Trick Or Treat Economy

To Jerome Powell and the Fed:

It’s a lesson too late for the learning,

Made of sand, made of sand.

In the wink of an eye, prices are rising

In your hand, by your hand.

Are you going away with no word of farewell,

Will you leave your inflation behind?

You should have tightened sooner, don’t mean to be unkind.

I know tightening was the last thing on your mind

You’ve got reasons a-plenty for waiting—

This I know, this I know—

Yet, the weeds of inflation have been growing.

Please, don’t wait, don’t be Burns.

—Inspired (sort of) by Tom Paxton, 1964.

The nice thing about Halloween is we can act scary without actually being scary. The vampires and zombies who knock on your door are just dressed-up kids having fun. We adults play along and give them candy. Everyone has a good time. The hardest part is staying away from the Snickers before the kids come.

The vampires and zombies knocking on the economy’s door are quite real. Sugary treats won’t make them go away, either. They have plans to complete, whether we like it or not. There’s almost no chance it will end well for us mortals.

Last week, I gave you my nutshell opinion: We are facing demand-driven inflation as a consequence of misguided monetary policy and misdirected fiscal stimulus. Those aren’t the only problems by any means, but they are the main ones. We may face the worst policy-induced economic calamity since the Smoot-Hawley tariffs triggered the Great Depression.

But even if not calamitous, it will be bad. Those in power have slowly but surely painted the economy into a corner. Every option is bad. All tricks, no treats.

Today, I’ll describe what I think will happen over the next year or so. I rarely make short-term forecasts because I’m usually early. Reaching the major turning points takes longer than we think. This time may be different.

Policy Changes

The Federal Open Market Committee meets next week, and many expect it to announce the end of its COVID-19-era asset purchases. The Fed has been buying $120 billion in bonds every month, composed of $80 billion in Treasury bonds and the rest as mortgage-backed bonds. The committee will likely taper those amounts gradually, reaching zero by mid-2022.

Possibly, the FOMC won’t start tapering next week. That would be a mistake of major proportions, on top of the mistakes they have made every meeting this year. We know they watch employment closely, and the last two reports weren’t great until you look at job openings and the quit rate. Then you see employment is extremely tight. Practical unemployment is in the 2% range. They may still decide to wait another month or two, hoping for better-looking data that mutes criticism.

There’s also the curious failure to either renominate Jerome Powell as chair or nominate someone else, with only three months left in his term. (Referring to the Tom Paxton song, will he really go away? If Biden does that, it is yet another mistake.)

Something must be happening behind the scenes. Maybe it relates to getting enough senators aboard. But it comes at a terrible time. The Fed doesn’t need a leadership vacuum while it is also trying to make a major policy shift.

Regardless, I think Fed officials will at least try to start tapering within a few months. It will still be too late. They are behind the curve—“a lesson too late for the learning.”

On the fiscal side, Congress is wrangling over the twin infrastructure/social spending bills. I assume they will both pass in some diminished form, though that’s not guaranteed. As a longtime observer of the political process, I find the lack of cooperation among Democrats entertaining. How can I be so callous? Because the same has been standard for Republicans for 40 years.

Back to the real world. Because the new spending will be spread over time, it probably won’t be as immediately stimulative as the COVID-19 relief funds. It will add unnecessary fuel to the fire, but the debt will keep growing in any case. The new taxes, depending on the particulars, will no doubt have some effect, but we don’t yet know when or how much.

So, we have both the Federal Reserve and Congress on the cusp of major turns away from the post-COVID-19 status quo, which the same Federal Reserve and Congress helped create. But there’s a third player: COVID-19 itself.

With vaccines and treatments, we are on the way to managing (though not eradicating) the virus. Yet, we have barely begun to process the changes it brought to personal habits, consumer attitudes, and business practices. All these will have an economic effect, which means policymakers are trying to restore an economy quite unlike the one they knew before.

This complicates their efforts -- but probably won’t stop them. It’s not a brave declaration, but we are not going back to the economy as it was in 2019. The economy of the 'Boring ‘20s' will be much different.

Trapped Money

We know policy changes are coming, though not exactly when. We know broadly what they will look like. The next question is how they will affect the economy.

Let’s begin by recognizing the obvious: The forthcoming changes will build on previous policy changes that were ineffective at best and probably outright harmful.

A year and a half of QE (plus assorted other programs) tangentially helped business formation and employment, but COVID-19 changed the entire zeitgeist. It was a massive kick in the head, and people simply changed their minds about what they thought was important in their lives. And that was one of the “reasons a-plenty” that the Fed should have stayed out of the way.

Their asset purchases served mainly to pump up stock prices, often the preexisting winners with near-monopoly status in their industries. Similarly, Fed-generated higher home prices helped homeowners who sold their homes, something not everyone is in a position to do. But everyone’s imputed values rose, as did their property taxes and maintenance costs.

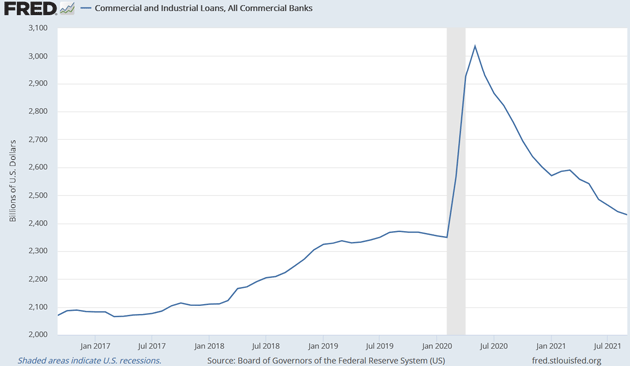

That raises an important and often-missed point. The Federal Reserve is not the main cause of the inflation we see right now. Yes, they’ve pumped up the money supply, but most of the new money is trapped in the financial markets. It can’t escape unless banks lend it to someone. Their willingness to do so has been shrinking, not growing.

Source: FRED

Worse, much commercial lending (and corporate bond issues) went to businesses that didn’t really need the cash but were incentivized by low rates to borrow it anyway. They are either keeping it in reserve or using it for non-growth purposes like stock buybacks.

The Fed’s stimulus created asset inflation in the segments it targeted. This has helped investors but has done nothing to spur GDP growth. The broader price inflation emanates more from the fiscal stimulus, which, as I said last week, shouldn’t have been “stimulus” at all.

Instead of helping those who lost jobs and income get through the crisis, it generated new demand, mainly for goods, which are now clogging the supply chains. The resulting shortages mean higher prices, i.e., inflation.

Now we see 5% inflation, improperly measured. If we measured actual housing prices, inflation would be in the high single digits at a minimum. Anybody that says inflation is not as bad as in the 1970's is comparing apples to oranges. Jerome Powell is in danger of being Arthur Burns, who kept saying that all the inflation data coming to his desk was transitory until it was +10%.

Ironically, this suggests the Fed’s forthcoming policy change will have little or no effect on CPI inflation. They didn’t drive it up, nor will they make it go down. But that doesn’t mean it will have no effect. The taper may remove some of the froth from stock and real estate prices. How quickly and to what extent will depend on their exit schedule.

Meanwhile, the goods inflation will likely ease as the demand-generating stimulus (hopefully) fades away. The extra unemployment benefits ended in the remaining states last month. New spending from the infrastructure packages won’t start for a few more months. So I suspect the supply chain problems will ease fairly soon. Here’s a note from Dave Rosenberg last week:

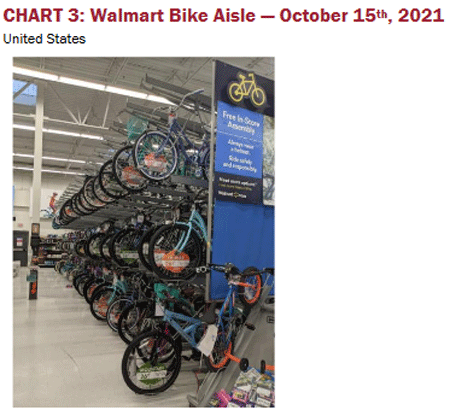

“Well, if a picture can tell a thousand words, then I have 3,000 words here below. Watch the “bottleneck” narrative soon die down. Always bet with US ingenuity, not against it. These photos come courtesy of a valued client and show the same thaw in the supply chain’s squeeze that has become evident of late in the expected supplier delivery delays from the various manufacturing diffusion indices.”

Source: Rosenberg Research

Walmart seems better stocked with bicycles now than it was in January, though, of course, that’s just one department of one retailer. Shortages are real. I was just reading about magnesium, which is essential to aluminum production. Most magnesium comes from China, where energy issues are causing a slowdown. Nonetheless, we learn to work around such problems. Microchip production seems to be on the upswing, which will help the automotive industry.

I often see the term “normalization” used to describe what the Fed is doing. It raises questions. First, do we really know what “normal” is? As noted, this economy is structurally different from the one we left behind in early 2020. Normal is a nebulous target. But even if we could go back, the previous normal wasn’t great.

And this reveals the real problems that are coming.

Modified Staglation

Back in December 2019, I ended the year with a letter called Prelude to Crisis. I didn’t know anything about COVID-19 or the economic turmoil that would begin weeks later. I saw a crisis coming in 2020 for entirely different reasons. The Fed’s half-hearted effort to exit from QE had sparked a repo market crisis and large liquidity injections to stabilize the markets. Their “two-variable experiment,” as I called it, ended badly.

Even back then, before COVID-19, the fiscal authorities weren’t helping matters. Here’s part of that letter:

“Just this week, Congress passed—and President Trump signed—massive spending bills to avoid a government shutdown. There was a silver lining—both parties made concessions in areas each considers important. Republicans got a lot more to spend on defense, and Democrats got all sorts of social spending. That kind of compromise once happened all the time but has been rare lately. Maybe this is a sign the gridlock is breaking. But if so, their cooperation still led to higher spending and more debt.

"As long as this continues—as it almost certainly will, for a long time—the Fed will find it near-impossible to return to normal policy. The balance sheet will keep ballooning as they throw manufactured money at the problem because it is all they know how to do and/or it’s all Congress will let them do.

"Nor will there be any refuge overseas. The NIRP countries will remain stuck in their own traps, unable to raise rates, and unable to collect enough tax revenue to cover the promises made to their citizens. It won’t be pretty anywhere on the globe.”

At that point, the federal debt was about $23 trillion, not counting off-the-books borrowing. I was concerned it would keep growing, which at the then-current trend would have brought it to around $25 trillion by now. Instead, it is approaching $30 trillion due to the unexpected pandemic-related programs.

In 2019, it was clear ballooning federal debt would prevent the Fed from “normalizing” policy. The federal debt had almost tripled since the beginning of the last recession, under presidents and Congresses of both parties. “Spend more money” was seemingly the one thing everyone could agree on. They differed mainly on how to spend it.

Federal Reserve policy enabled the political folly. Real interest rates at or below zero made borrowing a lot less expensive for the Treasury. Borrowing at negative real rates made deficit spending not just feasible but turned it into another revenue source.

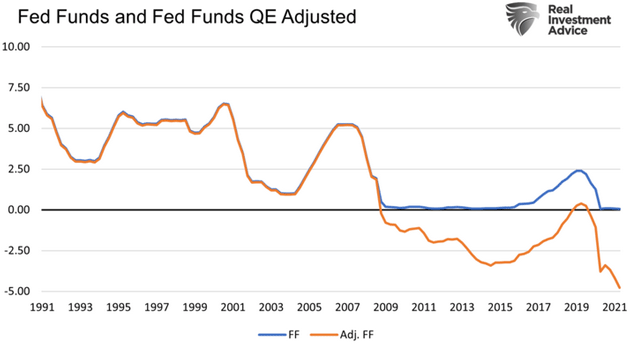

My friend Michael Lebowitz recently produced a fascinating chart. Noting that ex-Fed chair Ben Bernanke estimated every $6–$10 billion of excess bank reserves (the QE money) is roughly equivalent to lowering interest rates one basis point. Michael calculated a “Bernanke adjusted” Federal Funds rate.

Source: RealInvestmentAdvice.com

With that adjustment, the nominal 0% Fed Funds rate was as low as -3% years before COVID-19 and is now even lower. Fed Funds are effectively -5%. Adjusting for inflation would make it lower still.

Michael also showed another academic study that mirrored his analysis, using a different methodology that still pegged Fed Funds at a “mere” -2.5%.

We have been in what Mark Grant calls a “Borrower’s Paradise” for over a decade now, and politicians took full advantage of it. But remember what borrowing is: future consumption brought forward in time. Wise borrowing produces some kind of asset to replace the future consumption. That’s not what we have done.

COVID-19 simply accelerated what was going to happen anyway. Indeed, it was already happening: Low GDP growth, high living costs, flat wages for many workers—general malaise, but not disaster.

Lately, many talk about “stagflation,” which in the 1970's was the combination of high unemployment and high inflation. Reagan ran on that theme and called it the “misery index.” When he ran in 1980, it was in the 19% range. I think something like that will be the next stage, but it will be our own variation, at least for the next few years: high inflation and low growth.

This will be a modified stagflation, though. Price inflation will vary tremendously as global trade patterns adjust to the post-COVID-19 world. Some goods will be scarce in some places, driving their prices higher, even as others are abundant, also in varying places. Broad inflation measures will be less and less meaningful to everyday life. And that is even more so when they use the now increasingly irrelevant “owner’s equivalent rent.”

That may not sound so bad. The problem is it will also aggravate social and political tensions, with unpredictable results. In January 2020, I said we were entering the Decade of Living Dangerously. That’s proving to be an understatement.

That being said, if you looked at my portfolio (and you can), you would see that I am not bearish. I am fully invested, but not in long index funds. Some would say I’m way too aggressive for my age. I will admit to trying to dial back a little, but I keep running into so many great transformational, new technologies. I almost can’t help myself.

I encourage you to call my friends at CMG and see what investments are in the “Mauldin ...

more

Really a great piece of writing, this article.One thing about the federal reserve and the comment "That it mostly healped stock prices." When did they ever have any othe goal?? The federal reserve bankers ONLY seem to care about the stock market and their banker friends. It has been that way for a very long time. AND ALL of their decisions are intended to do that. So either the fed is very misguided OR they have a hidden agenda that is quite evil.

55% of Americans invest in the stock.market, so helping the stockarket does help the majority of Americans.

Yes, but not equally. Most Americans may own one or two stocks. But they don't have a meaningful amount of their net worth invested. This only benefits the wealthy few or as William K. said, the "their banker friends."

F.B. is right! just owning a bit of stock simply because bank interest rates are much less than inflation does not mean much. If my investments stay flat I break even! When we read about investors dumping a few thousand shares of some $155 per share stock, those are the ones who are seriously into stocks, and probably in that 1% or at least the top 5% of wealth.

And since wealth=power, and with the fed working primarily to benefit them, that leaves the bottom half of wealth holders in the abandoned realm. And we all know that inflation is most hurtful to those who are not able to conveniently increase their incomes. THAT includes a whole lot of our population, myself included.

Hit the nail on the end. Well said.

What do you know about convertible arbitrage?