Trade Focuses On Lost Black Sea Exports

Market Analysis

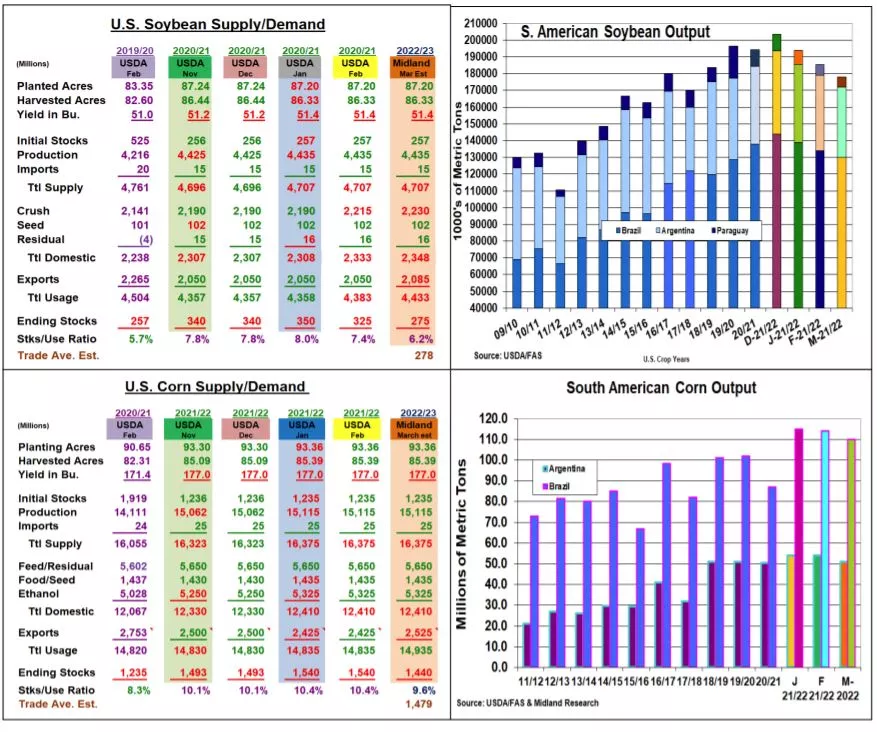

The USDA’s next US & World supply/demand & S. American crop updates will be released on March 9. However, the current Russian invasion into Ukraine has been the market’s focus the past week. Traditionally, not many changes in the US & World numbers are made as USDA waits to see important US quarterly stocks & processing reports later this month before making demand changes. However, extreme heat & dryness in S. Brazil & Argentina earlier this year suggests further downward cuts in their soybean & corn outputs this month. With intense military action occurring across Ukraine & all the Black Sea ports closed, the markets main concern has become the trade flow in this area. The sizable wheat & corn export shipments that might not be shipped in the next 3-4 months has buyers scrambling to find alternative sources which could increase US exports yet this season.

In soybeans, trade and attaché estimates of lower S Am crops suggests the USDA will dip their output by 7-8 mmt. Recent Indian b.oil purchases & the rapid jump of renewable diesel operations suggests the US crush could be raised by 15 million to 2.23 billion bu. S Am’s smaller output should up US exports by 35 million bu to 2.085 billion. Overall, the US 2021/22 ending stocks could be reduced to 275 million bu.

Similarly in corn, the trade is expecting the USDA to lower S Am corn output by 4-5 mmt because of heat & dryness in S Brazil & Argentina. However, unshipped Ukrainian exports for China & others has been corn’s big market factor with their Black Sea ports closed. Concerns about curtailed spring planting activity reducing Ukraine’s 2022/23 output has also been supportive. No changes in US feed or ethanol demand are likely this month, but exports could be raised 100 million reducing old-crop stocks to 1.44 billion bu. as overseas buyers look for alternative sources.

Given the Black Sea’s 30% of the world’s wheat trade, this grain has exploded to its highest prices since 2008. US exports might increase by 35 million. But, India’s sizable stocks & big upcoming harvest could be the big supplier to the Mideast & Asia with the US dollar value high. (not pictured).

What’s Ahead:

Given the extreme price volitity because of Black Sea’s conflict, grain & oilseed prices are overbought. Use May advances to price 90% of your 2021/22 corn & soybean output at $7.65-$7.75 & $16.60-$16.90.

With Chicago wheat at $12.00 complete your old-crop sales, while KC & Minn growers hold your sales at 90% given drought conditions in your areas.

Hold New crop sales at 25% for now.