TMO Stock Forecast: The World Leader In Serving Science

Summary:

- TMO’s 2021 Q2 net sales have been increased 34.06% compared with 2020 Q2.

- TMO’s recently completed acquisition of PPD will give it more market share and room to grow.

- Relatively Lower P/E ration and P/S ratio indicate TMO has been undervalued.

Overview of Thermo Fisher Scientific Inc.

Thermo Fisher Scientific Inc. (NYSE: TMO) is a global leader in Scientific services, founded in 1896, with more than 90,000 employees, and provides its customers with life science solutions, analytical instruments, specialty diagnostics, and laboratory products and services.

The Life Sciences Solutions division has received more than 168,000 citations in cell analysis and culture, gene expression analysis, RNAi, and more. The Analytical Instruments division offers a wide range of medical devices, medical consumables, software, and services, as well as a range of applications for use in laboratories. Professional Diagnostics offers a wide range of diagnostic test kits, reagents, media, instruments, and related products. Laboratory Products and Services provides products and solutions needed by laboratories.

The Medical Tech Giant Continues to Expand

As a global leader in medical technology, Thermo Fisher Scientific continues to enjoy strong growth this year, In Q2 2021, Thermo Fisher Scientific’s sales increased 34.06% compared to Q2 2020, 9.4% higher than its competitors.

According to WITN, the North Carolina governor’s office announced on September 14 that Thermo Fisher Technologies will create nearly 300 new jobs in Pitt County. Thermo Fisher Technologies is investing $154 million and 290 jobs to expand its presence in the region. This will mainly expand the company’s pharmaceutical business. Thermo Fisher Technologies believes North Carolina offers a quality workforce, strong industry partnerships, and an innovative business environment that will benefit the company’s pharmaceutical expansion plans.

On the other hand, according to the Thermo Fisher media room, in order to further expand its services to pharmaceutical and biotechnology customers, Thermo Fisher Scientific has decided to acquire PPD Corporation (NASDAQ: PPD), a leading global provider of clinical research services to the pharmaceutical and biotechnology industries. Under the agreement, Thermo Fisher will acquire PPD for $17.4 billion in total cash at $47.50 per share plus approximately $3.5 billion in assumed net debt to complete the acquisition. PDD is a leader in the growing $50 billion clinical research services industry with more than 26,000 colleagues in nearly 50 countries. In 2020, the company’s revenue was $4.7 billion. Upon completion of the transaction, PPD will become part of Thermo Fisher LABS ‘products and services division.

Thermo Fisher Scientific’s Major Financial Metrics: Compare with Industry

Thermo Fisher Scientific’s current ROE as Q2 2021 is 20.34%. According to GuruFocus, Thermo Fisher Scientific’s highest ROE % was 25.57%, TMO’s highest ROE % is ranked higher than 70% of the 90 Companies in the Medical Diagnostics & Research industry over the past 13 years, which has a competitive advantage on ROE. It indicates Thermo Fisher Scientific has a better financial performance and Thermo Fisher Scientific has the increasing ability to make a profit without as much capital.

On the other hand, Thermo Fisher Scientific’s current operating margin as Q2 2021 is 24.61%. According to GuruFocus, TMO’s largest Operating Margin % over 10 years is ranked higher than70% of the 101 Companies in the Medical Diagnostics & Research industry. TMO also has a stable growth in operating Margin. Thermo Fisher Scientific’s 5-Year Average Operating Margin % Growth Rate was 9.20% per year. This relatively higher operating margin and stable growth rate indicate that Thermo Fisher Scientific’s performance has been getting better.

On the other hand, Thermo Fisher Scientific’s current net margin is 19.71%, at a relatively higher level compared with other competitors. We can expect that Thermo Fisher Scientific s management is generating enough profit from its sales under a stable operating condition.

Thermo Fisher Scientific’s current EPS without NRI is 21.57, at a relatively higher level in the industry. This higher EPS indicates a greater value of TMO, investors can expect that TMO has higher profits relative to its share price.

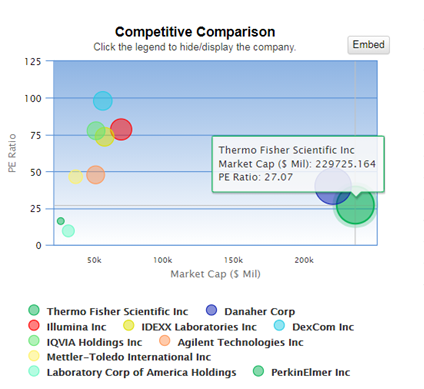

Thermo Fisher Scientific’s current P/E ratio is 27.07, which is at a relatively lower level compared with other competitors. As the graph below shows, the average P/E ratio of TMO plus its 9 competitors in the Medical Diagnostics & Research industry is 51.437, TMO’S P/E ratio lower than this industry average value, which means TMO may be undervalued.

Thermo Fisher Scientific’s current P/S ratio of is 6.07, as the graph below shows, the average P/S ratio of TMO plus its 9 competitors in the Medical Diagnostics & Research industry is 9.776, TMO’s PS Ratio is lower than this average value. This lower P/S ratio also indicates that TMO is undervalued.

We can see that TMO’S EPS in Q3 2020, Q4 2020, Q1 2021, Q2 2021 both beat the previous EPS expectations. TMO is going to provide the Q3 2021 financial statement to the public on October 19th, let’s expect that TMO’s price will continue to increase with its strong upward momentum.

According to GuruFocus, Thermo Fisher Scientific’s Altman Z-Score is 6.42. This score indicates that Thermo Fisher Scientific has a good performance at profitability, leverage, liquidity, solvency, and solid financial positioning. Thermo Fisher Scientific’s Piotroski F-Score is 9 of today, Piotroski F-Score uses to assess the strength of the company’s financial position, a score of 9 indicates Thermo Fisher Scientific has a strong financial position.

Conclusion

TMO is a strong buy stock, it is a stable and powerful technology stock with good management and a strong financial position, which is reasonable for long-term holding. The dark green for the 1-year forecast is a strong bullish signal. With the continuous worldwide capital expansion and strategic deployment of the company, it will further seize market share and bring more potential power for stock appreciation.

Past Success with TMO Stock Forecast

I Know First has been bullish on the TMO stock forecast in the past. On June 23rd, 2021 the I Know First algorithm issued a forecast for TMO stock price and recommended TMO as one of the best stocks to buy. The AI-driven TMO stock prediction was successful on a 3-months time horizon resulting in more than 23.57%.

Disclosure: This article originally appeared on Iknowfirst.com, a financial services firm that utilizes an advanced ...

more