Tuesday, March 29, 2016 2:35 PM EST

Are you enjoying Yellen Day as much as I am? If so, then you are enjoying it zero. Do the math. It checks out.

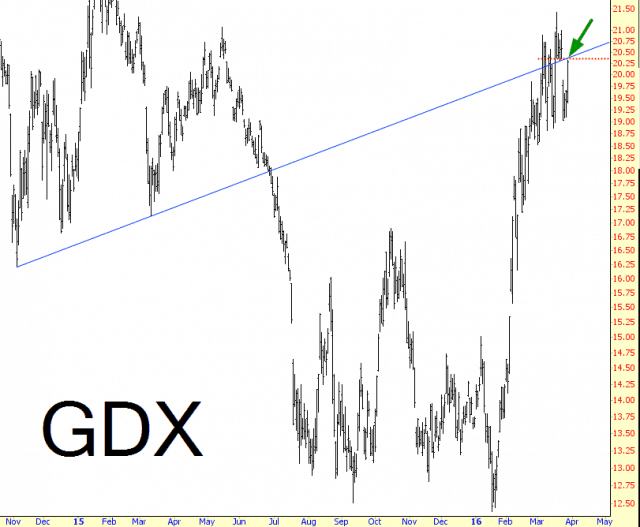

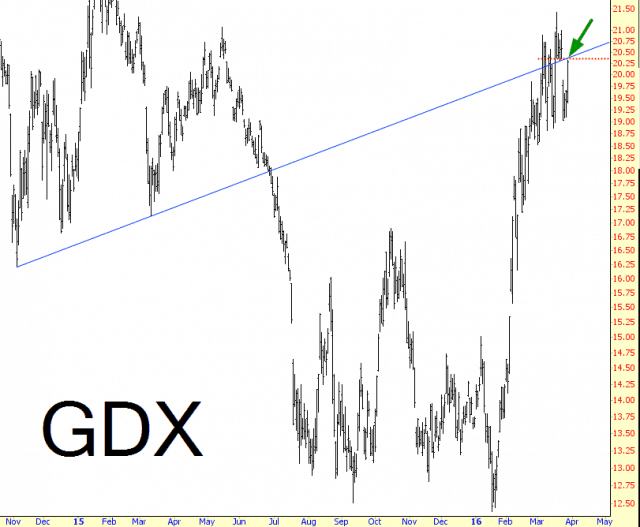

Setting that aside, I wanted to mention that there’s an interesting gap-fill going on with the miners ETF symbol GDX. The price level represented by the red line is 20.35:

Disclosure:Short Workday This blog is not, and has never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make ...

more

Disclosure:Short Workday This blog is not, and has never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural observations or other odds and ends strike me as worth writing about. So I take absolutely no responsibility for the losses – or any credit for the gains – you may or may not make from reading this forum. Whether you lose your life savings or make a fortune is entirely up to you and your own skills/luck/fate.

Please note I am the principal of Tim Knight Organization, LLC, a California-registered investment adviser. The content of the postings and investment strategies and discussions provided herein do not necessarily reflect the views, opinions or policies of Tim Knight Organization, LLC and Tim Knight Organization, LLC makes no warranties regarding the accuracy of their content or their completeness.

less

How did you like this article? Let us know so we can better customize your reading experience.

Shorting the gold miners is the last thing I would be doing. Everyone who has done it this year has been wrong. Gold and miners may have a lot more upside before any kind of meaningful pullback.