Ugly, Tailing 5Y Auction Sees Lowest Foreign Demand In 3 Years

90 minutes after a solid 2Y auction stopped through in the first sale of this week's abbreviated bond auction schedule, moments ago the Treasury sold $70BN in 5 year paper in what was a surprisingly ugly auction.

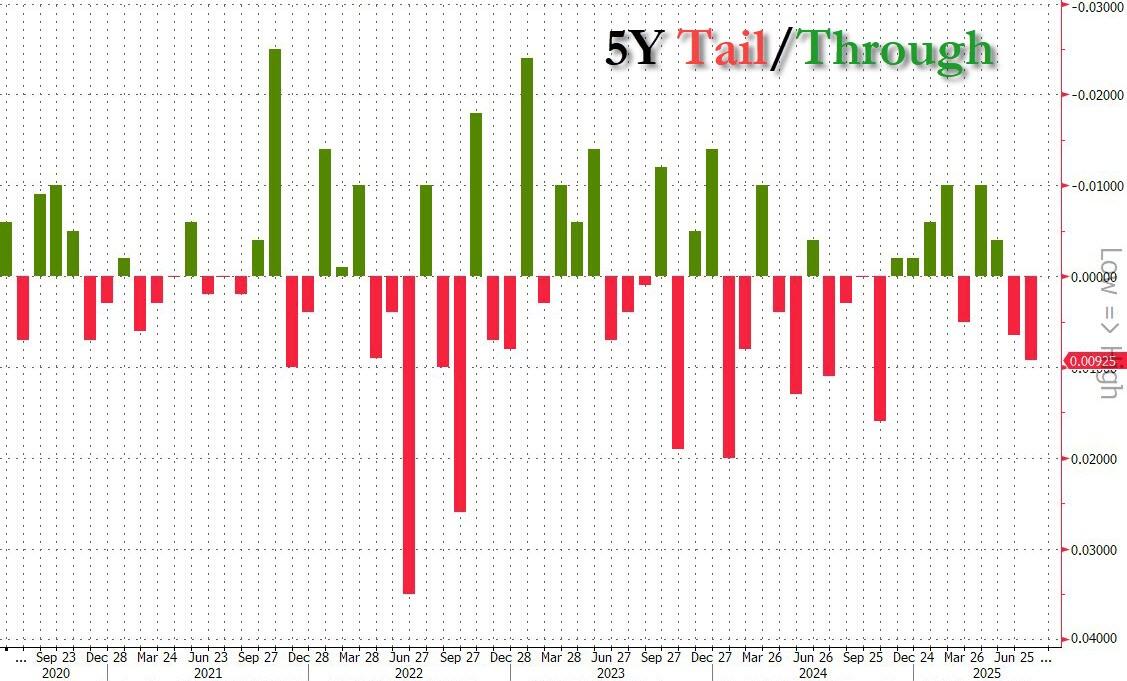

Starting at the top, the high yield was 3.983%, up from 3.879% in June, and tailing the When Issued 3.975% by 0.8bps, the biggest tail for this maturity since last October.

(Click on image to enlarge)

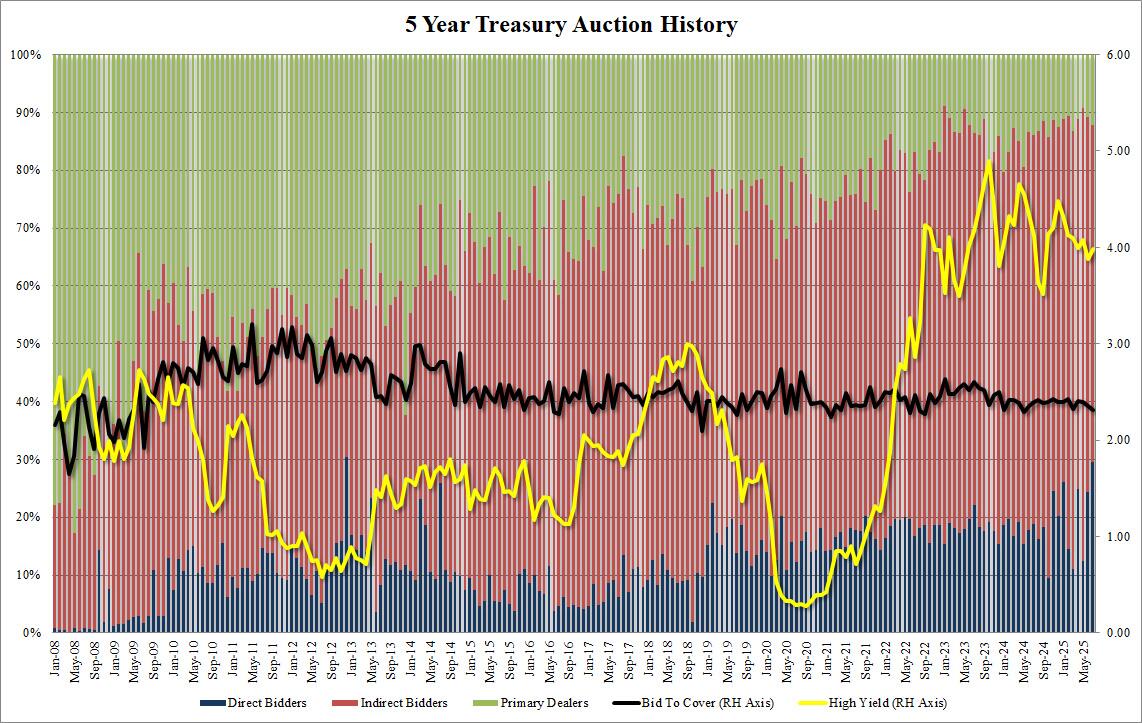

The bid to cover dropped to 2.31 from 2.36, the lowest since May 2024, and below the six auction average of 2.38.

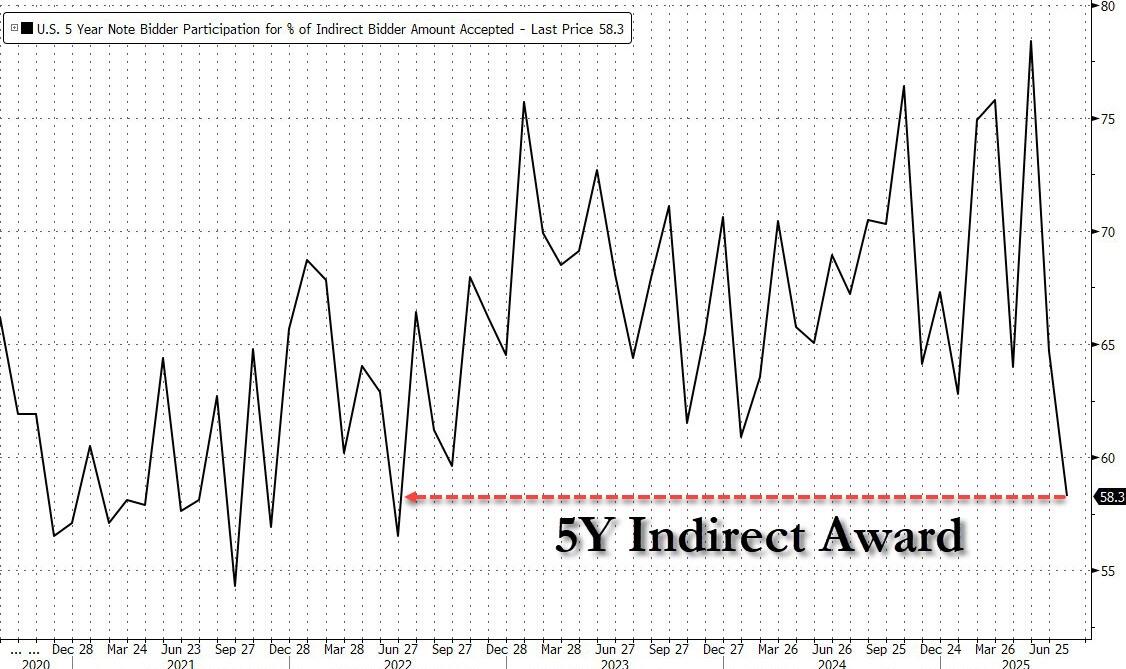

The internals were also ugly, with Indirects slumping to 58.3% from 64.7%, and the lowest since June 2022.

(Click on image to enlarge)

And with Directs awarded 29.5%, or the highest since 2012, Dealers were left holding 12.2% just above the recent average of 11.0%.

(Click on image to enlarge)

Overall, this was a surprisingly poor auction, yet despite the very ugly reception, the broader market barely noticed, with 10Y yields trading a tad lower after the break. We expect this complacency toward lack of demand for US paper to change very soon.

More By This Author:

Key Events This Extremely Busy Week: Avalanche Of Macro, Central Banks, Earnings And Trade NewsOil Rips As Trump Reduces Russia's 50-Day Deadline For Peace Deal With Ukraine

ECB: Is The Strong Euro Becoming A Problem

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more