Updating The Current VIX-Based ETP Landscape

There is a lot going on in the markets, with several themes weighing on volatility or the potential for more volatility. COVID-19 cases are spiking to new highs in Europe and the U.S. and could be at an inflection point in the U.S. Election uncertainty is also unnerving investors with the election only nine days away. Lasts and not least, markets are strongly influenced by the Pelosi-Mnuchin stimulus dance, which appears to have migrated from tango to a polka – but at least the music is still playing.

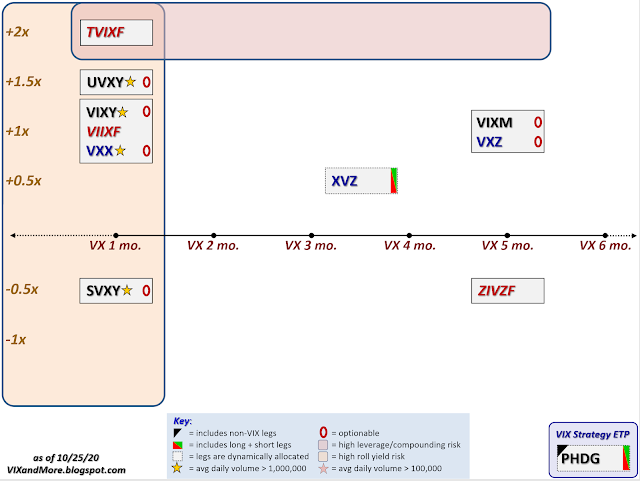

In the time since I was a regular contributor in this space, a lot has happened in the volatility world and the VIX ETP space has also changed dramatically. For this reason, it seems like a good time to update a favored VIX ETP graphic to reflect the many products that have closed, matured, and been moved to the pink sheets. In keeping with tradition (this graphic has been published many times in various incarnations since 2010), I have plotted all of the VIX ETPs with respect to their target maturity (X-axis) and leverage (Y-axis).

It has taken more than a decade, but the bottom line is that the VIX ETP space has essentially been narrowed down to two dominant products:

VXX (iPath Series B S&P 500 VIX Short-Term Futures ETN) – the pioneering +1 long volatility ETN that launched back on January 30, 2009 and has been the dominant product in the VIX ETP space throughout its lifetime

UVXY (ProShares Ultra VIX Short-Term Futures ETF) – the +1.5x ETF that spent most of its life as a +2x product and moved to +1.5x following the February 2018 Volmageddon event which resulted in the termination of XIV

Both VXX and UVXY trade an average of over 30 million shares per day and both are regularly in the top 5-10 highest volume ETPs as well as ETP options volume leaders. The remaining VIX ETPs have been largely relegated to niche product status. Additionally, Credit Suisse delisted and suspended its VelocityShares ETNs, meaning that the former TVIX, VIIX, and ZIV now trade in the OTC market under the symbols TVIXF, VIIXF and ZIVZF. For this reason and because of low liquidity and the increased risk with trading on the OTC “pink sheets.” I have highlighted these tickers in red.

[source(s): VIX and More]

Disclosure: Net short VXX and UVXY at time of writing.

Disclaimer: "VIX®" is a trademark of Chicago Board Options Exchange, Incorporated. Chicago Board Options Exchange, ...

more