"Transitory" Inflation Cooling As "Sticky" Heats Up: Here Is The Heatmap From Today's CPI Report

Markets breathed a sigh of relief today when the latest CPI print came in weaker than expected, missing consensus expectations for the first time since October, and prompting economists from Pantheon Macro to declare that "in one line: The surge is over." We doubt it, but first here is the data.

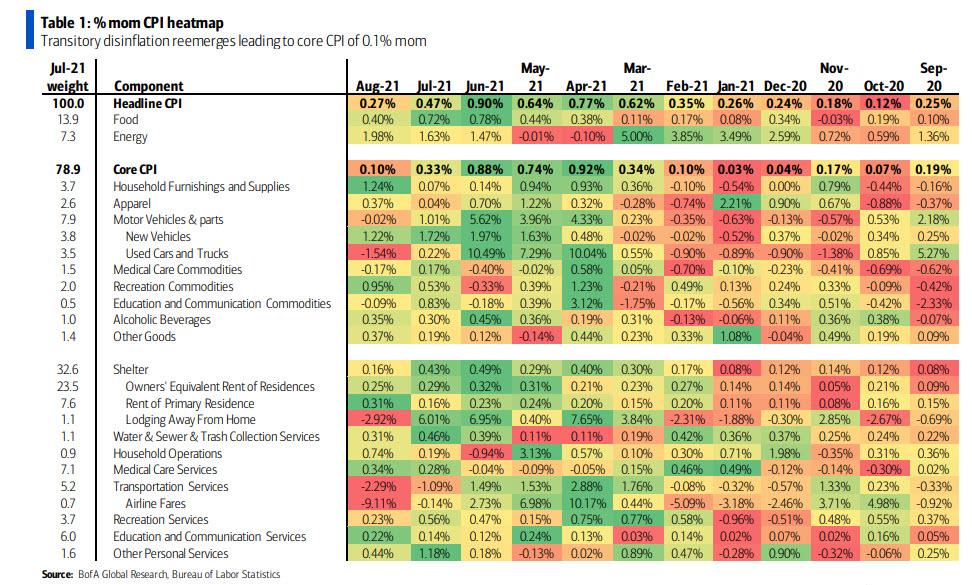

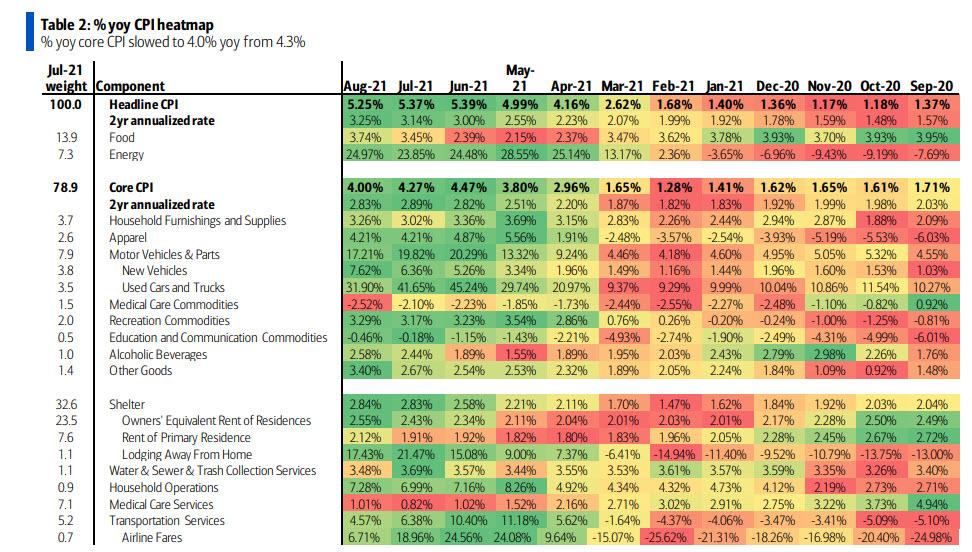

Core CPI inched up 0.1% (0.10% unrounded) mom in August, marking the softest sequential gain since February. This was below consensus expectations and led to the % yoy rate moderating to a still elevated 4.0% yoy clip, from 4.3% previously. Headline CPI rose 0.3% (0.27% unrounded) mom, boosted by a 2.0% surge in energy prices and solid 0.4% rise in food. Headline % yoy edged down to 5.3% yoy from 5.4%.

The winds of transitory inflation became crossed this month:

-

On one hand, used car prices started to see a negative payback after the record-smashing rally over the past year, declining 1.5% mom. The timing is consistent with wholesale used car prices, which began to turn lower in June and are now down 4.2% from the peak through August. Reopening pressures also saw a sharp reversal with lodging prices plunging 2.9% mom and airline fares collapsing 9.1% mom. The broader transportation services sector also fell 2.3% mom, pulled down further by a 2.8% drop in motor vehicle insurance (which reflects seasonal factors that will likely bounce by +2.0% mom in September) and an 8.5% collapse in car & truck rental prices. Together, these components sliced 0.26% from core % mom.

-

On the other hand, there were signs of continued shortage-related pressures as price gains were seen across commodity items. Both new car prices and household furnishings & supplies jumped 1.2% mom in August, recreation commodities soared 1.0% mom, apparel and other goods both rose 0.4% mom, and alcohol rose 0.3% mom. These categories added 0.16% to core, meaning net transitory disinflation this month.

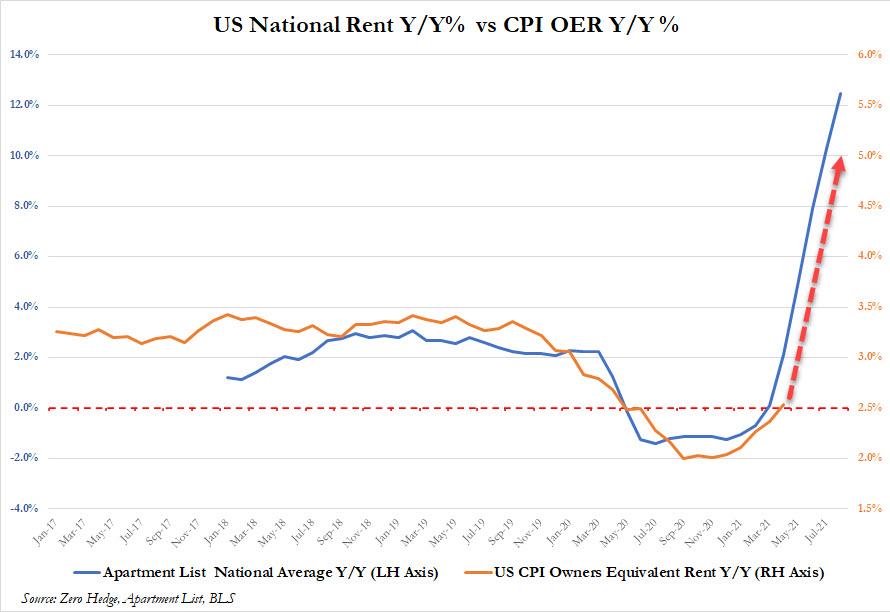

Yet despite the softer core reading, there was continued pressure from a persistent inflation perspective. Both OER and rent of primary residence rose 0.3% mom, the latter improving from its recent 0.2% trend and catching up to the former. If 3rd party subscription-based sources like Zillow, Apartment List, CoreLogic, and YardiMatrix are any indication, OER is set to soar in the coming months.

Medical care services also held in at 0.3% mom. There was also broad price pressures across other major services, with labor constraints and resilient wages potentially playing a role.

With CPI and PPI data feeding into PCE inflation, the Fed’s preferred inflation metric, BofA estimates a solid August core PCE of 0.3% (0.34% unrounded) mom, which would keep the % yoy rate at 3.6% (3.65% unrounded). Both % mom and % yoy have a risk of rounding up. The PPI data point to better autos and transportation prices within core PCE, versus core CPI, and strong food services also feeds into core PCE.

The market response to the fading of transitory readings at a faster pace than priced-in is consistent with what we would expect. Inflation breakevens declined across the curve with moves concentrated in the front-end of the curve while real rates rose. Market measures of forward inflation, like 5y5y breakevens, were little changed as transitory inflation should have little impact on longer-term inflation expectations.

A heat mapped summary of the data looks like this, first on an M/M basis...

... and here is the Y/Y.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more