Top 4 Popular Dividend Stocks To Not Hold

Warning: be ready to be shocked by reading this article.

And I’m ready to take your tomatoes… even though I’m right.

Instead of making another list of great stock picks, I decided to do the opposite today. I actually wrote about these companies over the past 12 months telling investors to sell them now before it’s too late. What makes them special is that they have tons of fans as they are very popular dividend paying companies. They often ace the first filtering processes due to their competitive advantage and good fundamentals. Their “brand” as a dividend paying stock is strong among investors but I feel that they offer more smoke than anything else. Many investors are blinded by the story told by these companies and tend to ignore the story that will happen in the years to come.

Those companies are on my black list and I don’t see them returning to my watch list anytime soon. In fact, I think each of them is a BIG SELL at the moment.

General Electric (GE)

General Electric is a 100-year-old company offering various digital industrial products. The company counts 8 divisions within its “GE Store”:

- Power: combustion science and services, installed base.

- Energy connections: electrification, controls, and power conversion technology.

- Renewable energy: sustainable power systems and storage.

- Oil & Gas: services & technology.

- Transportation: engine technology and localization in growth regions.

- Lighting: LED bulbs.

- Healthcare: diagnostics technology.

- Aviation: advanced materials, manufacturing, and engineering products.

All right, what could possibly go wrong with this all-star player? I mean, even Warren Buffett holds shares of GE in his portfolio. Now that the company is getting rid of its financial division (GE Financial), management is claiming to focus on what they do best; manufacturing a wide variety of products. Fine.

But what this great story doesn’t tell you is that it’s not looking well for future dividend payments. First, the company cut its dividend severely back in 2008 and shareholders haven’t gotten back to their previous distribution level yet:

Source: Ycharts

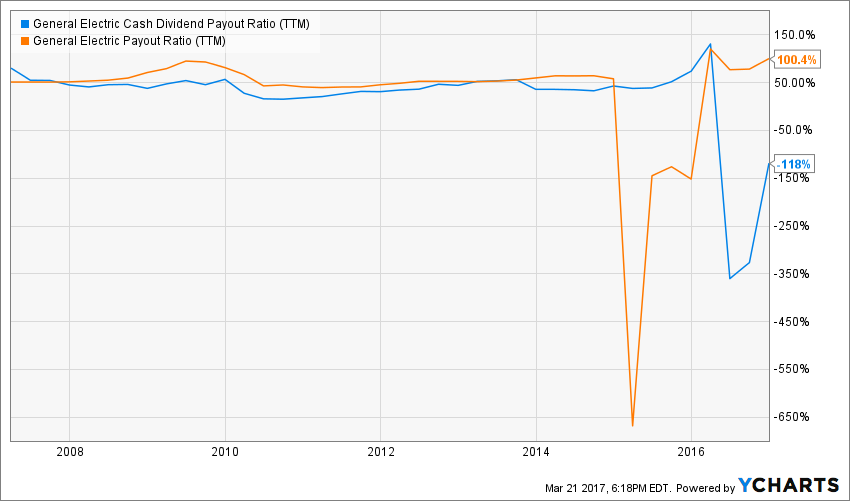

But you are going to tell me the dividend payment is climbing slowly but surely again. However, tell me how they will continue to do this with such payout ratios:

Source: Ycharts

If you take the accounting approach, the company is fully saturated with a 100% payout ratio. It is not surprising to see a meager dividend increase since 2014. Then, if you take the cash flow approach, it’s even worse. The company is bleeding cash seriously.

The main argument I hear from current shareholders is that they picked up GE at $9 during the crisis. Well done, great move! However, now that you have made a solid profit on your investment, tell me where GE stocks will be going in the next 10 years? We already see that the dividend growth rate won’t be astonishing… and the stock price will not go anywhere. In fact, GE’s stock has been severely underperforming the stock market for the past… 20 years!

Source: Ycharts

Wal-Mart (WMT)

Source: Ycharts

While GE has a good fan base, my guess is that Wal-Mart is even more popular. For one fact, WMT is part of the elite group of dividend aristocrats with 42 consecutive years with a dividend increase. In fact, it is now closer to gaining the ultimate title of Dividend King. Which kind of heretic would be crazy enough to spit on such a stellar company. After all, WMT’s dividend growth and payout ratios numbers are far from disgusting:

Source: Ycharts

In fact, when you look at these numbers, you would probably do well to throw me under the bus for my declarations. Wal-Mart is in no position to go wrong tomorrow morning and fail their shareholders. However, the vision of the future is definitely not as flourishing as the WMT of past days. Towards the end of 2016, I decided to sell Wal-Mart from my portfolio. The problem is that I don’t see how the company will be able to grow in the future.

In the retail industry, we all know the future is online. Brick & Mortar stores will continue to see their sales slow and eat up money in operating costs (more storage, more employees, etc). I was confident WMT would pick-up on the e-commerce trend at one point, but they have literarily failed to build an efficient online store over the past three years. The proof? They now had to spend $3 billion on Jet to get a sales platform that should perform… all the previous money was wasted on their website and now, more money will bleed out of their bank account to integrate this new platform. In the meantime, Amazon (AMZN) is growing their revenues like there is no tomorrow:

Source: Ycharts

If I project Wal-Mart in 50 years from now, what do I see? Probably an old success story that aged very badly with outdated stores and poor clientele still going to their stores. They will probably restructure, cut some employees and close some stores in the hopes of preserving their cash flow and dividend payment. This is called putting your company on an artificial respirator.

Being a Canadian, Wal-Mart’s future looks like a lot like the 130-year-old Eaton company failure (which declared bankruptcy in 1999). We also had other retail stores that didn’t survive such as Zeller’s and Woolco’s. The three companies have something in common with Wal-Mart: they all underestimated their competitors coming to serve the retail industry but from a different angle. I’m telling you, Amazon will kill retail stores as we know them.

Target (TGT)

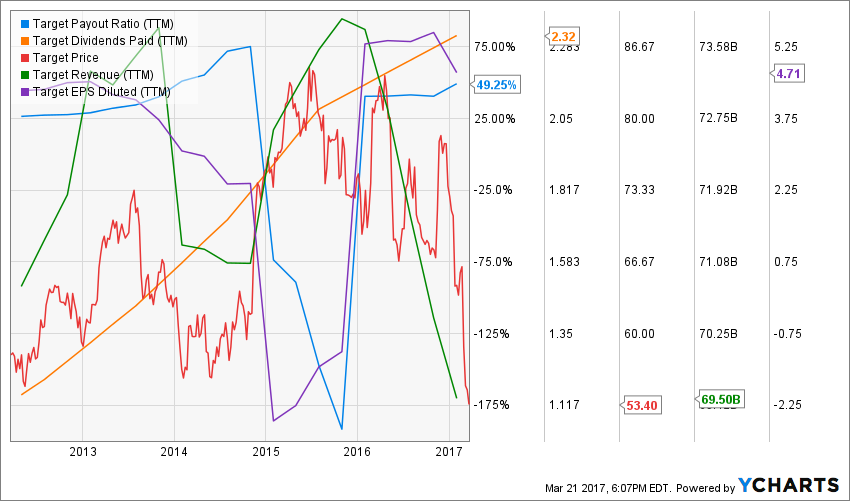

Source: Ycharts

Target’s story follows along the same lines as Wal-Mart. However, before proving their inefficiency online, Target had already disappointed me. This happened a couple of years ago when they tried to waste as much money as possible entering the Canadian market thinking they could sell us lower-quality stuff and compete against Wal-Mart that way. To be honest, I wasn’t insulted by Target coming to Canada. However, I was shocked to see how management misread the Canadian market.

Growth opportunities are getting rarer in the retail store business. You are not allowed to waste an opportunity like this. This makes me question Target’s ability to create growth vectors for the future. I mean, if they can’t read potential new markets and they can’t impose themselves as leaders online, where could they find growth?

I can appreciate Target’s solid core business. GE and WMT both have solid core businesses like TGT. However, having a core business is not enough to ensure future dividend growth. Even if a company evolves in a more mature and stable industry, it needs to find growth possibilities somewhere. Hoping consumers will spend more in your store is not a strategy.

Unfortunately, TGT’s fate seems in line with WMT… they will be both be eaten alive by the Amazon’s of this world…

Chevron (CVX)

Source: Ycharts

The last, but not least, stock you should sell in a hurry is Chevron. The CVX situation is a little bit different. You should not sell it because it has no future, you should sell it because there are absolutely no upside potential at the current price. After the oil bust in 2014, the CVX price dropped all the way down from its peak price of $133 in 2014 to $75 in 2015. I had advised my DSR members to buy the stock shortly after this drop (price was around $80 something). However, CVX stock price went rapidly back up and recovered most of its loss to $122 in December 2016. This was the time to sell the stock and this is what we did in our DSR buy list towards the end of 2016.

The thing right now with CVX is that its stock price is solely supported by rumors and hopes oil prices will go back up. As we all know, hopes don’t make money and don’t pay the bills. The proof is that CVX went from $120 to $108 in the span of the past 3 months as oil prices are struggling again. Buying or holding CVX right now is as good as putting your money in a coffee can in your refrigerator. You will not lose your money, but it will do sweet nothing for a while.

Chevron is going through a very challenging period. The company is selling assets to pay their dividend and is surfing on previously developed projects to generate cash flow. However, this long “pause” due to weak oil prices will affect the company for several years to come. There is no short-term future when CVX will generate an interesting return for its shareholders. It’s not worth it, even at a 4% yield.

Consider This List Instead

I’ve always considered those who only bash and complain to be unproductive. It’s a good thing to tell the world something sucks, it’s another to tell you what doesn’t, right? I thought it was important to highlight these 4 companies as they appear to me like big investment mistakes at the moment. I’d like to offer 4 replacements if you are about to sell these companies. I will provide a detailed analysis in my upcoming article but I didn’t want to you hanging in the dark in the meantime. Here are my 4 choices:

Disclosure: Each month, we do a review of a specific industry at our membership website; Dividend Stocks Rock. In addition to have full access ...

more