This Winter Storm Is A 17-Year Stress Test

Image Source: Unsplash

We’re all set. We've got plenty of food, plenty of water, and enough propane to get through next week. The power will likely go out, and I’ll need to find a way to communicate with you about the markets on Monday and Tuesday.

For those of you living under a rock, a massive winter storm is ripping across the United States. It’s incredibly important, as it’s the first big storm in the post-artificial intelligence/data demand era. By Monday, some of the largest parts of the nation's power grid could see stress and demand it's never experienced.

And somewhere, a guy who bought a $4,000 Generac generator in 2021 is standing in his garage, hands on his hips, not smiling. He can't say he wanted this storm to prove his friends at the bar wrong about his Generac. But he did prepare for it. He won't brag, but that would make this worse somehow.

For 17 years, politicians have said they would "harden the grid." They said it calmly, into microphones, next to construction equipment that wasn't doing anything. They cut ribbons, or at least they tried.

Tonight, the weather arrives to see if our grid can back up all the talk and investment of public dollars. That’s right, this is not a weather story. This is a generational infrastructure audit we forgot would happen one day.

Seventeen Years of Promises

In a Keynesian economy, all roads point to more debt and more spending. Infrastructure is a perpetual hole of public dollars and political ambition. After the 2008 Financial Crisis, infrastructure stimulus was an easy sell to ensure that capital flowed hard and fast in the U.S. economy.

In October 2009, President Obama announced $3.4 billion in stimulus grants for smart grid technologies. His climate director, Carol Browner, said the current system was "outdated" and "dilapidated." The Recovery Act provided billions to modernize the grid, installing millions of smart meters and funding countless projects.

In February 2017, President Trump promised to invest $1 trillion in infrastructure. A year later, his administration released a plan calling for $200 billion in federal funds to spur $1.5 trillion in total investment. Congress never passed it.

In November 2021, President Biden signed the Bipartisan Infrastructure Law. The White House called it "the largest electric grid infrastructure investment in history." The bill allocated $10.5 billion for the Grid Resilience and Innovation Partnerships program. In October 2023, Energy Secretary Jennifer Granholm announced billions more, using almost identical language to that used in 2009.

The power sector's capital investment hit a record in 2024. Transmission spending tripled from 2003 to 2023. We’ve seen hundreds of billions flow into the grid, both public and private.

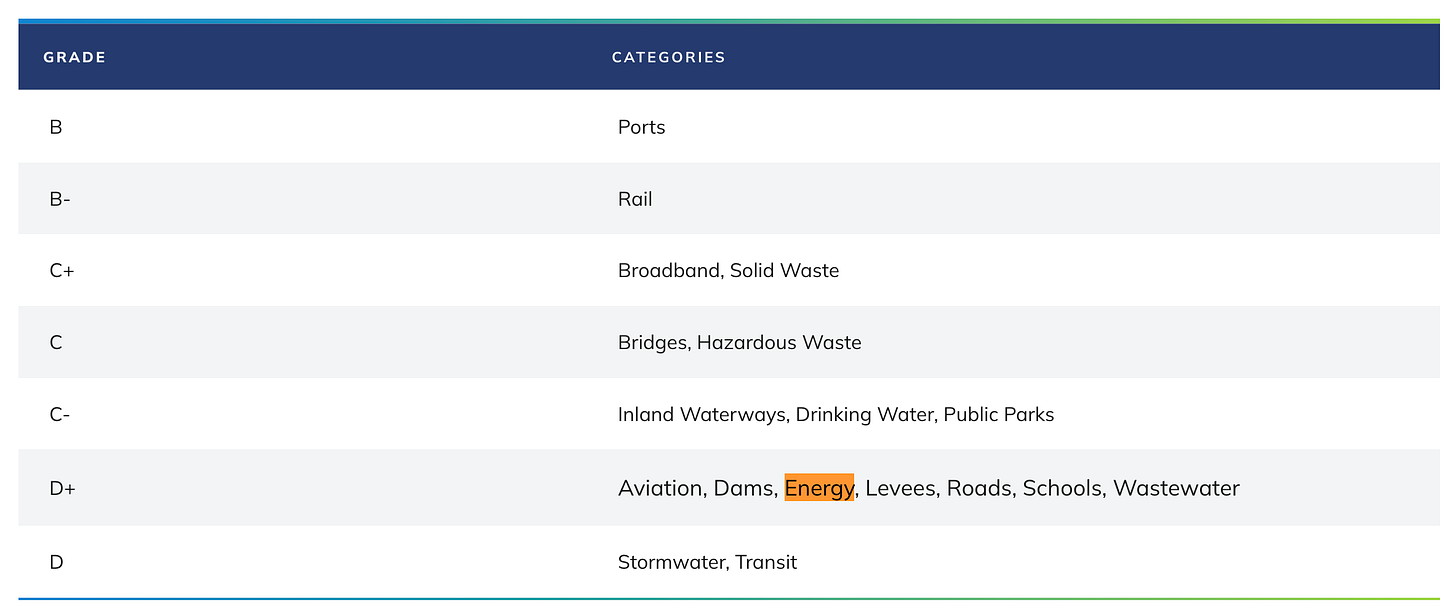

And yet the American Society of Civil Engineers estimates that grid modernization and resilience alone require nearly $1.9 trillion through 2033 just to keep up with future demand. In its 2025 Infrastructure Report Card, ASCE downgraded the U.S. energy sector from C- to D+.

(Click on image to enlarge)

After years of record spending, the grid is officially graded as barely functional under modern stress. The money went somewhere. Well, to be honest, it was about priorities.

A lot of that money went to digitization, decarbonization, and efficiency gains rather than raw physical redundancy. We got really excited about new technologies, but prioritized measuring energy efficiency over the things we need to build structurally sound systems: You know, like having a U.S. steel industry.

The grid became smarter, but it certainly did not become sturdier.

Let’s Go to The Numbers

PJM Interconnection operates the electricity grid here in Maryland. It’s the nation's largest grid operator serving up to 67 million customers across 13 states, has warned that demand this week could hit levels "never experienced before." Peak demand could reach 144,465 megawatts by Monday, topping last January's all-time winter record of 143,700 MW.

The grid could sustain demand above 130,000 MW every single day through January 30. PJM described it as a "winter streak that PJM has never experienced." PJM says it has 180,800 megawatts of operational capacity available. That should be sufficient under normal conditions. But reserve margins are tightening, and long-term capacity concerns persist. This will be a major test for them.

At least 170 million Americans are under weather-related alerts stretching from the Arizona-New Mexico border to upstate New York. Dallas faces 36 straight hours of freezing precipitation. Texas, whose grid catastrophically failed in February 2021 and killed more than 200 people, faces another major test.

Officials say they are ready. But if the power goes out, how would we know?

The Question No One Will Answer

This is the first real test of major parts of the patchwork U.S. electrical grid in the era of Artificial Intelligence and ongoing demand for electricity from data centers. In a world of incentives, we could soon learn how they really work, and who really matters most to the economy.

Let me ask a question that is uncomfortable for politicians and regulators. When power is scarce, who gets it first? You’ll say hospitals and emergency services, of course. But then the list becomes uncomfortable. It’s then going to data centers, cloud providers, and AI workloads. And it’s going to the military and financial infrastructure.

No one has gone on air yet to explain who arranged these priorities. And that’s by design. The data center surge is the story of the grid, and a massive driver of rising electricity costs across the nation. S&P Global's 451 Research projects U.S. data center demand jumping 22% in 2025 and tripling by 2030.

These facilities do not spike like air conditioning on a hot afternoon. They run continuously and are concentrated geographically.

Listen to state and city planners, and they’ll treat data centers as high-priority loads because of their economic significance. But that’s not all. Look at what Governor Wes Moore is doing in Maryland. At a time when our grid is strained, he’s prioritizing a vanity project in National Harbor, Maryland, that would bring a “Mini” Sphere amphitheater for concerts and shows. Peak electricity at the Las Vegas location would power 21,000 homes.

Now, let’s think about AI data centers and vanity projects. What happens if those things stay protected while residential outages are prolonged? The questions won’t be about meteorology. It’ll be about why ChatGPT stays on while other homes go dark? Or why are we electrifying everything if the grid cannot handle it?

This storm does not break the grid. It reveals the hierarchy embedded inside it.

Backup Problems

Get ready. If this energy grid breaks, everyone everywhere will start talking about and speculating on the demand for backup batteries for our electrical grids. We’ll have so many conversations about Generac (GNRC), and forced investments into more infrastructure to “solidify the grid” and ensure that “this never happens again."

I’ve been dealing with this for years. I know a thing or two about batteries because I’m an investor and consultant for a company that builds BESS systems in Scandinavia. It’s easy to build those systems abroad.

In Finland and Denmark, politicians are easy to work with. Regulators just want to make sure that nothing lights on fire. Communities welcome the investment. And everyone gets along. There’s no politics or greed because everyone understands the boring importance of electricity.

Here in the United States, good luck. It’s not about trying to build something. It’s about trying to extract something at every step of the process, which leads to more bureaucracy, a worse product, and project delays.

I spent a year trying to get a simple backup battery project launched in Maryland, where there are physical mandates for this backup power. After every conversation, every politician had their hand out. If I wanted to get through the next gate, it was implied that I’d support them in some (financial) manner.

Funny enough, it all ends up in a perfect circle of gatekeeping. Even though we have the technical expertise to build enough battery capacity to meet all Maryland mandates from 2027 to 2033, I advised our teams to avoid the U.S. market. It’s too political, too slow, and the legacy players have the entire network locked down. I’ve never been more frustrated by a state or country when just trying to build something simple that actually solves a problem.

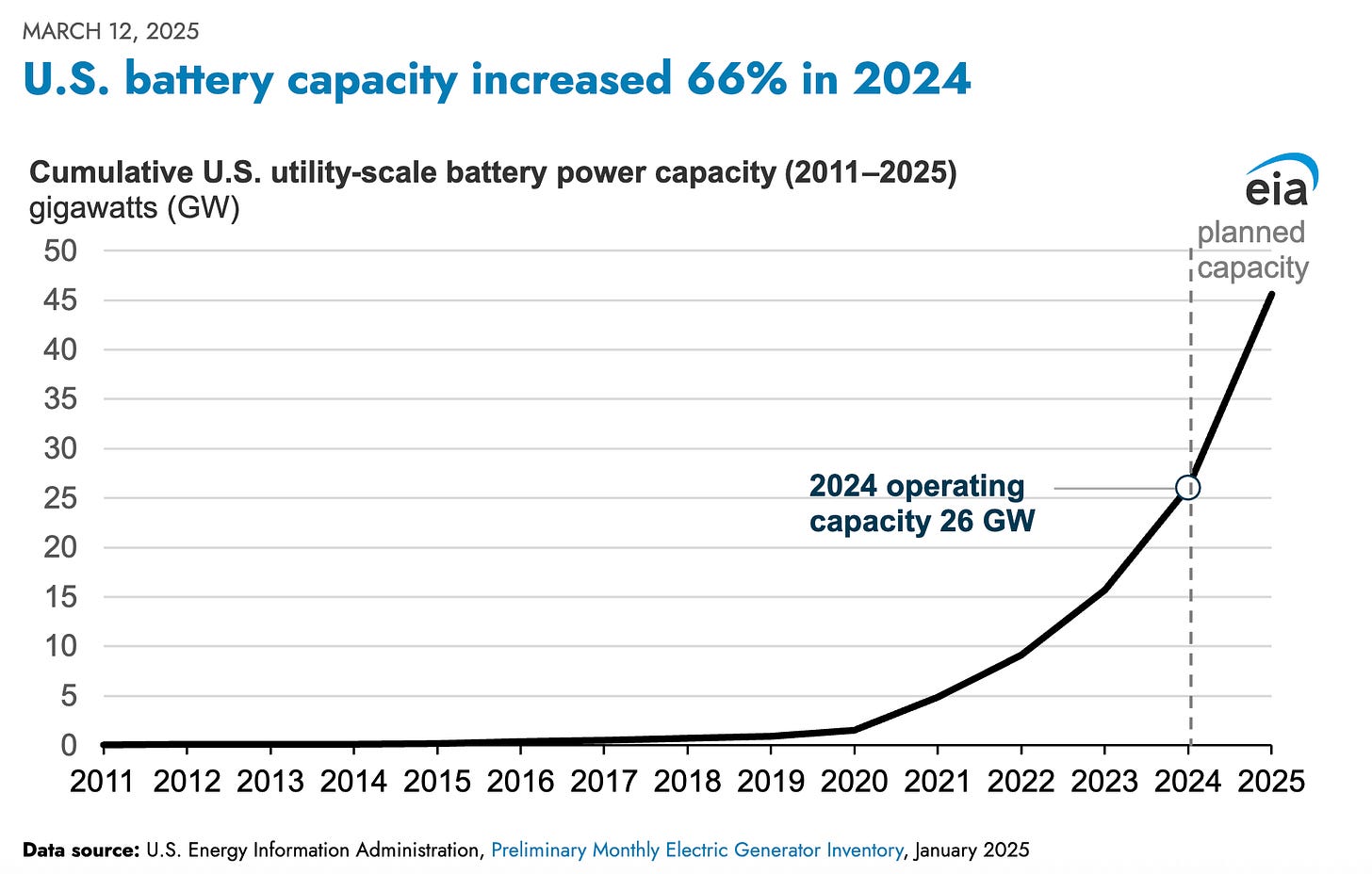

Plus, no one likes each other. Politicians don’t like the electricity companies. The utility players complain about PJM, and the grid operators don’t like the regulators. That said, battery capacity is growing fast thanks to a concentration of suppliers. Utility-scale storage exceeded 26 GW in 2024.

(Click on image to enlarge)

The EIA expects another 18-20 GW to be added. By the end of 2026, total capacity could reach approximately 65 GW. But the thing is, that nameplate capacity is not resilience. Battery statistics are typically reported in megawatts, not megawatt-hours.

Power capacity looks impressive, but duration is where the math collapses. A four-hour battery at 30 GW covers one cold evening, not a three-day freeze. Batteries look like resilience on a chart, but they’ll act like fuel tanks in a blackout. Storage helps, but it doesn’t replace dispatchable power during sustained stress.

Welcome to The Rehearsal

If your lights stay on, nothing happens. If they go out, a politician will appear on television and explain that this was "unprecedented."

That explanation, however, won’t restore power. The grid does not need to fail to change markets. We’ve added all these data centers, and now we are going to get a test of not just the grid, but also our priorities.

For 17 years, money has been spent, bills have been passed, and press releases have been issued. Tonight, the weather arrives to check the receipts. Stay safe out there.

More By This Author:

Yen Intervention, Leverage Checks, And Other Things To Think...A Short Look At Charts

Why I'm Going Long The Stock That Nearly Destroyed The Financial System