United States: Huge Debt Refinancing Remains 2025's Biggest Challenge

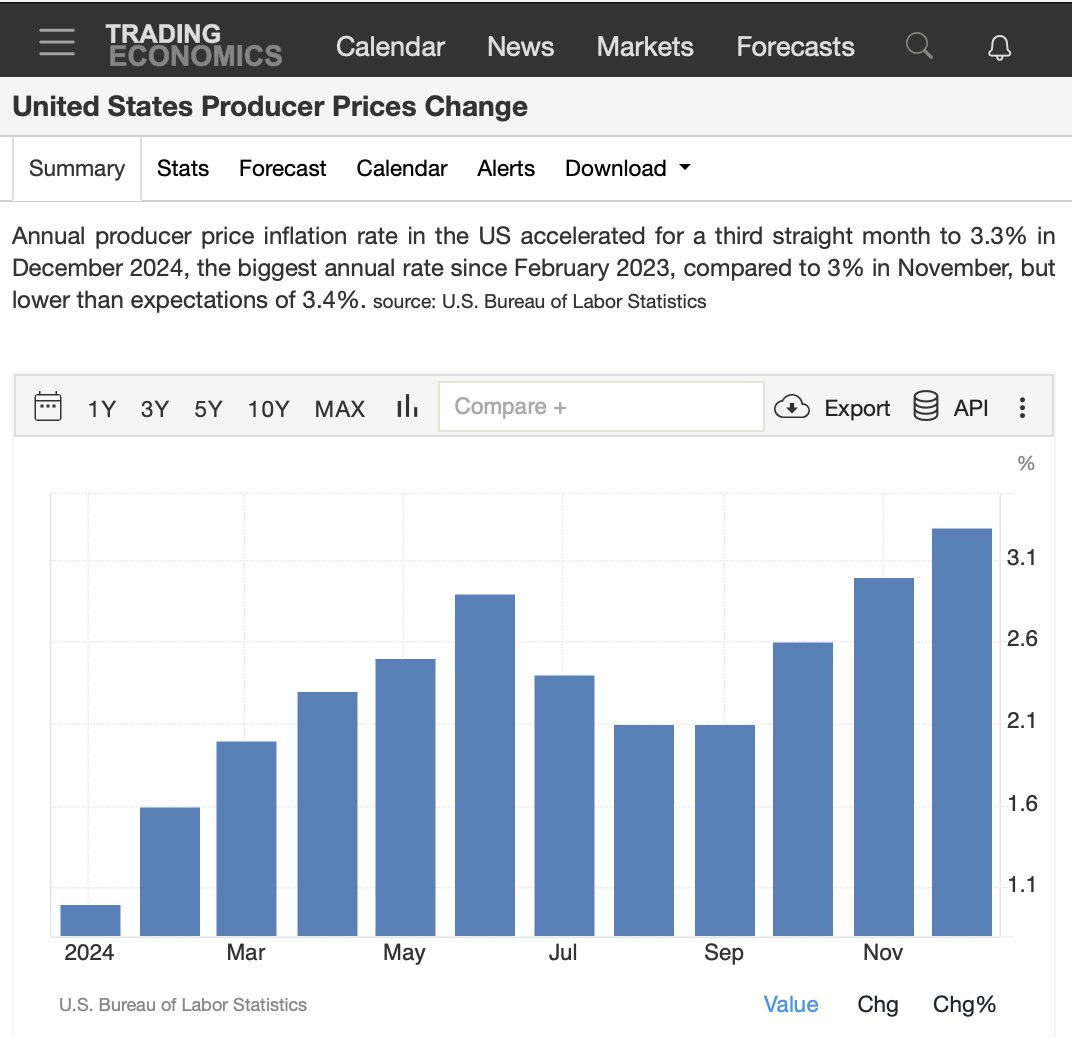

US Producer Price Index (PPI) figures are worse than expected.

On a monthly basis, the overall PPI rose by 0.2%, below the forecast of 0.4%. Core PPI (excluding volatile items) remained unchanged at 0.0%, whereas an increase of 0.3% had been anticipated.

On a yearly basis, overall PPI grew by 3.3%, slightly below expectations of 3.5%. As for core PPI, it rose by 3.5%, also below the 3.8% forecast.

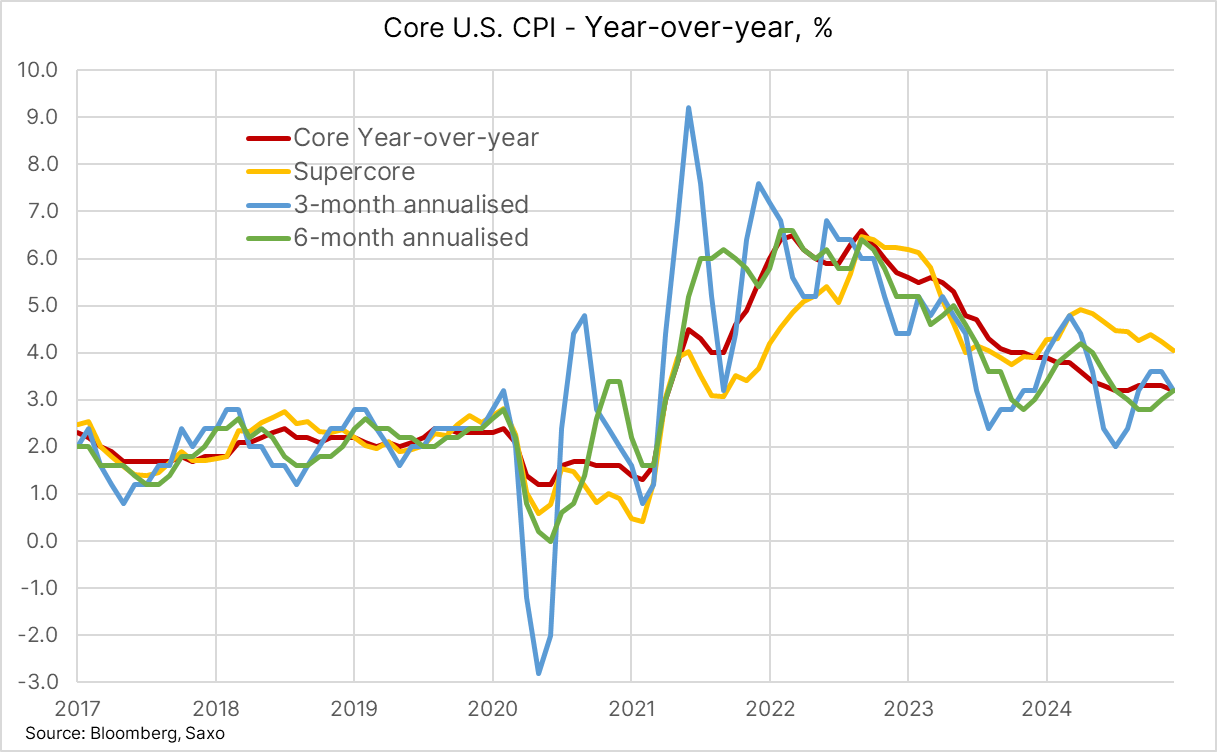

In December, core CPI inflation in the US slowed to 3.2% year-on-year, while headline CPI inflation reached 2.9% year-on-year, in line with expectations. The 3- and 6-month annualized rates also converged at 3.2%. In addition, supercore inflation fell from 4.25% to 4.05%, signalling a weakening of inflationary pressures in key sectors.

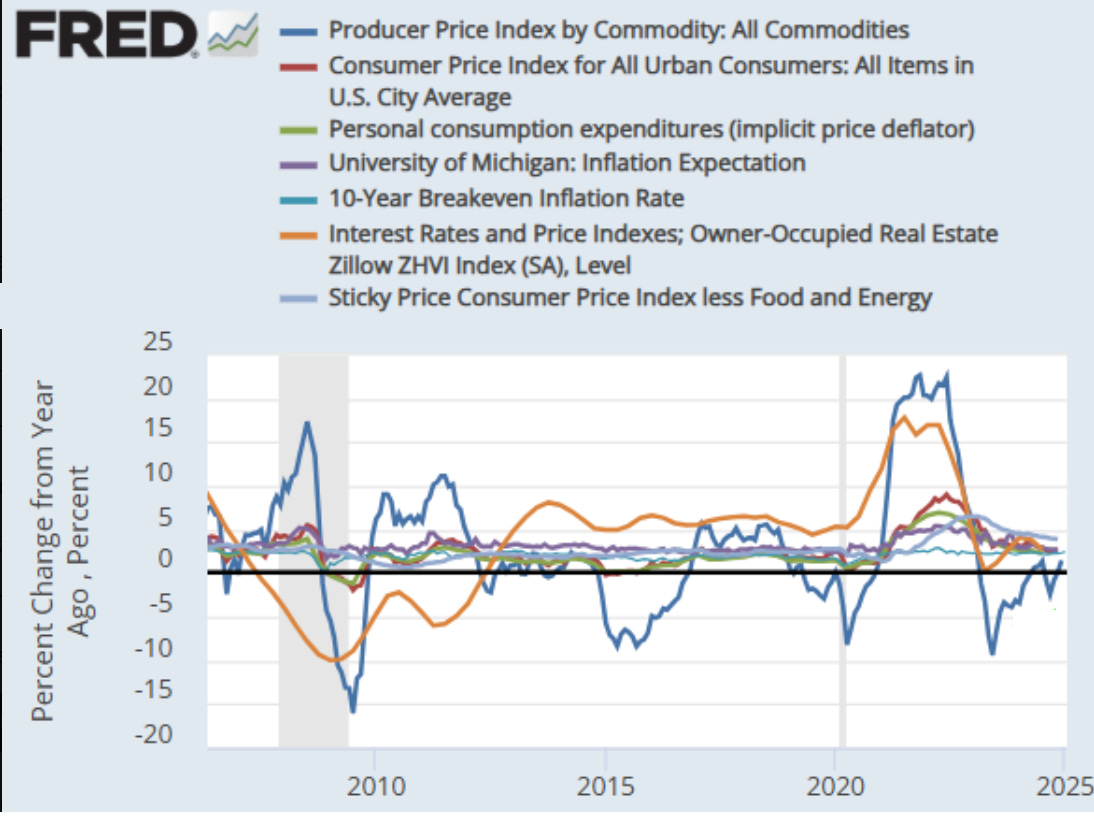

The fall in inflation stems mainly from lower energy prices, with the price of oil reaching its lowest level at the end of 2024, due to fears of an economic slowdown in China. However, it is important to point out that since the beginning of 2025, the price of oil per barrel has started to rise again, which could exert further upward pressure on future inflation indices (CPI):

Inflation is having a particularly strong impact on certain key sectors: car insurance (+11.3%), transport (+7.3%), car repairs (+6.2%), city gas (+4.9%), homeowners' costs (+4.8%) and rents (+4.3%).

The housing component, including rents and owner's equivalent rent (OER), has now taken over from the energy component as the main driver of rising inflation!

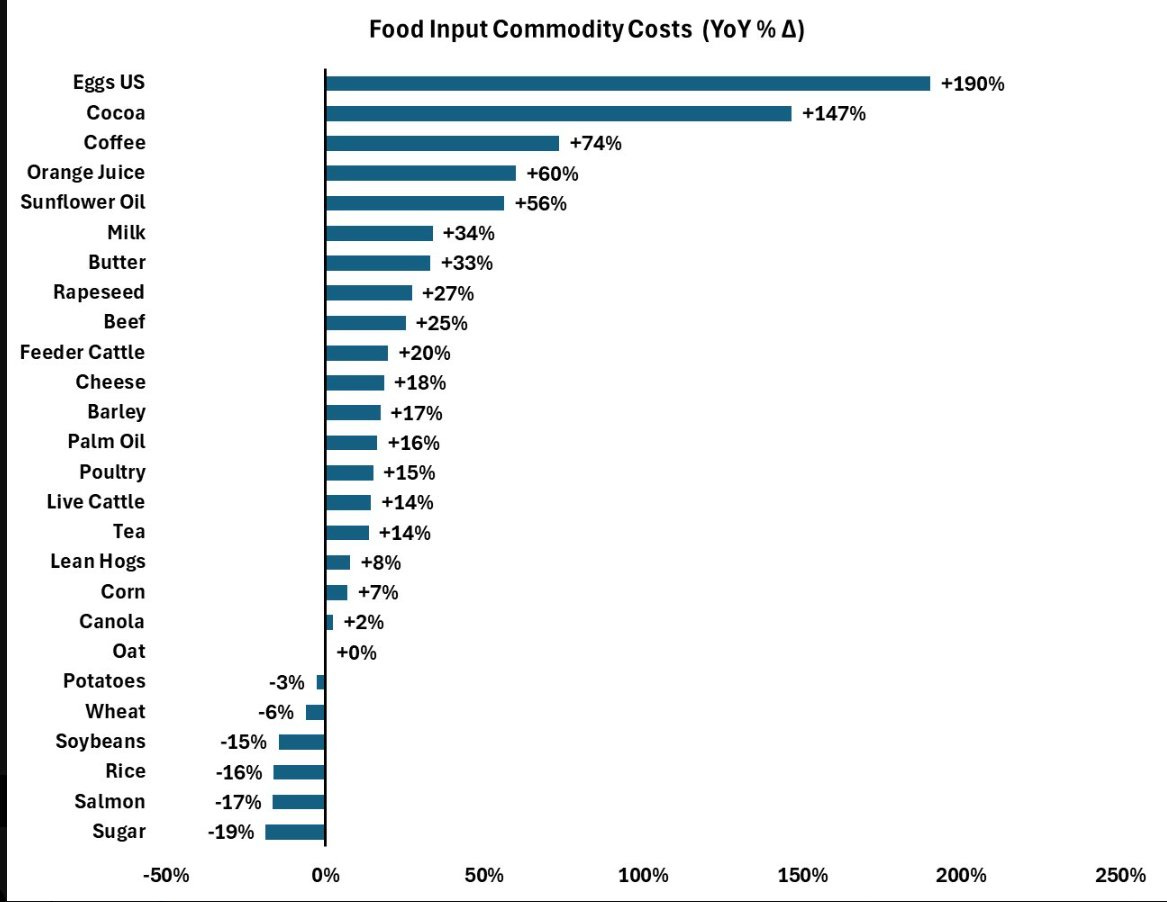

The “food” component of the index also continues to soar, fueled by spectacular rises in agricultural commodity prices:

These data reveal inflationary pressure well below expectations, which, in theory, should have an immediate impact on the bond market. In principle, a greater fall in inflation should lead to a sharper reduction in interest rates:

However, the bond market faces a new threat: inflation is no longer the only issue. The US deficit is now seen as the main source of concern.

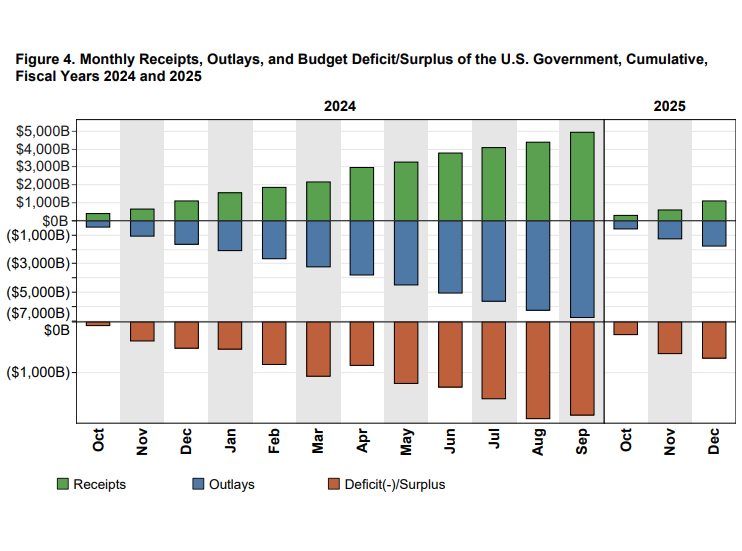

And for good reason: the latest deficit figures are dizzying, revealing a budget situation that continues to deteriorate:

This was the worst start to a fiscal year on record: spending rose by 10.9%, revenues fell by 2.2%, and the year-to-date deficit jumped by 39.4% to $711 billion.

The United States now has an annual deficit of $3 trillion, reflecting a particularly worrying fiscal situation.

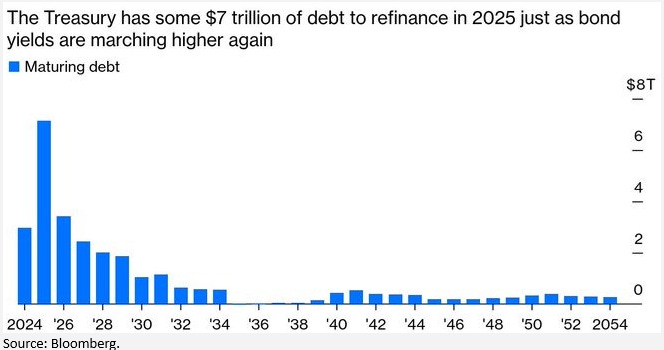

This deficit comes in 2025, a year in which the U.S. will face a veritable wall of debt:

By 2025, the US Treasury will need to refinance around $7 trillion of maturing debt. This enormous amount coincides with a period when bond yields are once again on the rise, further complicating the situation.

This massive refinancing will lead to a significant increase in the cost of debt, as the Treasury will have to borrow at much higher rates than when these debts were issued. This will mechanically exacerbate the US budget deficit, already at critical levels.

In addition, pressure of this magnitude on the bond market could lead to major tensions. Issuing such a high volume of new bonds could push investors to demand even more attractive yields. At the same time, it could dampen international investors' appetites for US debt, accentuating the risk of financial imbalances.

With such colossal refinancing, the currency could depreciate so quickly that even high rates will not be enough to preserve the real yield on bond products. This is probably why the US Treasury bond market is currently so unattractive, despite the slowdown in inflation.

This refinancing peak in 2025 represents a major challenge for US economic stability, with potential repercussions for global financial markets. This is precisely the message the bond market is seeking to convey.

Real yields on US 30-year bonds have fallen back to 2008 levels. Clearly, bond markets are not just concerned about inflation. Behind this, much broader concerns are emerging: growth at half-tempo, soaring deficits, and perhaps even systemic risks.

This rise in rates represents a risk for the bond portfolios of most financial institutions.

The colossal losses recorded on the bond portfolios of Primary Dealers in the United States, amounting to over $364 billion, illustrate the unprecedented pressure exerted on the financial system:

These losses, although currently unrealized due to the strategy of holding bonds to maturity, are nevertheless profoundly weakening banks' liquidity.

This is due to a significant drop in the collateral value of these assets, which is essential for guaranteeing loans and interbank transactions.

With the bond market sounding the alarm, gold is reasserting its traditional role as a safe-haven asset. Investors, concerned about the pressures associated with the 2025 debt wall, are turning to gold as a safe asset in the face of growing uncertainty.

This move is driven by fears of a possible devaluation of fiat currencies. When the US Treasury has to refinance trillions of dollars of debt at higher interest rates, budgetary pressure could force the authorities to adopt expansionary monetary or fiscal policies, such as money printing or quantitative easing, to absorb this massive debt. These strategies are likely to further weaken the value of the dollar and other currencies.

Against this backdrop, physical gold, which is not tied to any sovereign entity or monetary policy, is becoming an attractive asset for investors wishing to protect their wealth. This anticipation reflects a growing mistrust of traditional currencies and a desire to guard against the inflationary or devaluation risks that could accompany the refinancing of this monumental debt.

It's hardly surprising that central banks are turning to gold in such a climate of uncertainty. In 2024, China officially added 44 tons of gold to its reserves, bringing its total to 73.29 million fine troy ounces in December. This strategy is part of a considered approach to asset diversification, initiated back in 2016 after the election of Donald Trump, and is aimed at securing its reserves in the face of a global environment marked by geopolitical and economic instability.

This accumulation of gold is also part of a strategy to reduce dependence on the US dollar, in response to the threat to the currency's value posed by the massive refinancing of US debt in 2025. By bolstering its gold reserves, China is anticipating the risks of a weakening dollar, linked to budgetary pressures and possible monetary expansion needed to absorb the debt wall. This policy reflects China's desire to protect itself against global financial uncertainties and to strengthen its economic autonomy in the face of the dollar's historic dominance.

🇨🇳 Chinese reserves for December : 2,280 tonnes https://t.co/MWoAydo5t5 pic.twitter.com/GoYanH1wVx

— GoldBroker (@Goldbroker_com) January 10, 2025

More By This Author:

What Is The Economic Outlook For 2025?The Bonds Decline Is Accelerating As 2025 Begins

What Does The Future Hold For The French Economy?

Disclosure: GoldBroker.com, all rights reserved.