Trade Buffett (Again) And The Week Ahead

We must prepare ourselves for a stronger U.S. dollar, higher for longer rates, and increased worry about wage growth and services inflation. Plus, there's a major warning sign with Nvidia right now.

Image Source: Pexels

Away we go again. Another Federal Reserve meeting, another massive short position from hedge funds, and never-ending questions about the reliability of government data.

We have a busy week ahead. Today, we will urgently discuss the market state of affairs and revisit one of the most reliable trades of the last three years.

Monday: There’s Money in the Buffett Trade

- Event(s): Reactions to the latest Buffett’s Occidental Petroleum Purchase

Warren Buffett’s Berkshire Hathaway (BRK-A) bought another $153 million in Occidental Petroleum (OXY). Berkshire bought at $59.75 per share on June 5, making this the first purchase since early February. It’s a perfect time to revisit the Buffett trade, and we’ll be recommending our favorite trade of the last two years. It might be in the $55-$57 range in July.

Tuesday: What’s the Other Oil Play?

- Event(s): OPEC Monthly Oil Market Report

As I noted last week, OPEC will start to unwind production cuts in the year's second half. This could bring nearly two million barrels of oil back online by next year. A few media outlets asked the question: Is OPEC moving forward with production hikes at a time when economic conditions appear to be weakening because of rising U.S. production?

Well, yes. The story is that the U.S. should produce nearly 14 million barrels of oil every day next year—all at a more efficient cost. All of that crude has to go somewhere.

The play in oil is to ride the inventory and the pipelines—and not the price itself. Let me remind you for the 100th time this year—there is always money in the Midstream.

Wednesday: Prepare for The Inevitable Powell Trade

- Event(s): Federal Reserve Chair Jerome Powell speaks at 2:30 pm, CPI Data

The Consumer Price Index (CPI) comes in a few days after the jobs report shows that no one’s buying the government data. Wages continue to rise. The forecast for CPI is now at 3.4% for May. The key issue is wage growth - and we can thank the ongoing surge in government and healthcare jobs. I am still apprehensive that the Core CPI bottomed last month - mainly on flat gasoline prices - and we see another uptick heading through the summer and into the rest of the year. We need to cut back on government spending, and we should raise rates by to 6% last year.

But we didn’t because we’d have driven more banks into bust and made big, short-term payments on our national debt. But instead, we’ll suffer stagflation instead. With Powell’s talk, no rate cut is coming, but the questions center on whether we’ll see two rate cuts - as predicted - in 2024.

As always, wait until the market direction until 2:35 pm and follow it as a trader, but be very wary about the last hour of the day. The trend has been a scream higher shortly into Powell’s speech, followed by selling. I doubt that Powell will discuss that a rate hike could be on the table next year.

Thursday: The Day Elon Musk Pays for Twitter?

- Event(s): PPI Data, Tesla shareholders meeting

Shareholders must decide whether to compensate Elon Musk, the founder of Tesla, some $56 billion. Wealth funds are lining up against the deal, but there are expectations that Musk could walk away from his business if he doesn’t get the compensation he believes he deserves. That’s a lot of money to expect, but I’m sure he could find plenty of time leading SpaceX, X (Twitter), xAI, Neuralink, and the Boring Co. How much free time does this guy have?

Friday: Bank of Japan (BoJ) Monetary Policy Chat

- Event(s): BoJ will talk about its rate decisions

As I’ve noted, the state of the Japanese yen is one of the most important stories in the battle between the U.S. and China. There will likely be talk about needing to see more data before raising interest rates. But the reality is that a rise in the Japanese rate will impact rates abroad - and could push U.S. 10-year bonds higher.

All the while, America seems to hope that it can force China into a difficult situation where global trust cracks in the yuan. It’s likely that there will be a yuan devaluation at some point, but that exact time is nearly impossible to predict.

China is a wild card that could bring the global economy into serious peril. The threat of war in Taiwan could impact the semiconductor industry and bring multiple industries to a halt. Or, we could revisit the perils of 2015-16, when a massive Chinese economic event brought global markets much lower.

Economics Woof

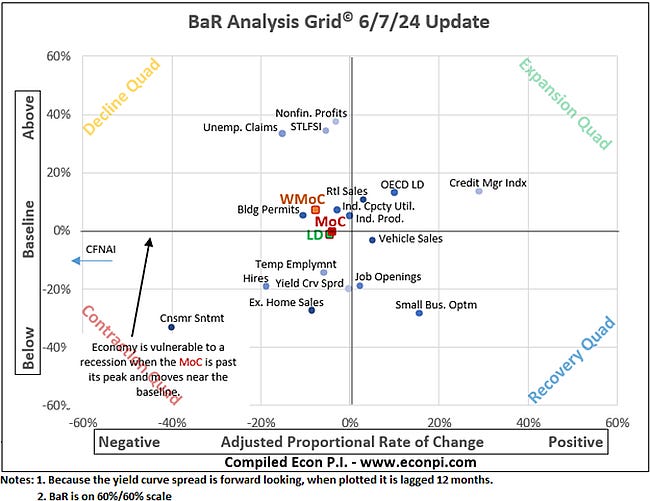

Econ P.I. takes us from worsening economic performance. Consumer sentiment doesn’t look to great at all, and I’m very worried about industrial production. There are voices out there suggesting that the Fed will cut rates due to the slump in housing and production. But - how can that happen when services inflation remains so high? How can that happen when wage growth is so high?

There was a massive fiscal policy error that they just can’t correct. We printed too much money and we gave Congress even more leeway to run massive deficits and borrow, borrow, borrow, all while rates are elevated. Now we have high services inflation, weakening private sector employment, and a host of other problems.

And Finally

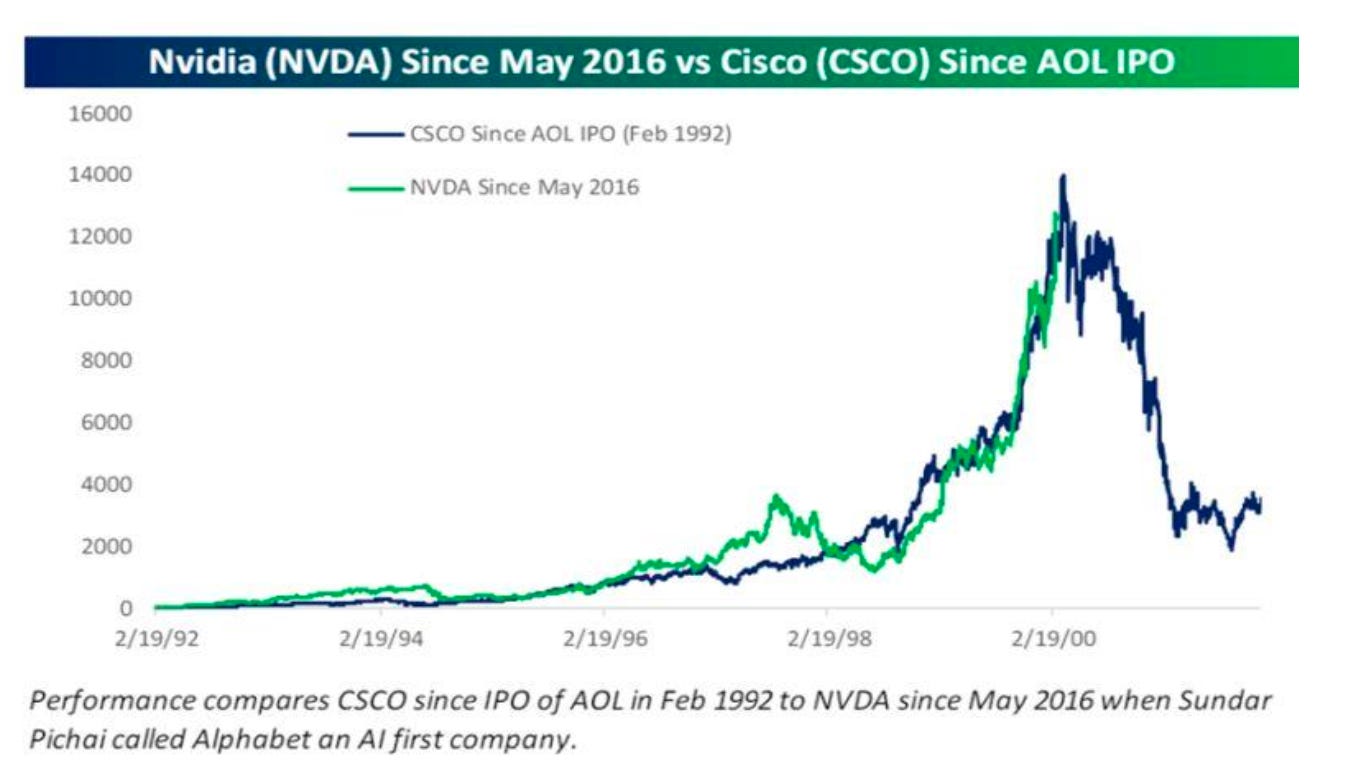

Nvidia (NVDA) defines the market right now, so any surprise downside would likely severely damage the Nasdaq and the S&P 500. I don’t know what to make about a company that somehow got cheaper despite the stock rising by 5x over the last year. But it did on a price-to-earnings multiple.

That said, it’s important to note that this follows an incredibly close path that Cisco (CSCO) followed during the Dot-Com Bubble, starting when AOL went public in the early 1990s, compared to the 2016 statement about Alphabet being the first AI company by Sundar Pichai. This chart comes from Bespoke via Syz Group.

(Click on image to enlarge)

It doesn’t mean it’ll implode, but we have to be rational about what we’re witnessing at some point. Come on, look at this chart. I’m not shorting this thing. Even in negative momentum, it’s just too resilient. And the market will eventually reprice that risk, or a paradigm shift will ensue.

It’s getting very expensive to hedge against a 10% correction in the S&P 500. It’s the worst since October 2023, when we had a rather relentless downturn and interest rates rallied to 5%. We’re nowhere close to this drama ending.

More By This Author:

Reflections, Predictions, Chaos

The Week Ahead: What's Next

The June Watch List

Disclosure: None.