This Real Estate Bubble, Like Some Relationships, Is Complicated

CNBC reports US home prices rise 5.9 percent to 31-month high in January according to S&P CoreLogic Case-Shiller. This puts the 20 city index close to an all time high, including the 2007 bubble.

Incomes have increased as well. As a matter of fact, you can see that consumers bore the brunt of rising housing costs in previous bubbles-cum recessions. Not this time though.

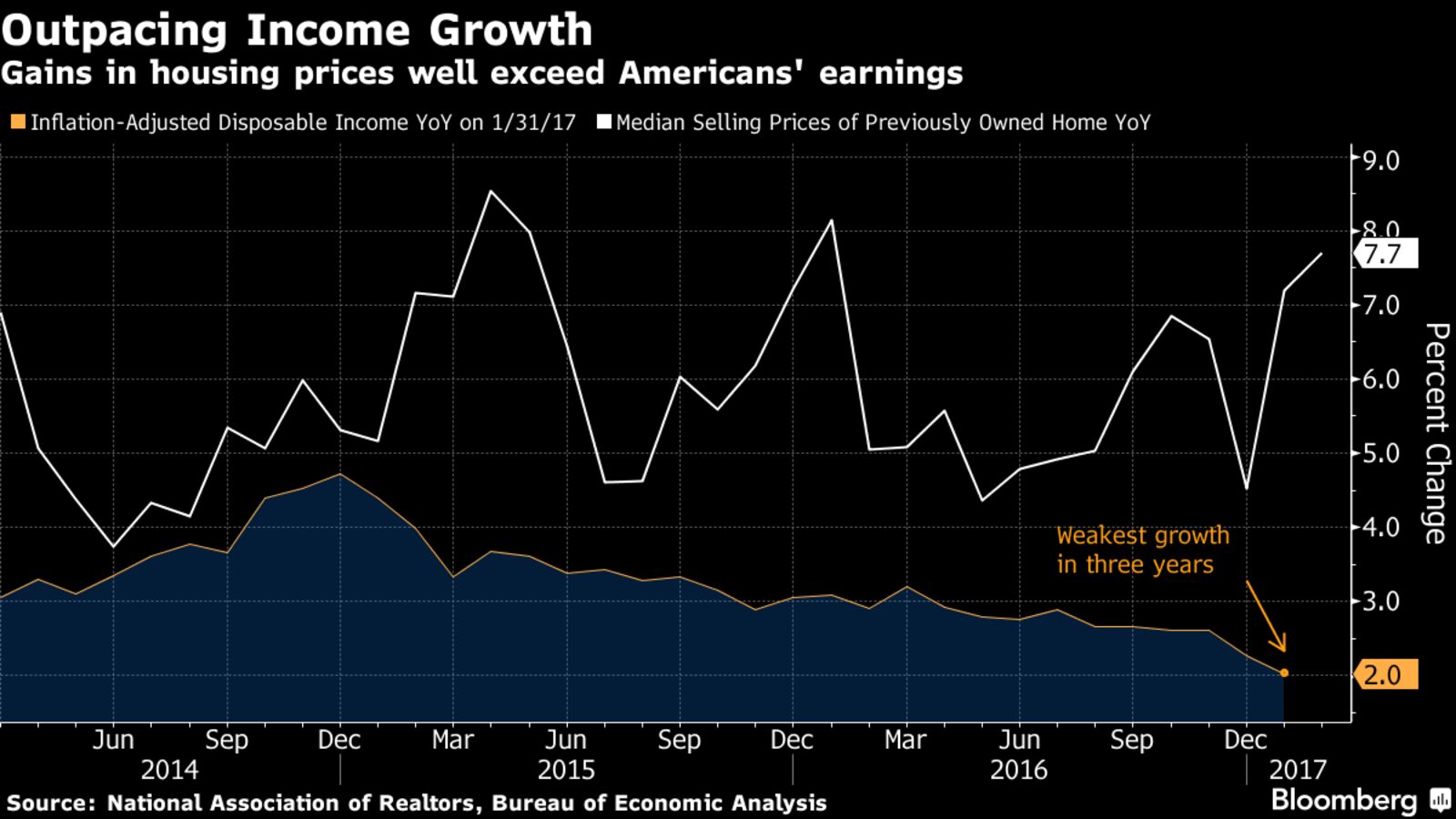

Don't be fooled by the debt service payments ratio. Housing prices are clearly outstripping income growth and incomes...

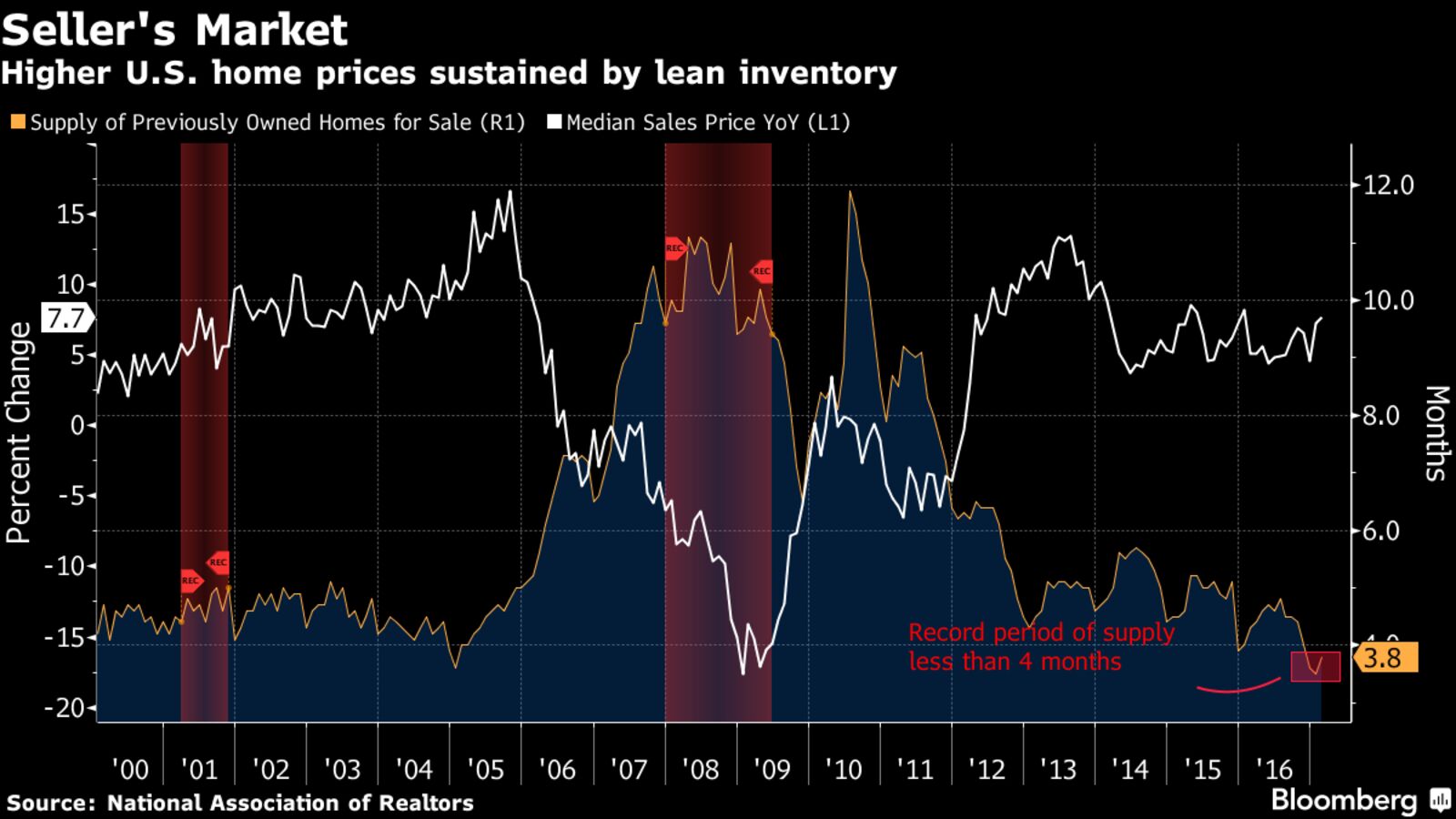

Are you wondering how housing prices are still rising? Well the answer is two fold. Lean supply in the low to middle markets...

So, I'm sure many of you query, "Who's paying for all of these increased housing prices if debt service is actually decreasing at the same time that housing prices are increasing? Well, the answer is in the (synthetic, highly manipulated, and unsustainable) interest rates.

The Fed ballooned its balance sheet to unprecedented levels, and continues to maintain such a balloon through steady MBS asset purchases even as it moves to raise its benchmark interest rates.

There is absolutely no way that the Fed can unwind this self-induced bubble without popping the housing market bubble. Absolutely no way. I've said this many times in the recent past.

- It's the Real Estate Crash That I Warned You About (again) housing, homebuilders, commercial real estate (look here and here and here and here and there) and ban ...Created on 20 March 20172.

- The Fed Raises Rates While Still Baby Feeding the MBS Market With Billions in Monthly Purchases The Fed has raised rates, officially making real what was mere signaling of the end of its expansionary era... Or is it? You see, from a practical perspective, QE is still in full effect. The US housing ...Created on 17 March 20173.

- A Real Estate Bubble in the Making? (Retail Lite Subscription Content)... risk in the world of a housing bubble, followed closely by Hong Kong. The UK Housing Market Observatory report compiled by Lancaster University came to the same conclusion in their 2015 Q4 estimate, that ...Created on 31 January 20174.

- Increasing Debt Burden Combined with Peaking Housing Prices Don't Mix Well With Capital Controls (Retail Lite Subscription Content)... of Canada along with many foreign investors have exposure in mortgage lending and related investment activities like mortgage bonds Housing Market in Canada: Movement in residential... Created on 27 January 20175.

- Ten Years Since BoomBustBlog Was 1st Published & That Initial Research Still Relevant Today in 2007. Here's my very first article - The Real Trend in US Housing Prices.... Yeahh, that's right. It's real estate. I posted very briefly on that topic last week, before we officially restarted t ...Created on 09 January 20177.

- To Bust or Not To Bust: Are We In A Real Estate Bubble?... it’s not uniform across the board. For instance, NYC has condo bubble (from new construction being priced above income growth, yet getting purchased anyway) but single family detached housinghasn&rsquo...Created on 04 January 2017

Disclosure: None.

Subscribe to BoomBustBlog now and learn how to our smart contracts system to invest in bitcoin and tens of thousands of ...

more

Has your opinion changed at all?