Three Things – Big Ol’ Data Dump

Image Source: Pexels

Here are some things I think I am thinking about this week:

1) Does the Negative GDP Mean We’re in a Recession?

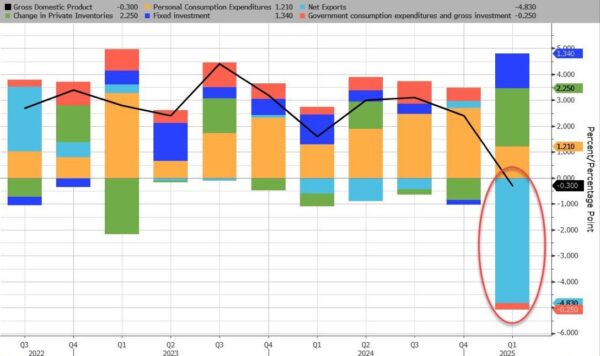

We got a huge data dump on Wednesday, including the first estimate of Q1 GDP, which came in marginally negative at -0.3%. Net exports and government subtracted a total of 5.08%, with exports making up the majority of that. But you had a lot of conflicting things going on under the surface. There was a large inventory build likely in anticipation of tariffs, and a very soft consumption component at just 1.21%. If you backed out inventories and exports, which can be hugely volatile, then GDP came in at 2.5% year over year. That’s not really bad.

Now, some people are going to start declaring a recession based on the negative reading. There’s this belief that two quarters of negative GDP growth means we are in a recession. This is a shorthand rule created in the 1970s by Julius Shiskin, a former commissioner at the BLS. The media loves to tout this narrative, but this isn’t the real way the NBER defines a recession. The NBER defines a recession as “A significant decline in economic activity that is spread across the economy and lasts more than a few months.” They consider multiple indicators, not just GDP, including:

Wholesale-retail sales

Real personal income (excluding transfers)

Employment (nonfarm payrolls)

Industrial production

Real personal consumption

So far, only one element of this is negative. And I’d argue the most important element, by far, is the labor market. I don’t think you can call anything a recession if lots of people aren’t losing their jobs. And so far, that’s not the case. So I wouldn’t jump to conclusions here. Yes, it does appear that the economy is softening, but we don’t need to go declaring recession just yet.

2) Is the Fed’s Transitory Problem Coming Back?

Speaking of the labor market, we’ll get a fresh update on Friday, but we did get a pretty soft ADP report on Wednesday. This is going to be the crucial element in Fed policy going forward. Inflation was hotter than expected in the GDP report, but that’s likely the start of the tariff effect. And tariffs aren’t likely to cause a persistent increase in prices. In other words, any increase in prices is likely to be what the Fed famously referred to as “transitory”. But now they’re in a real bind here. We have a labor market that has been softening for a while and sticky inflation that might bump a bit higher in the near term. What are they to do?

My guess is that the labor market will dominate Fed policy direction in the coming year. Inflation is not quite at target, but it’s also not so high that they need to be panicked about it. And if we get a persistent softening in the labor market, then we’ll almost certainly get softening prices in the coming year as any impact of tariffs wanes. So keep a close eye on these labor market reports for an idea of where the Fed is likely to go.

3) Let’s Talk About Gold.

I’ve done a bunch of podcasts in the last few years saying that I personally own some gold. It’s not a lot of my net worth, but it’s in the range of 5-10%. I wish I’d owned a lot more, given that it’s up 84% since 2022 while the global stock market is up 15% and aggregate bonds are down -3.5%. I like to think of gold as fiat currency insurance, the same way I view something like Bitcoin. So, when the Dollar ripped 28% in 2021 and 2022, I figured it might be beneficial to hedge that exposure since I consume everything in Dollars. This is also the primary reason to own foreign stocks in my view, although that hasn’t worked nearly as well over this time horizon.

But now the Dollar Index is down almost 10% from its highs earlier this year. It’s down 22% from its 2022 highs. What’s an investor to do? I always struggle a bit with assessing gold in a portfolio. With stocks and bonds, you can make reasonable financial planning based estimates about how they fit into a financial plan over specific time horizons. I know I am getting 4.25% from a 1-year T-Bill in the next year. I know I am getting 3.78% from a 5-year T-Note over the next 5 years. And using my Defined Duration methodology, I’d estimate that a 6-7% return is reasonable for stocks over the coming 15+ years. But I have no idea what gold will do over any time horizon. And this is why I like to think of it as insurance. By definition, you don’t know how your insurance will perform. That’s the whole point of it. And we don’t really know what will happen to fiat currencies in the future. So, a bit of insurance isn’t unreasonable to own.

And that argument probably has even greater validity in an environment where your own government is actively attacking the Dollar with tariffs and policies designed to make the Dollar more competitive against its trading partners. But that’s just a short-term guess on my part, and you’d never want insurance, which is typically a longer-duration instrument to begin with, to be the centerpiece of a portfolio. It’s always a satellite asset that ensures you are over a specific time period. It might be tempting to trade an instrument like gold, but when viewed through the perspective of insurance, it becomes more of a permanent holding since we’ll all have fiat currency risk throughout our lives. But that assumes you even need or want insurance to begin with, and that is a very personal decision.

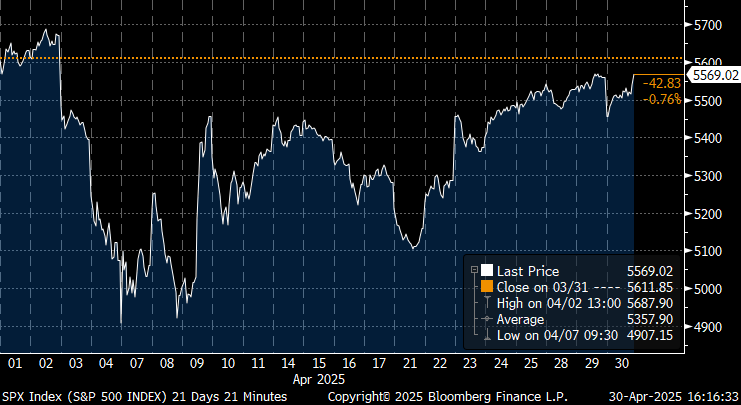

BONUS THING – I had to post this incredible chart of April’s stock market performance (from Mike Bird on X). This is why every single short-term comment about stocks should be ignored. When I created the Defined Duration strategy, one of the main goals was to try to quantify a reasonable time horizon over which to judge different instruments. Investing is hard, in large part, because we have no idea what the time horizon of the stock market is. I quantify it as about 17 years as of today, which is probably a bit conservative, but the point is that you don’t have any real certainty over the stock market in short-term horizons. It cannot be utilized in a financial plan or asset liability matching strategy for any period under about 10 years. It just doesn’t generate reliable enough returns. And April’s performance is a perfect microcosm of short-term narratives that are 99% noise.

I hope you’re all having a great week. Be well and, as always, stay disciplined out there.

More By This Author:

Trade Deficit, Hard Data, American ExceptionalismThree Things – An Update

Fed, Bonds, Tariff Wars...

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more