Trump Optimism Shown In Markit Index

As the year ends, not much looks to be changing in the markets as volumes decrease and data points become less frequent. The prognosticators have made their picks for another bullish year in 2017 even though stocks are at near record high valuations. We are in ‘wait and see mode’ on whether the optimism is warranted. As a rule, optimism should be met with skepticism and fear should be met with bullishness. The 1990s-tech bubble was brought about by optimism caused by the anticipated expansion of the internet. The internet ended up being more amazing than anyone could have expected and even then, the market fell because excitement was too high. If Trump does succeed, there may be a selloff and if he doesn’t there could be a crash.

Markets are the most obvious place where optimism can be seen because they keep hitting record highs which makes the news. It’s like how gas prices are the most discussed inflation measure because the prices are blaring at every gas station. However, the stock market isn’t the only place where optimism reigns supreme. Businesses are also expecting a boost in the economy in 2017 probably based on the universal positive consensus economists have. There has been a pickup in some economic data in November and December, but it’s equivalent to one of the many fits and starts we have seen in this recovery. The real reason for excitement is the Trump administration.

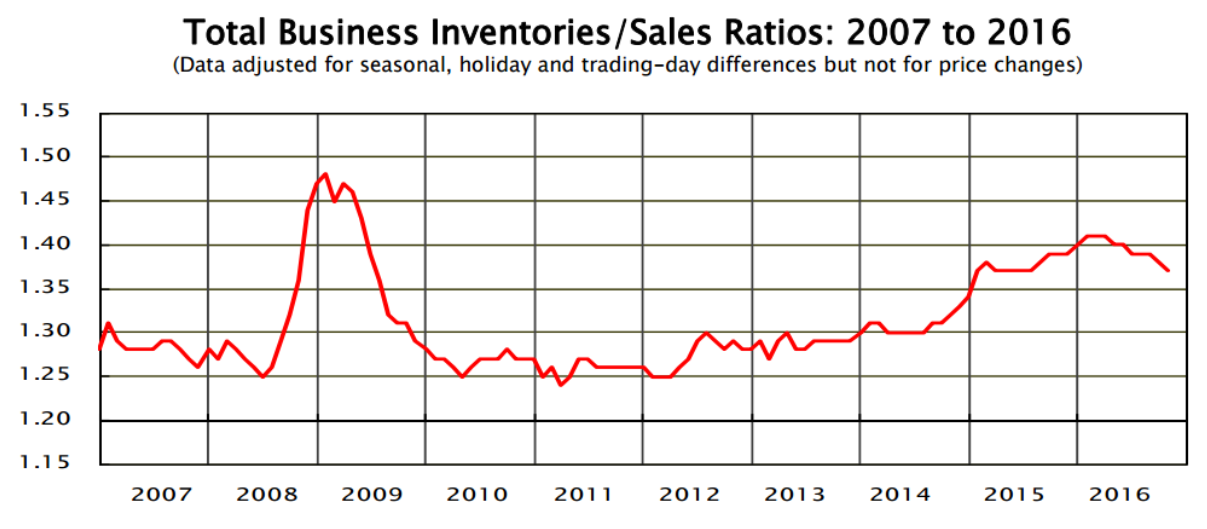

Being too optimistic can be risky for businesses because it can lead them to order too much inventory or hire too many workers. When too much inventory is in warehouses or on shelves, it needs to be discounted to make room for new products. This is why the inventory to sales ratio was talked about so heavily by bears in late 2015/early 2016. It was reaching recessionary levels at the time. It has pulled back in the past few months which makes sense because there’s been a similar level of demand. High inventory begets low inventory because it can’t be held for long. There needed to be a crash in demand for it to reach late 2008 levels.

Bears were wondering if the rise was signaling a crash, but that wasn’t the case as October sales increased 0.8% month over month (inventories down 0.2%). It’s not surprising that this wasn’t a leading indicator because it was very low in mid-2008 even after the recession started. It’s a lagging indicator. The indicator can renew its upward trajectory if the optimism caused by Trump doesn’t translate into the sales growth expected. The data is delayed all the way back to October, so we don’t know if new inventory has been building in the past month.

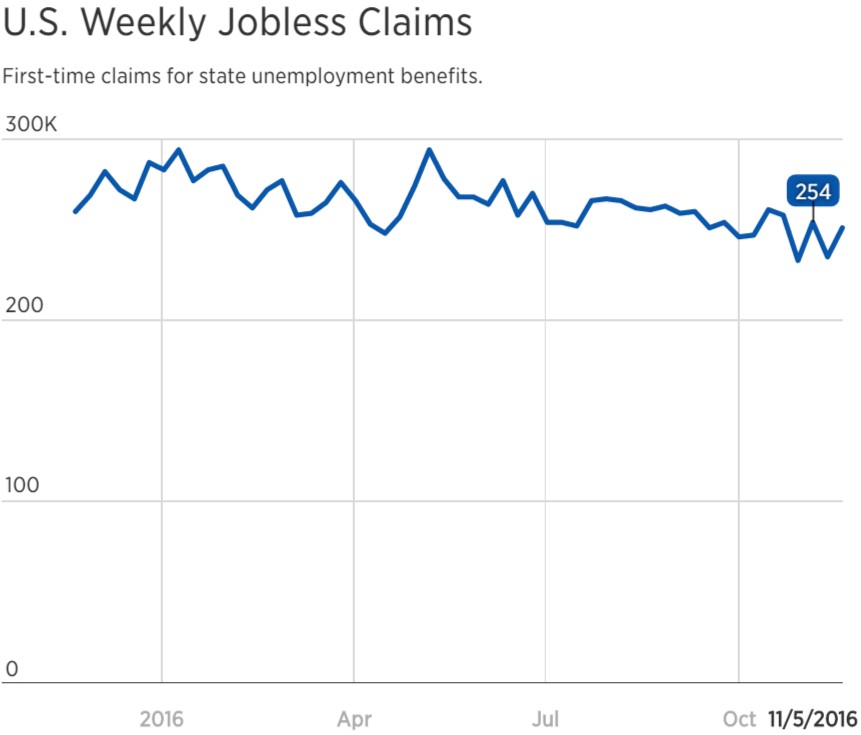

Hiring too many workers is tougher than having too much inventory because firing workers ruins employee morale. The best employment situations usually beget recessions as the labor market tightening causes inflation which causes the Fed to raise rates which hurts growth. As I have mentioned in other articles, the jobless claims are at historic lows in relation to the population. It will be interesting to see if optimism causes jobless claims to fall in the next few weeks. Since the election, we’ve seen the near-record low of 235,000 and 251,000.

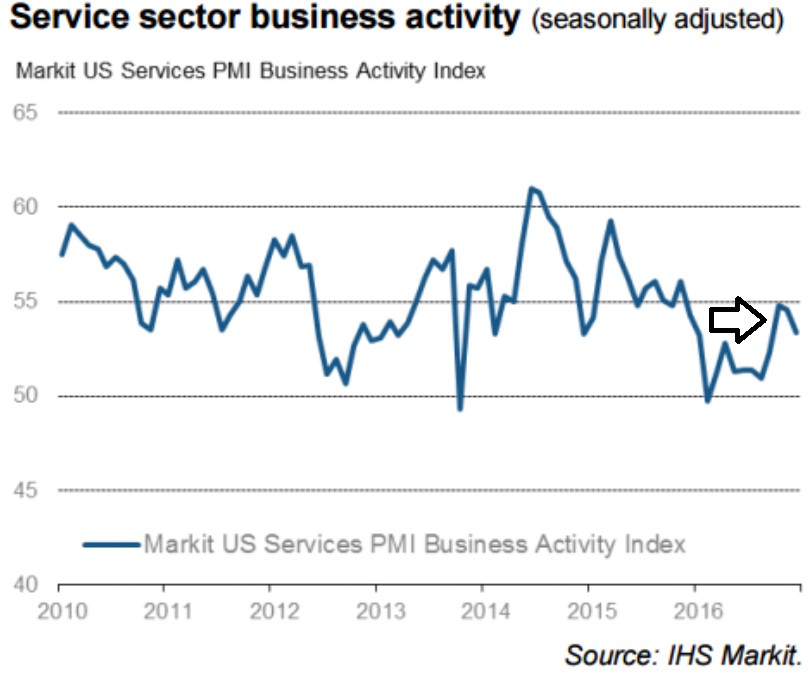

The Markit Flash U.S. Services PMI reveals the possibility that the optimism can be overdone. First, I’d like to point out that the service business indicator has reached a 3-month low falling to 53.4 in December. I have an arrow pointing to the blip up which has sparked the rally this year. Markit describes the recent downward trend in the metric as a blip, but that blip is half the size of the upturn. It uses optimism as justification for calling the 3-month lows a blip, but it doesn’t mention the possibility that the optimism can be misplaced.

The optimism expressed by service providers is interesting because jobs growth accelerated for the third month in a row and cost inflation in December increased at one of the fastest rates since mid-2015. Costs for workers and materials are rising and business activity ticked down, yet optimism is strong. That is what I would call hope. Hope shouldn’t be a business strategy

Zero Hedge produced the graph below of the latest rally in stocks in terms of the trailing S&P 500 P/E. It has been a hope trade as investors front-run the stimulus and buy infrastructure stocks with reckless abandon. I’m not against front-running events. Front-running is how the market is supposed to price in anticipated events before they happen. The problems come into play when you have a global economy running out of steam and investors acting like its 2009 all over again.

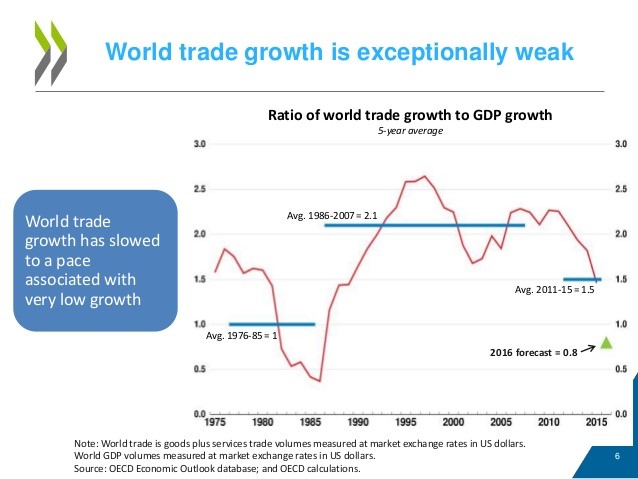

The chart below shows global trade growth. It has been weakening over the past few years. 2016 growth is expected to be a continuation of this downtrend. There’s a possibility Trump’s toughness on trade will hurt growth, but what will hurt growth for sure is the latest dollar rally.

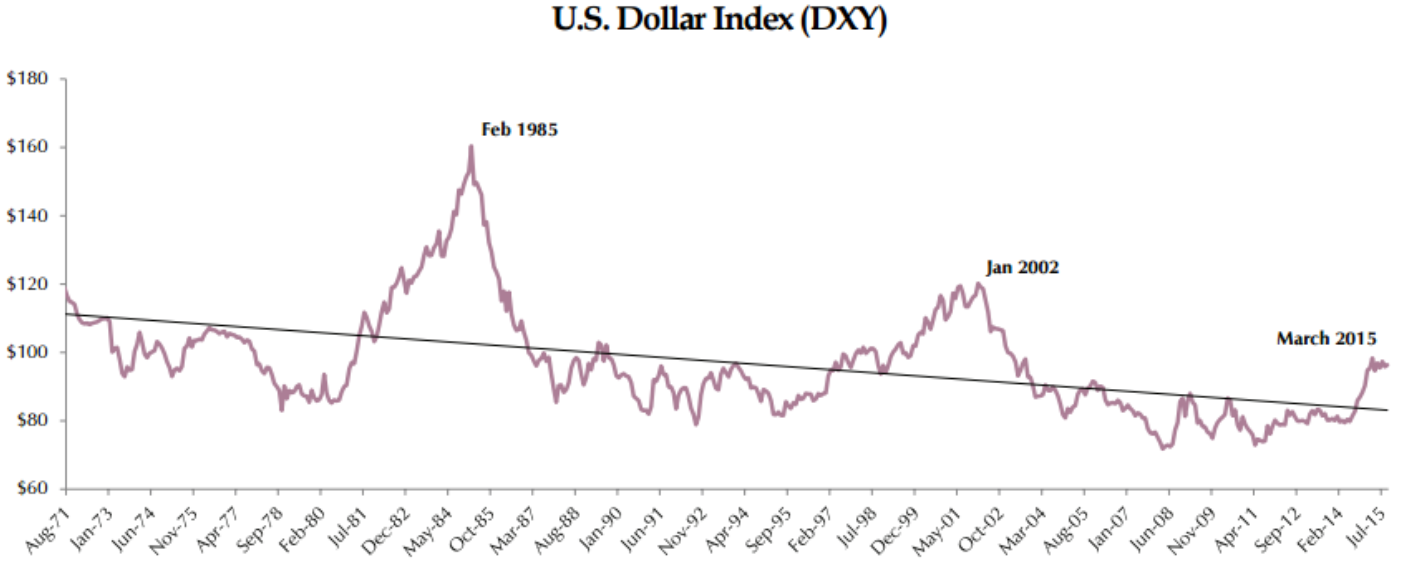

The chart below shows the long-term peaks and valleys of the dollar. A strong dollar hurts American exports and hurts emerging markets because it makes their dollar denominated debt more expensive. If you pair the dollar chart with the global trade growth chart, they are inverses. The strong dollar of the mid-1980s led to trade growth below 0.5%. The strong dollar of the early 2000s let to trade growth falling a full percentage point. The dollar chart below doesn’t have recent data, but the latest rally in the dollar has led to the latest woes in trade growth.

Conclusion

The big data point today was Markit’s business activity index. I don’t want to make it appear like the data was weak. It did show growth, but when put in context of the optimism the market has, the two don’t match up. I propose the thesis that firms are hiring too many workers and building up too much inventory in anticipation of Trump bringing demand growth. It’s also worth keeping in mind the negative implications of the dollar rally. Global trade will be weak even if Trump is really for free trade. Figuring out what Trump will do on trade is the toughest aspect of his presidency to predict. Luckily, we only have a few more weeks until it starts, so we can get a better idea of what the next 4 years will look like.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more