Translating What Is Central

In a credit-based monetary system, take the term literally. Central banks don’t matter, the global banks that make, distribute, and redistribute credit do. And if banks aren’t as willing to make it, there is no amount of QE byproducts (bank reserves) that can save it.

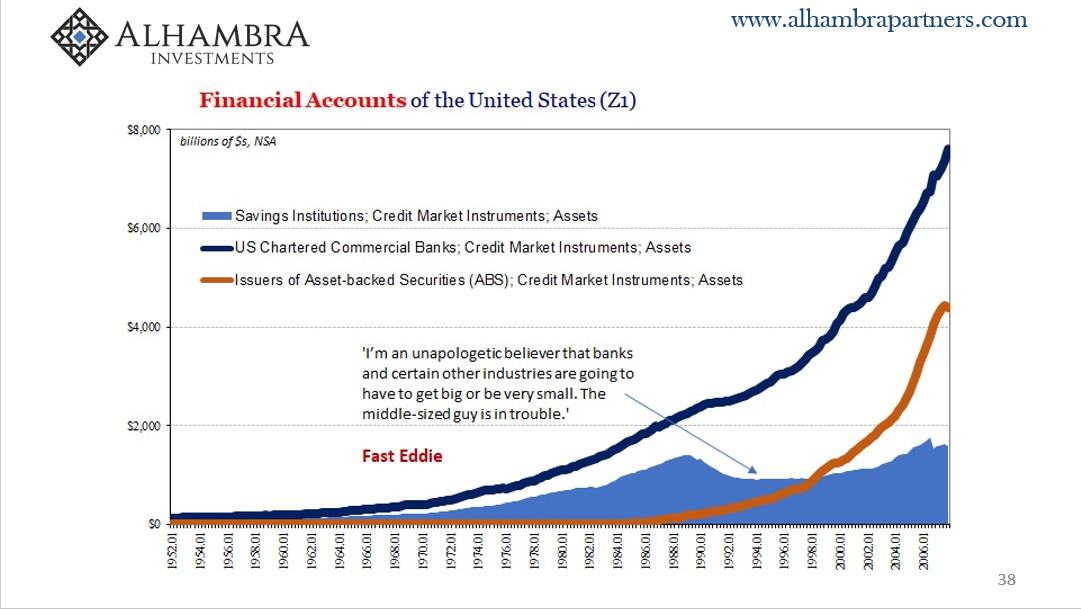

The entire issue is risk/return. Some will blame regulations, but as I’ve often written there is no regulation a big bank won’t try to overcome if the reward is perceived to be fat enough. The class of workers that arguably benefited the most from the housing bubble (meaning eurodollar) era were all those lawyers and lobbyists working for Lombard Street firms (Wall Street banks, in the popular imagination).

Every time we go through one of these eurodollar squeezes, the more banks are reduced for them. It proves to the remaining holdouts, there is no upside only downside. You can believe a Janet Yellen or now Jay Powell when they declare recovery, but that will only lead you into the red.

Banks shrink and then shrink some more. They cut back in the one area that is crucial to money dealing, the capacities in a credit-based monetary regime that manufacture and redistribute the end products (what looks like currency and money). FICC.

I wrote during the last one, Euro$ #3, why it was only going to continue:

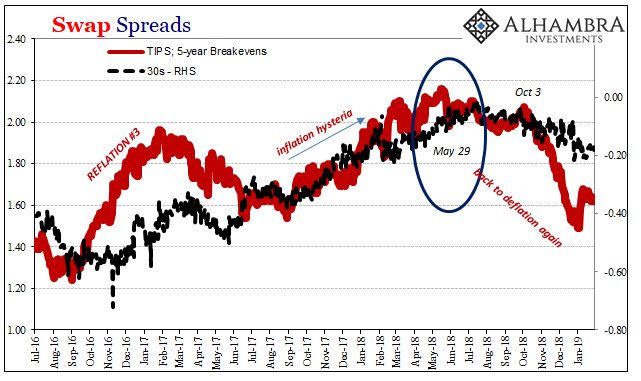

As this point is pressed home over and over, as each bank cuts back and restructures against FICC, the “dollar” only cuts deeper and deeper into the financialized global economy and makes it only less opportune for what balance sheet resources remain; and round and round we go. The media cannot grasp as to why swap spreads would not only be negative, but quite negative and quite widespread and persistent, yet here it is staring them right in the face. A negative swap spread holds no meaning except to say that there is great imbalance in balance sheet factors on offer to carry out the financial factors necessary for the wholesale system to remain at least steady. You don’t have to know anything about interest rate swaps or dealer activities to see that plainly from what these banks report on their (off) balance sheets and in their own words.

Risk/return. In the “glory days”, it was all return, no risk. Only, there was a ton of risk everyone chose to ignore believing for no real reason it was all so easily manageable (the myth of the “maestro” very complicit). It was a prominent theme for my speech in Vancouver:

That’s the other side of this sprawling transformation, in the desperate rush to get bigger, broader, more comprehensive, some big questions were left unanswered particularly in relation to understanding how all of this worked and fit together.

The monetary bubbles of the late 20th century were to see if they could do it, and while they did it nobody stopped to consider whether they should and for how long it could keep up. Short-termism. On the other side of August 9, 2007, it’s all risk and no return.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

As I wrote in 2015, there is no upside. Banks cutting back, as others had done before, assures there won’t be. Eurodollars squeeze, banks shrink “bond trading” making it all but inevitable how despite reflation another squeeze will eventually follow instead of recovery. The degrading cycle repeats and precious time is sunk down the hole of moneyless central banks.

Now the noose tightens for the fourth time.

The first for February 2019:

Goldman Sachs Group Inc. is considering plans to reduce the capital dedicated to its core trading business within the fixed-income group, a nod from the bank’s new chief that the business may not be as lucrative as in its glory days, according to people briefed on the matter…

Senior executives also told leaders at a strategy meeting last week that market-making is too big in the fixed-income trading business, emphasizing the need to diversify operations within the division.

Like Deutsche Bank in 2014, Goldman out of its peer had been the biggest believer in the unemployment rate/Yellen “transitory” pitch. “Not as lucrative” simply means we got beat up because there is no globally synchronized growth, no recovery. We won’t do it again.

The results look like the liquidity trap of orthodox Economics theory, but there is no liquidity. This is the monetary trap. Banks won’t make any, and already they are setting up for another round of shrinking. Or, as I put it in 2015, despite this being eleven lost years now, why it will still continue.

(Click on image to enlarge)

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more