Treasury Publishes Borrowing Estimates For Q3 Which Sneak Below The Median Estimate

Image Source: Pexels

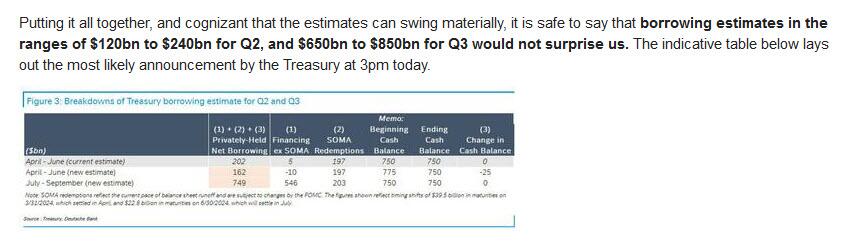

Ahead of today's big event - the Treasury borrowing estimates publication - we said that contrary to hyperbolic expectations of $300BN in revised Q2 funding needs and a whopping $1.2 trillion in Q3, the most likely range of Q2 and Q3 borrowing estimates is as follows: a ranges of $120bn to $240bn for Q2, and $650bn to $850bn for Q3, to wit:

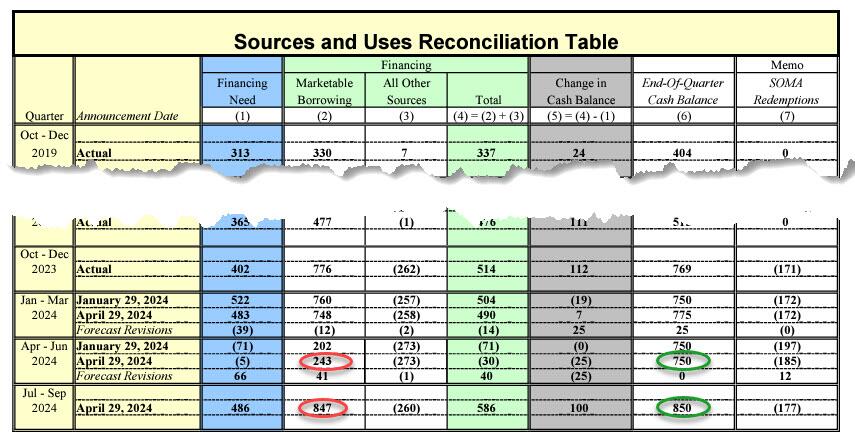

Well, at exactly 3:00 pm the Treasury published the numbers, and while we were almost spot on correct, they did come on the high end of our forecast range, specifically:

- Q2 funding needs were revised higher to $243 billion (just above the upper end of our range of $240 billion) from $202 billion projected last quarter. According to the Treasury, the borrowing estimate was "$41 billion higher than announced in January 2024, largely due to lower cash receipts, partially offset by a higher beginning of quarter cash balance."

- Q3 funding needs (released for the first time) were estimated at $847 billion, just below the upper end of our range of $850BN.

But wait, there's more, because while the Treasury projects $750BN cash balance at the end of Q2, this number rises to $850BN at end of Q3, and since the street-wide estimate for Q3 end of quarter cash was $750BN, this suggests that the real funding needs (on an apples to apples basis) is actually $747BN, which is below the median Wall Street estimate.

(Click on image to enlarge)

Bottom line: amid some ridiculous speculation and even conspiracy theories that the BOJ intervened today because it was expecting a surge in funding needs, the Treasury reported numbers that came in in line with expectations for Q2, and actually below the estimate for Q3, which is precisely what we said, because the number is driven not so much by financial but by political considerations.

The real question should be not what the Treasury projects for Q2 and Q3, but Q4, which is after the election, and when all the lipstick on this pig will finally wash off.

More By This Author:

Key Events This Extremely Busy Week: Fed, Treasury Refunding, Jobs, JOLTS, ISM And Tons Of EarningsAmericans Are Increasingly Negative About China

It's Entirely Legal To Own "Thermonator"

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more