Understanding The Stage 1 Basing Phase After A Stage 4 Decline $SPY

One of the most powerful advantages of using Stage Analysis to understand what’s going on in the markets is simply knowing what stage the S&P 500 is in. The stage of the S&P 500 has a dramatic affect on all stocks. Even the best stocks in the market have a hard time overcoming selling pressure that exists when the S&P 500 is Stage 4 or Stage 1.

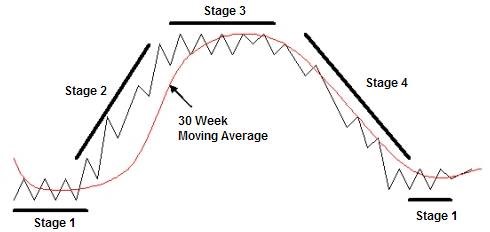

Currently, the S&P 500 is in Stage 4 having declined below a falling 30-week moving average over the last month. From the transitions in Stage Analysis the next thing we should expect is some sort of Stage 1 base to develop after this decline.

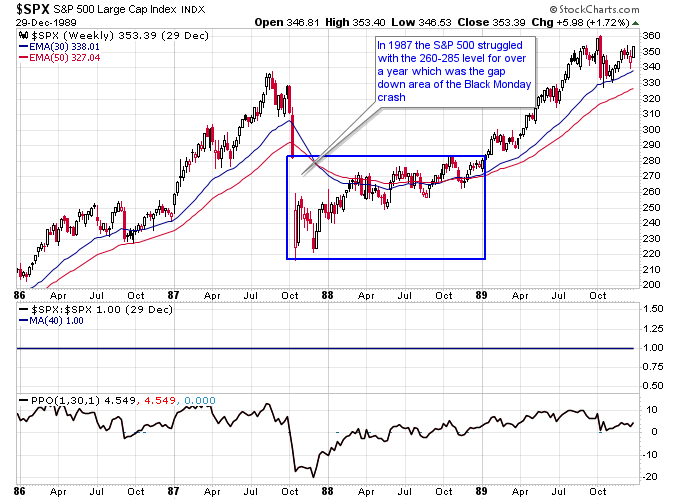

In 1987 after the crash the S&P 500 had a hard time overcoming the 260-285 range which was the gap down area after the Black Monday crash. It took the S&P 500 most of 1988 to struggle with this area and form a Stage 1 base before finally breaking out into Stage 2 in early 1989.

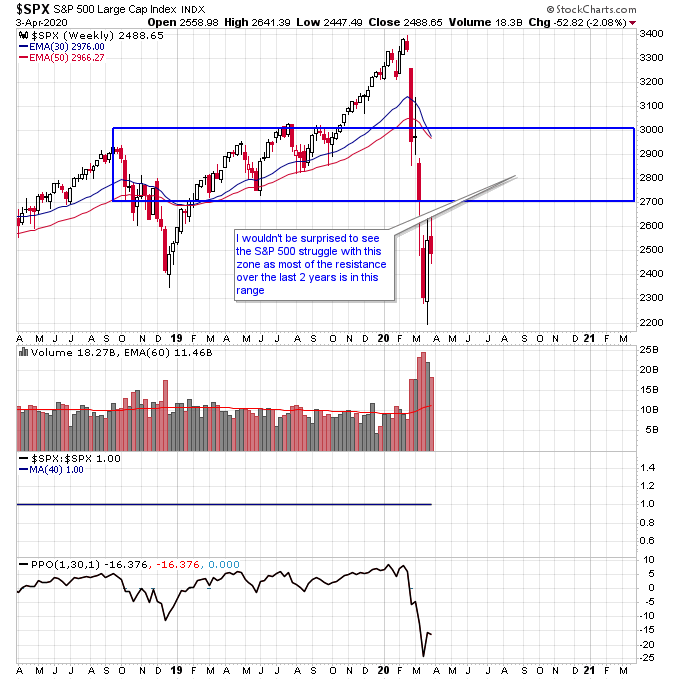

This time around in 2020 we didn’t have a one-day crash finale to the most recent panic but we still have a band of resistance from 2019 where the market will most likely struggle with on the way back up. This may be the area the S&P 500 consolidates into a Stage 1 base as it struggles with overhead selling pressure that occurs after a decline.

The key problem stocks have as they stabilize and move back up after a Stage 4 decline is resistance. That’s why it is extremely important to identify stocks and sectors with the least amount of resistance after a Stage 4 decline. They will most likely be the new leading stocks and sectors once the market starts moving higher again because they will have the least amount of sellers looking to get back to even after the decline.

Paradoxically most people will be looking for the most beaten up sectors to buy after a Stage 4 bear market. Those sectors will no doubt experience sharp initial rallies, but once they run into resistance zones they will struggle with overhead selling pressure and most likely need more time to move through those zones than stocks with no overhead resistance.

The new leaders will emerge from stocks with minimal resistance, and besides sectors that have held up another area to look at will be recent IPOs which haven’t been around long enough to experience the significant selling damage from the 2020 panic.

Disclaimer: The views and opinions expressed are for educational and informational purposes only, and should not be considered as investment advice. The author of this website is not a licensed ...

more