US 2020/21 Stocks Were Mixed - South American & US Weather Important

Market Analysis

After last year’s defensive market tone from the expanding Coronavirus pandemic, grain and oilseed prices were on the opposite side of the spectrum going into the April 2020 USDA report updates. The latest quarterly reports showed the smallest levels in years while 2021 planting intentions were lower than trade’s expectations except for US wheat seedings. China’s return to the world ag markets as they retool their pork production after African Swine Fever damaged its meat production and weather reducing the world’s crop output the past 2 seasons were the reasons for the ag prices being at their highest levels in 7-8 years.

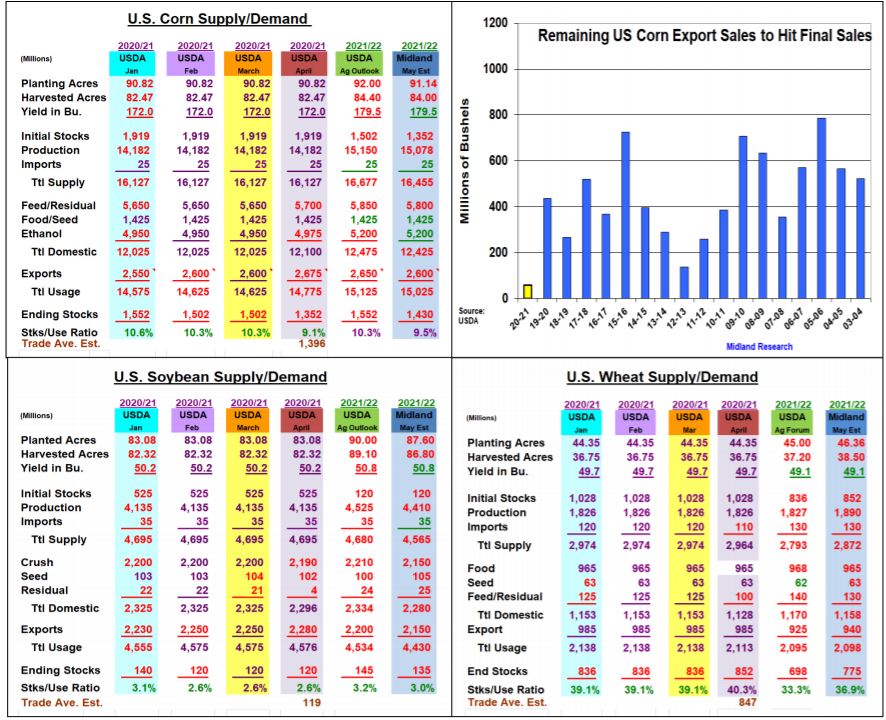

After last month’s lower quarterly corn stocks and recent Chinese purchases, smaller 2020/21 sending stocks were expected. How this occurred was unexpected. The USDA only increase exports by 75 million to 2.675 billion bu while increasing feed by 50 million & ethanol demand by 25 million for their 150 million lower stocks. Given the 5 months left in crop year and US export sales already at 2.617 billion bushels, the 58 million in remaining sales for this crop season appears too low by 100 to 125 million bu given previous sales paces of the past 20-25 years (CORN).

In soybeans, the USDA upped its export outlook by 30 million bu to 2.58 billion. However, the World Board also sliced beans’ residual demand by 17 million bu, their seed use by 2 million and this year’s soybeans crush usage by 10 million bu. which left this month’s US ending stocks unchanged. The USDA leaving Argentina’s crop size unchanged and upping Brazil’s crop by 2 mmt also was a bit of a surprise given recent erratic South American weather (SOYB).

Wheat’s larger quarterly stocks also impacted this grain’s April balance sheet. The USDA sliced 25 million bu from wheat’s feed demand, but they also dropped the crop’s imports by 10 million bu. This upped its ending stocks forecast by 15 million bu since no change in this crop’s exports were made. The USDA’s 5 mmt increase in China’s wheat feeding this month lent support since the world stock were decreased by a similar amount (WEAT).

What’s Ahead

The need to curtail overseas demand from shrinking US corn and soybeans supplies and the weather uncertainty of S America’s crop prospects in Argentina and Brazil’s Mato Grasso area will likely keep these two markets quite volatility.

Utilize the upcoming Central US cold weather blast to finalize your Chi/KC old-crop wheat in their $6.30-6.50 and $5.75-$6.05 ranges.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more