Turbulence Ahead: $2 Trillion In June Op-Ex; Massive $76 Billion In Pension Selling On Deck

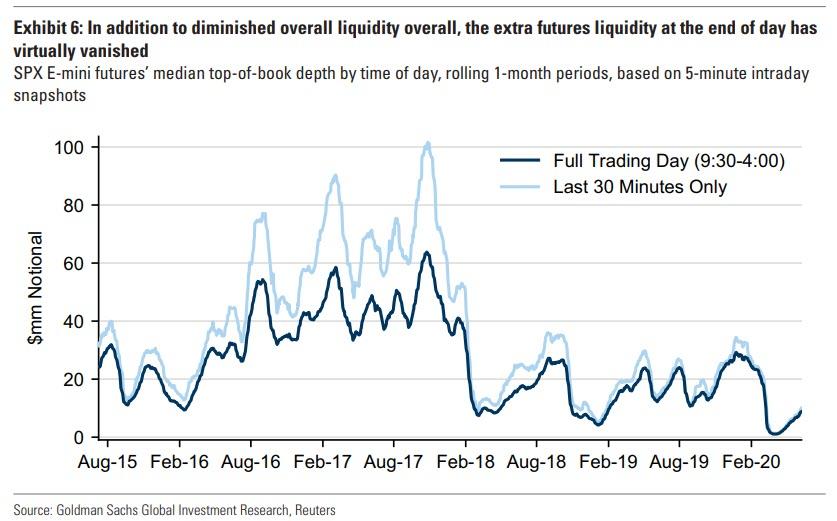

With market liquidity stubbornly stuck near all-time lows (which permits retail investor trades to have such an outsized impact on the broader market)...

... the next two weeks promise to be volatile for stocks for two reasons: first, there is a rather massive option expiration set for this Friday (with some caveats), and then for quarter-end, we are facing what appears to be one of the biggest pension fund dumps in history.

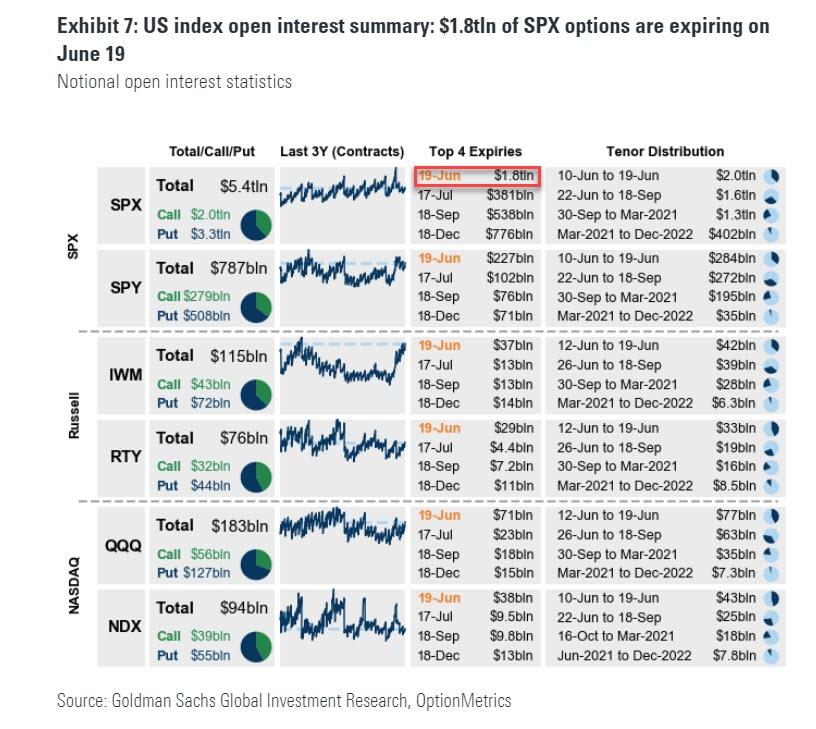

Starting with this Friday's Op-Ex, Goldman's Rocky Fishman writes that from a purely "headline" perspective, June's expiration is massive with $1.8 trillion in SPX options expiring on the 19th...

... making it the third-largest non-December expiration on record, in addition to $230bln of SPY options and $250bln of options on SPX and SPX E-mini futures.

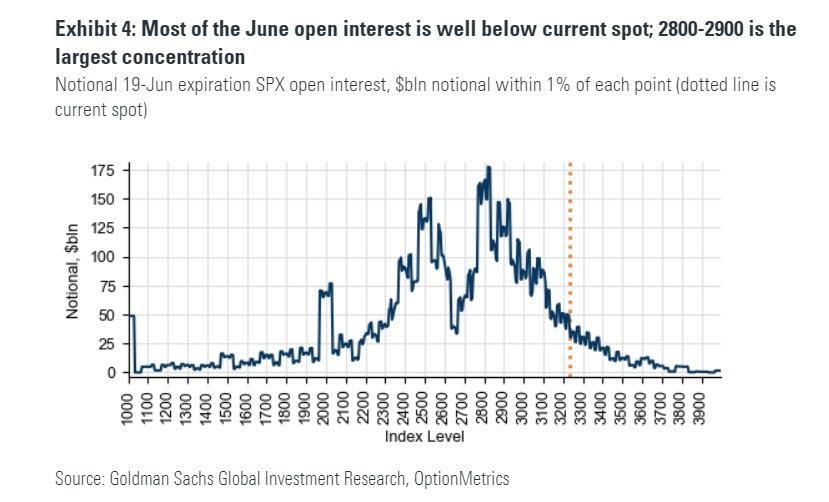

That said, as a result of the strike distribution heading into Friday, the gross gamma exposure is relatively modest (for a comprehensive primer on gamma and option-driven equity flows, please see "All You Ever Wanted To Know About Gamma, Op-Ex, And Option-Driven Equity Flows"). According to Goldman, the $80bln of gross SPX gamma is relatively small (4th %ile vs. the past 3 years), because most of the expiring June SPX options are far away from the current index level, a result of the sharp move in the market over the past quarter.

Furthermore, June has the smallest amount of expiring open interest within 10% of spot of any recent quarterly maturity.

Also of note, most of June's open interest is well below the current spot level; peak strike concentration is in the 2800-2900 range.

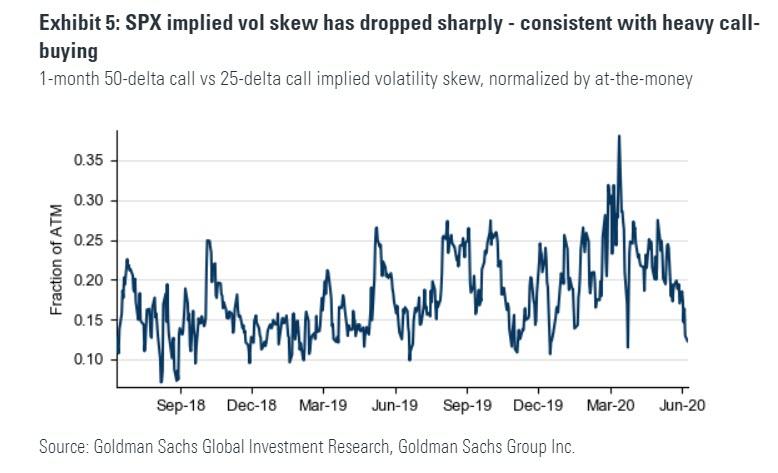

A more granular look at the composition of the opex, amid the recent strong call volume, June has a higher percentage of calls than a typical expiration according to Goldman, who points out that call option volume has strengthened in both index and single stock markets over the last few days' rally, and sharply declining SPX skew indicates that investors are primarily buying calls, something we discussed last week when we showed the tremendous surge in retail call buying.

The June open interest is 43% calls, higher than the 35-40% that is typical, but most of the elevated call activity is in the form of in-the-money calls (after investors had chased the rally by buying calls and sold calls to fund protection in the last few months).

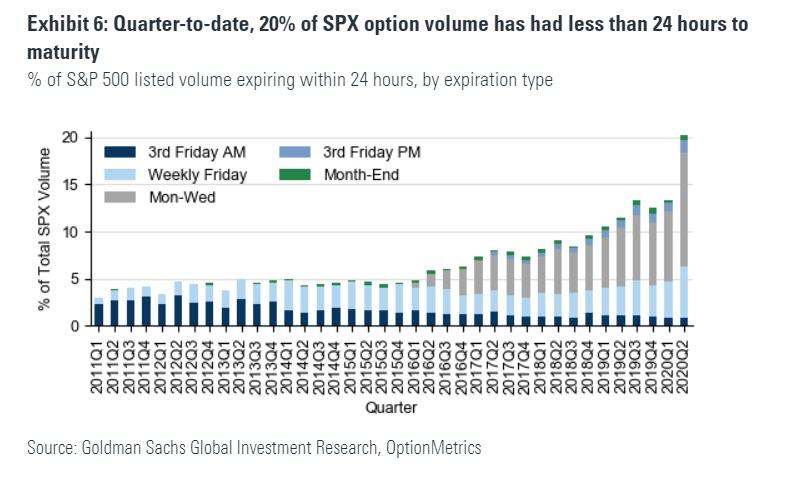

The biggest wildcard, according to Goldman, is the concentration in ultra-short-term momentum chasing. As a result of the aggressive momentum-chasing, soon-to-expire option volume has exploded: over the course of Q2 2020, there has been an acceleration of final day trading of SPX options that expire every Monday, Wednesday, and Friday. Most such expirations had over $100bln notional trade on their final day, "making them a potentially large, but hard-to-track, source of gamma."

* * *

The bottom line is that while we are facing a near-record $1.8 trillion in option expiration in two days, it is not immediately clear if this alone will have a material move on the market in the immediately preceding period, and also whether this impact would be bullish or bearish.

One thing we do know for certain, however, is that pension selling will be substantial, as a result of the outperformance of stocks over bonds this quarter. Indeed, according to Goldman, as of the close on Tuesday, the desk’s theoretical model estimates a net $76bn of equities to sell, the third-largest estimate on record, only behind Mar 2020 and Dec 2018, both of which happened to be extremely volatile periods.