US Bank 'Jog' Is Back - Deposit Outflows Soar Most Since SVB

The flow of funds continues into retail money-market accounts and banks' usage of The Fed's bank bailout fund remains at record highs (above $100 billion), but tonight we get to see The Fed's latest efforts in obfuscation and seasonal shenanigans about US banks' deposits and loans.

Seasonally adjusted, total deposits plunged $78.7 billion last week - the biggest weekly 'run' since March 22nd (right after SVB)...

Source: Bloomberg

And, for a nice change, non-seasonally-adjusted total deposits agreed, with a $90 billion deposit disappearance...

Source: Bloomberg

Which means the divergence between money-market funds and bank deposits starting to close...

Source: Bloomberg

Large Banks saw a massive $78bn(SA) deposit outflow last week (the biggest outflow since Oct '22) with Small Banks seeing a small $1.25bn outflow...

Source: Bloomberg

Non-seasonally-adjusted, large banks saw deposit outflows top $100 billion and Small Banks lost $6.5 billion in deposits...

Source: Bloomberg

So, Domestically, the bank run is back - with significant deposit outflows (on both SA and NSA basis)...

Source: Bloomberg

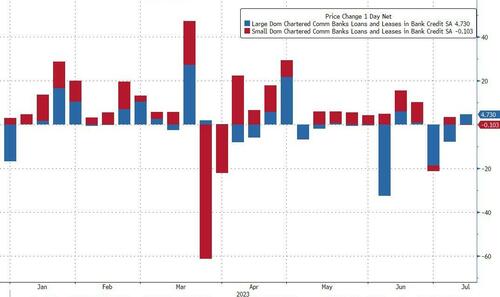

Interestingly, on the other side of the ledger, the picture was more mixed with Small banks seeing loan volumes shrink marginally by $103mm while Large banks saw loan volumes increase by $4.7bn.

Source: Bloomberg

Will the 'smaller' banks be able to relieve themselves of the $100-billion-plus of BTFP Fed-bailout program borrowing within the next 8 months?

Not if this deposit run continues!

More By This Author:

World's Largest Chipmaker Slashes Guidance As AI Boom Fails To DeliverNetflix Tumbles Despite Blowing Away Subscriber Estimates, As Revenues Miss, Guidance Disappoints

TSLA Beats Top- & Bottom-Line: Record Revenues As Margins Decline

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more