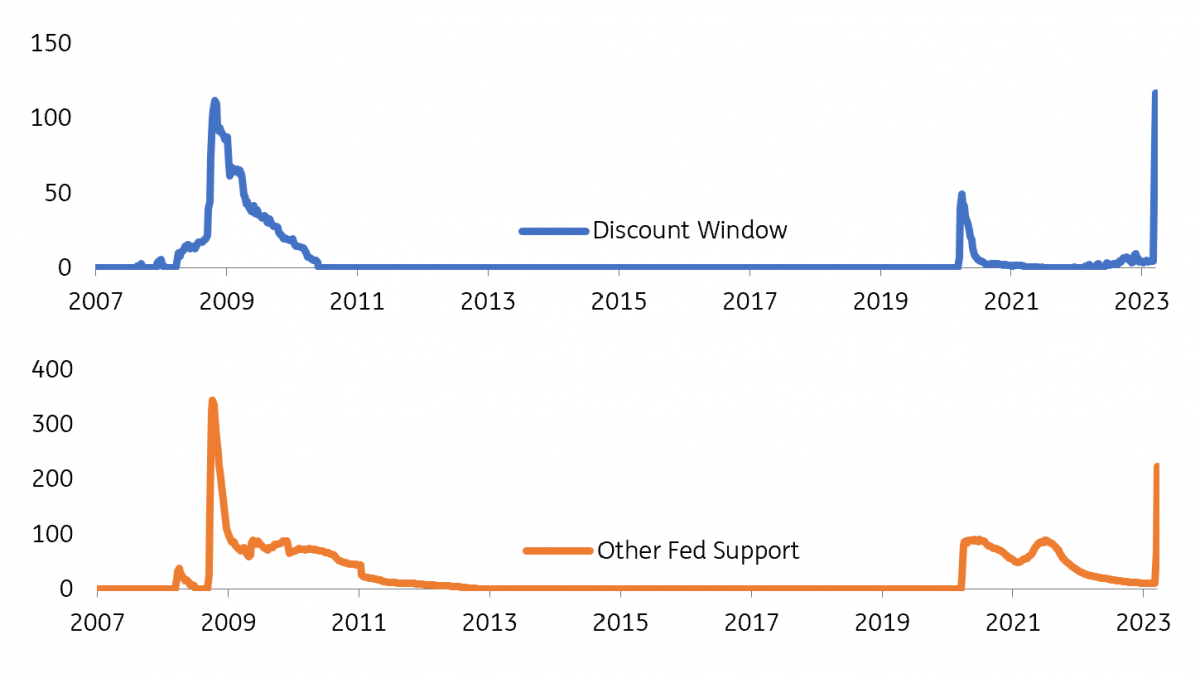

Fast forward to today, and the breakout of the US$354bn lent is very different. Some US$110bn has been provided through the discount window. This is the traditional means by which banks can access emergency liquidity. This had typically been provided at emergency terms too, but the Fed softened these and extended the available tenor. The volumes here are similar to the peaks seen during the Great Financial Crisis (peaked at US$117bn at end-October 2008). The good news is the latest number is in fact down from the US$153bn drawn in the previous week, which suggests a calming (even if that was a calming from the highest Discount window drawdown on record).

At the same time, use of the new Bank Term Funding Program rose to US$54bn, up from US$12bn in the previous week (the first week of its existence). This facility is an alternative to the Discount window, the major differences being a 12-month tenor and better pricing terms. It’s a means to liquifying hold-to-maturity bond portfolios, and even sub-par priced bonds get liquidity back priced at par (the bond redemption value). Basically, the fall in the use of the Discount window was offset by a rise in the use of the Bank Term Funding facility.

The silver lining is that in the past week there was no perceptible increase in the use of emergency funding facilities.

Recourse to Discount Window and other facilities (US$bn)

Source: Macrobond, Federal Reserve, ING estimates

Also, we know from official commentary that a large chunk of the use of these facilities was for First Republic Bank, and if that’s the case, it’s likely that the rest of the banking system were not big takers. Also, if we look at the provision of liquidity and other interactions at Regional Fed Banks, there was no material evidence of a rise in angst at a regional level.

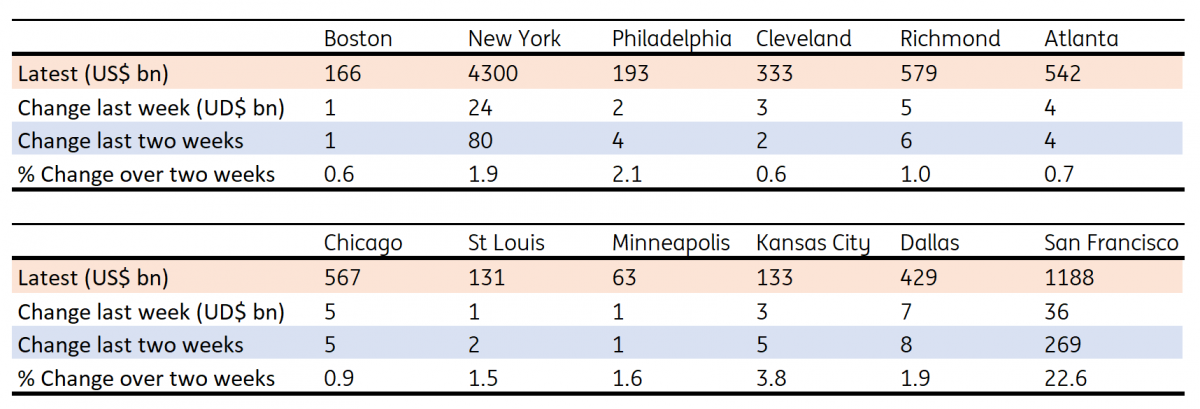

Most of the rise was at the New York Fed and the San Francisco Fed in the previous week, which most likely was a direct consequence of Signature Bank in New York and Silicon Valley Bank and First Republic Bank on the West Coast.

Breakout of Regional Fed interactions with local banks (US$bn)

(Click on image to enlarge)

Source: Macrobond, Federal Reserve, ING estimates

A final important aspect to this is the loans provided as a corollary of the Federal Deposit Insurance Corporation provision of support, where all deposits at Signature Bank and Silicon Valley Bank were made whole. That now sums to US$179bn, which includes the US$36bn increase for the latest week.

On the asset side of bank balance sheets, the sub-par pricing of hold-to-maturity bond portfolios is no longer an issue, as they can be liquified at the Fed, at 100%. Mortgages can also be liquefied through exchanges with Freddie Mac and Fannie Mae, but valuations at the point of exchange is more open to interpretation. Liquidity is king right now, which makes things tough for the banks, as their job is to transform liquidity into 'assets' that are subject to illiquidity and / or price uncertainty. Right now, many small banks need that liquidity back, and there's the rub.

It does not have to go wrong though, and looking at the hard evidence away from financial market vaguaries, evidence over the past week suggests that things are at least not taking a deep dive here in the US. That of course can change, but the latest week has in fact seen some stabilisation.

More By This Author:

FX Daily: Trading Places

Central Bank Of Turkey Keeps Policy Rate On Hold

Bank Of England Tightening Likely Done As It Hikes By 25bp

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more