Uranium Stocks Reawaken After Cameco Cuts Production

At the end of 2016 and the start of 2017 we saw an explosive breakout in the uranium miners, but that rally flamed out and the uranium market went back into a Stage 1 base. After that failure from about May of this year until the last couple weeks, the uranium miners drifted sideways and volume dried up, signaling disinterest in the sector but a general balance between buyers and sellers. Recent news out of Cameco cutting 10% of world production in uranium caused a flurry of activity in the uranium miners and the price of uranium.

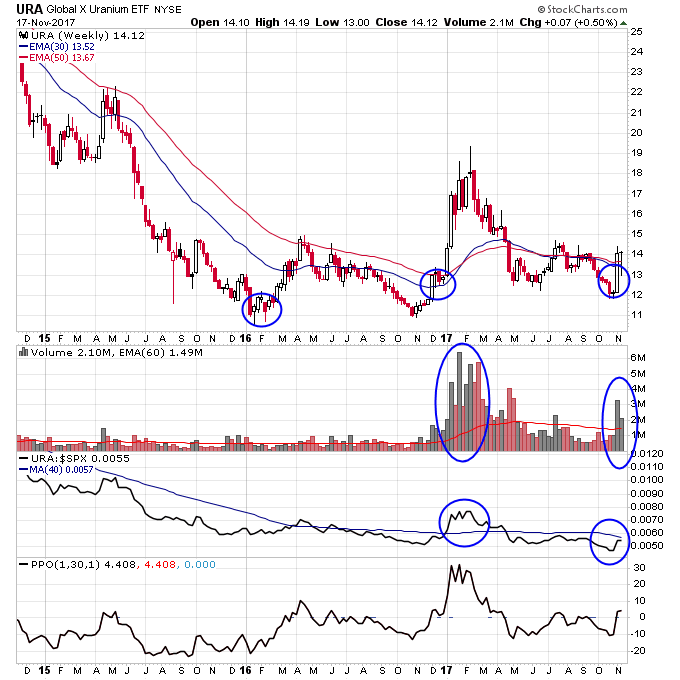

One of the most bullish aspects of the uranium miners that I haven’t seen discussed anywhere else is the positive divergence between the miners and the price of uranium that continues to this day. Take a look at the charts of U.TO and URA below and notice how the uranium miners (URA) have put in 3 minor but important higher highs (denoted by the circles on the chart) at the same time the price of uranium (U.TO) was making lower lows. Often this type of action is seen in market bottoms where further declines in the commodity fail to produce lower lows in the commodity producer. This means the shares of the commodity producer have shifted into stronger hands, they are no longer willing to sell even if the underlying commodity continues to decline in price. This is what leads to explosive Stage 2 breakouts because once demand comes back in there is literally no one left to sell, and the stocks start ripping higher.

U.TO took fairly good volume last week doing 3x average weekly volume. The volume in URA was also over 2x average volume on the previous week. The bigger the volume on a Stage 2 breakout the better, and if we continue to see increased volume in these over the next few weeks that’s a good sign.

I took initial positions in UEC, URG, and UUUU to play this potential new Stage 2 breakout in the uranium miners. I’ll be watching the price action as always and using the 30-week moving average as my risk management line and indicator of whether to stay in the trade.

Disclaimer: The views and opinions expressed are for educational and informational purposes only, and should not be considered as investment advice. The author of this website is not a licensed ...

more

Interesting I have been trying to explore alternative commodities like uranium over the last few months. Is there concern that demand for uranium will only get weaker as nuclear power plants go offline and get replaced by cheaper and safer energy sources?