Top 5 Consumer Goods Ratings Of 2015

An analyst must give a stock the correct rating at the right time in order to make a profit. Let's take a look at the most profitable consumer goods sector ratings of 2015.

1. The most profitable rating of 2015 for the consumer goods sector was made by Craig-Hallum analyst Alex Fuhrman for Weight Watchers International, Inc. (NYSE: WTW) on September 19, 2015. The analyst upgraded the stock to Buy after citing positive results from the company’s new marketing plan, which caused the stock to surge. Launched last year, the company worked on several marketing initiatives to stay competitive with new technologies such as apps and fitness trackers. Of these initiatives was the “Help with the Hard Part” campaign, which replaced celebrities and presented a more honest approach to weight loss. As a result, the analyst stated that the company’s website reached peak levels for unique online visitors in September. The stock surged again following October’s announcement that Oprah Winfrey joined the company’s board and purchased a 10% stake in the company.

On the day of Fuhrman’s rating, shares of Weight Watchers were trading at $6.79. Three months later, the stock surged to $24.23. If you had purchased shares of Weight Watchers when Fuhrman suggested, you would have made a 252% profit in three months. Alex Fuhrman has a 75% success rate recommending Weight Watchers with an average return of 84.6% per recommendation when measured over three months.

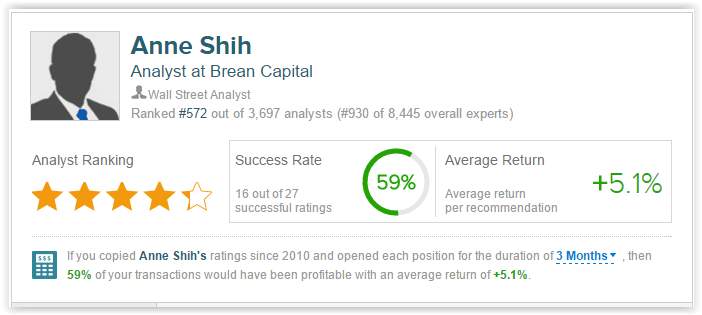

2. Anne Shih of Brean Capital made the second most profitable 2015 consumer goods rating when she recommended buying China Distance Education Hldgs Ltd (ADR) (NYSE:DL) on August 20, 2015. The analyst maintained a Buy rating on the company but lowered her price target to $14 from $23 following the company’s disappointing Q315 earnings report. The company lowered guidance, citing slow enrollment growth. However, the analyst remained hopeful about the company’s leverage during enrollment. She stated, “Though DL’s pure online business model leads to disproportionately negative impact on margin during enrollment downturns, on the other hand, the company gains leverage with each incremental enrollment during periods of growth.” Although the disappointing earnings release caused her to lower her price target, she believed that “mid- to longer-term there may be potential upside from more meaningful contribution from new revenue drivers (teacher training, college cooperation, etc.). Consequently, we are maintaining our Buy rating.” She also cited the company’s leading position in the market.

On the day of Shih’s rating, stocks were trading at $8.25. Three months later, shares were up to $15.66. If you had purchased shares of DL when Shih suggested, you would have made a 90% profit in three months. Overall, analyst Anne Shih has a 59% success rate recommending stocks with an average return of 5.1% when measured over three months.

3. Analyst Bob McAdoo of Imperial Capital made the third most profitable 2015 consumer goods rating for Republic Airways Holdings Inc. (NASDAQ:RJET) on August 27, 2015. The recently retired analyst reiterated his Outperform rating and price target of $10 after a local pilots union would not allow company pilots to vote on a contract involving pay rate increases and work rule improvements. The analyst believed that the national union would ultimately enable Republic pilots to vote on the current contract proposed by the company, returning the company to normalcy in both shares and operations. He stated, “We view this non-recommendation as further sabre rattling by local union officials. With chapter 11 bankruptcy as the potential alternative to a new contract, we suspect the national union will ultimately override the local union’s decision and allow for a pilot vote.”

On the day of McAdoo’s rating, stocks were trading at $2.54. Three months later, shares were up to $4.40. If you had purchased shares of RJET when McAdoo suggested, you would have made a 73% profit in three months. Overall, retired analyst Bob McAdoo had a 57% success rate recommending stocks with an average return of 5.9% when measured over three months.

4. The fourth most profitable rating of 2015 for the consumer goods sector was made by Gene Munster of Piper Jaffray for China Distance Education Hldgs Ltd (ADR) (NYSE:DL) on August 19, 2015. The analyst maintained his overweight rating and price target of $16 following the company’s Q3 earnings release. The analyst stated that although the company posted disappointing guidance for its next quarter, revenue exceeded estimates by 4% and therefore cited an long-term positive outlook for the company. Munster attributed his rating to “low penetration rates in key verticals including accounting (midteens) and healthcare and engineering/construction (single-digits).”

On the day of Munster’s rating, share of DL were trading at $9.50. Three months later, the stock was trading at $16.22. If you had purchased DL when Munster suggested, you would have earned a 71% return in 3 months. Analyst Gene Munster is ranked #1 out of 3,697 analysts with a 64% success rate recommending stocks and a 7.2% average return when measured over a 3 month horizon.

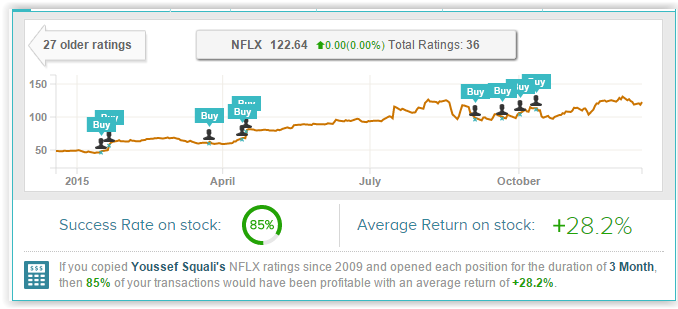

5. The fifth most profitable rating of 2015 for the for the consumer goods sector was made by Youssef Squali of Cantor Fitzgerald for Netflix, Inc. (NASDAQ:NFLX) on January 16, 2015. Prior to the company’s Q4/2014 earnings release, the analyst rated Netflix a Buy with a $415 price target. The analyst expressed positive sentiment on the company, stating that he “[expected] Neflix to report solid 4Q:14 results on 1/20, with healthy growth across both the U.S. and international markets.” Additional reasons for his bullishness included the previous quarter’s lowered subscriber guidance “to more achievable levels” and a “compelling slate of original content scheduled for 2015 and the current valuation.”

On the day of Squali’s rating, shares of Netflix were trading at $48.19. Three months later, shares rose to $80.29. If you had purchased shares of Netflix when Squali suggested, you would have made a 67% profit in 3 months. Analyst Youssef Squali has an 85% success rate recommending Netflix with an average return of 28.2% per recommendation.

Note: All analyst photos and statistics in this article are measured over a three-month horizon. Links to analysts ...

more

I'm certainly buying $WTW. Especially after all the overeating from the holidays! Wish I had seen Alex Fuhrman's buy call back when he first made it though.