Top Stocks To Own In Today’s Oil Market

Oil prices have been swinging up and down recently leaving investors scratching their heads looking for good investments. It remains true however, that there’s something for everyone in the oil market, you just have to know where to look. Here are our top investments for new money right now.

It’s been a volatile few weeks for crude. Which has gotten a lot of investors excited for a rebound, but has also left some investors skeptical.

The government released inventory numbers that showed crude oil supply was actually up, bad news for prices. This sent oil prices tumbling back below $48 a barrel. But we’ve seen oil slowly climb back over $50 and beyond over the last few days.

This comes as the latest weekly report for oil rig drilling activity showed oil producers continue to cut capital expenditures and idle rigs, which is good news. It means producers are curbing production and that should help with any oversupply worries.

However, there’s still mixed feelings in the market. Remember that back in December, oil investor T. Boone Pickens called for a move back to $100 a barrel in less than 18 months.

But famed oil trader, Andrew Hall, put out his investor letter this week that calls for $40 a barrel oil in the next few months. Hall is referred to as the oil trading God in the book Oil and was paid $100 million back in 2008 by Citi for his great insight on the oil markets. However, for those that read all of Hall’s latest investor letter, he notes that oil prices can’t stay that low for very long.

I’ll be the first to admit that the market makes mistakes all the time.

Just last week we made the case that investors can use overreactions to earnings as a strategy to buy solid stocks at a cheap price. Will oil’s move from $100 a barrel down to $50 in some six months be the biggest mistake of 2014?

Even if you assume that it was, there’s no shortage of ways to play an expected rebound in oil prices. The hundreds of companies that produce oil are overwhelming. But for investors looking to play a rebound in oil prices, the smaller explorers and producers will have the most to gain. So they’re worth digging into.

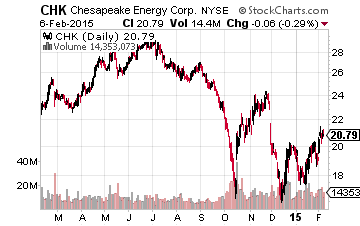

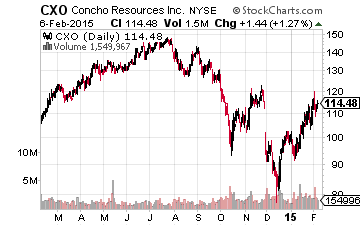

To start, there’s Chesapeake Energy (NYSE: CHK) and Concho Resources (NYSE: CXO), which both have very strong asset bases and reasonable debt loads. These guys are strong enough to take advantage of the oil selloff by buying up oil producers that are trading for cheap. Their net debt-to-EBITDA (based on 2015 expected earnings before interest taxes depreciation and amortization) ratios are just around 2x.

But the other thing is that Chesapeake and Concho are just big enough, with market caps of around $14 billion, to possibly attract larger players. Meaning they can be either acquirers or acquisition targets.

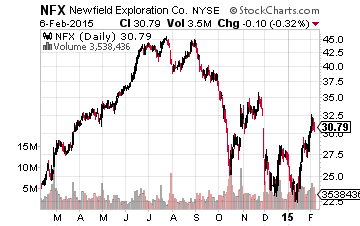

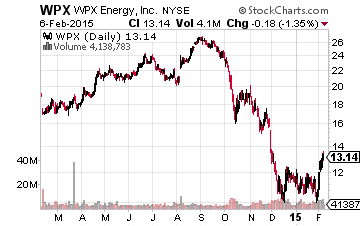

Some companies, more than others, will be licking their chops to get prime oil average for cheap. Two companies that come to mind are Newfield Exploration (NYSE: NFX) and WPX Energy (NYSE: WPX). Given their strong balance sheets and the need to strengthen their acreage portfolios, look for these guys to be active on the acquisition front.

Newfield is one of the few players in the oil and gas exploration business with an investment-grade corporate rating, where its S&P corporate rating is “BBB-“. And WPS has a net debt-to-EBITDA ratio of just 1.7x.

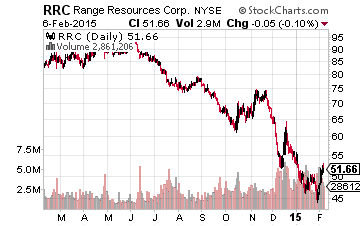

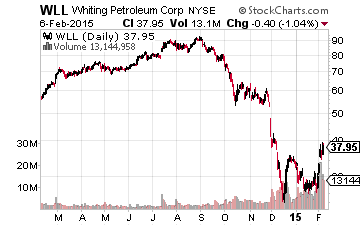

Digging deeper, some companies don’t have the balance sheets to be acquirers, but they will be buyout targets. A couple acquisition targets are Range Resources (NYSE: RRC) and Whiting Petroleum (NYSE: WLL). Each of their stock prices are down 60% over the past six months.

The balance sheets aren’t golden — Range Resources has a net debt-to-EBITDA ratio or 3.2x and Whiting is at 2.9x — but these guys have some of the best acreage in the business. Range Resources has a strong presence in the Marcellus shale and Whiting in the Bakken shale.

Then of course there’s the more risky plays.

The asset bases of the riskier companies in the oil exploration business aren’t as strong as the other names, plus they’re saddled with debt.

Recall that we put Halcón Resources Corporation (NYSE: HK) on our 2015 bankruptcy watchlist. The company has a net debt-to-EBITDA ratio 5x and its debt is rated junk, with a “CCC+” corporate credit rating from S&P. It has $2.9 billion in bonds (debt) outstanding, versus its $850 million market cap.

But the key is that not all leveraged oil and gas companies are created equal.

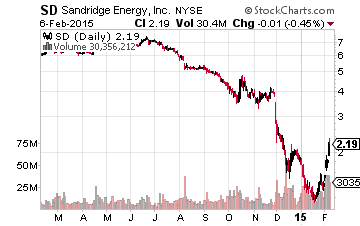

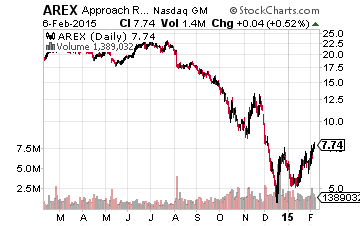

Consider either SandRidge Energy (NYSE: SD) orApproach Resources (NASDAQ: AREX). The stock price of each has been cut in half over the last six months, but each have a “B-“ compare S&P rating.

Approach Resources is particularly interesting because its net debt-to-EBITDA ratio is less than 3x. Its bond debt is just $250 million, versus its $300 million market cap.

Bringing it full circle, recall that Andrew Hall is calling for lower oil prices in the near-term. And there’s a number of other oilbears, such as Again Capital founder, John Kilduff, who last week called for $30 oil — noting that $30 a barrel oil was the low point in late 2008.

While myself, and many other informed investors, may not believe things will get that dire, let’s entertain the idea for a minute.

Dividends are a great place to take refuge until we do see a true sign that oil is ready to break out to the upside. Dividends also provide income should oil prices trade sideways for a few months.

On its recent earnings call, Anadarko Petroleum (NYSE: APC) noted that, “We would concur with those that are in the camp that think we have a U shape. We’re not anticipating it being V shaped.”

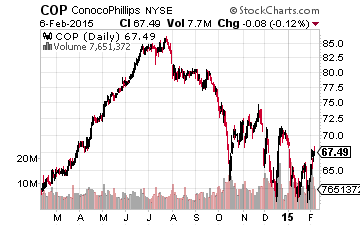

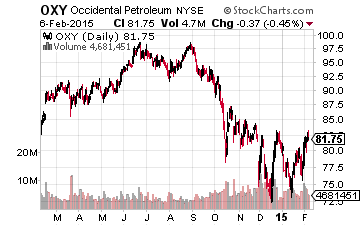

In any case, a couple top picks under this scenario are ConocoPhillips (NYSE: COP) and Occidental Petroleum (NYSE: OXY). They offer 4.3% and 3.5% dividend yields, respectively, and neither missed a dividend payment during the mass selloff of 2008. The debt loads are more than reasonable and both won’t have a problem remaining profitable next year. But both are still down over 15% for the last six months given the oil selloff.

Even for risk averse investors, I think ConocoPhillips and Occidental are better positioned to reward investors going forward than say, Exxon Mobil (NYSE: XOM) and Chevron (NYSE: CVX).

Guessing where crude oil will trade next week is a fool’s game. We think the best thing for investors is to set up their portfolio for where crude oil will be longer-term, which by all accounts is higher than where it is today — assuming the current trend of production cuts continues.

Regardless, there’s something for everyone in the current oil price environment. It just depends on your risk appetite as to whether you stick to underrated dividend payers and explorers with strong balance sheets and prime acreage, or whether you invest in a company that might not have the prettiest balance sheet but is buyout bait for the bigger players.

Disclosure: None

Another energy stock that has fluctuated greatly over the past few months is EXXI - up 43% in the past month. it seems to follow the fluctuating price of oil as do the stocks you mentioned. Noone can know where the bottom is for oil prices but there's a lot of money to be made (or lost) in the ups and downs of these stocks currently if investors can handle the fear of potential losses in the short term.

If the volatility is big, buying options may be a good choice for investors: the potential losses will be much less compared to investing in equities.