This Lucrative Turnaround Stock Will Make You Fall In Love With Your Brokerage Account

Three decades of investing have shown me fewer strategies for life changing returns than investing in turnaround stories. My name is Bret Jensen, and this strategy allowed me to retire before I even turned 45. The stock I’m sharing today will win you big profits that will make you smile when you see your brokerage account.

One of my first investments when I was a teenager was a small purchase in Chrysler at the beginning of Lee Iacocca’s efforts to bring the American manufacturing icon back from the brink of bankruptcy. That investment turned out to be my first five bagger in the market. It was also the first of many successful turnaround bets that have benefited my portfolio to a significant degree over the years.

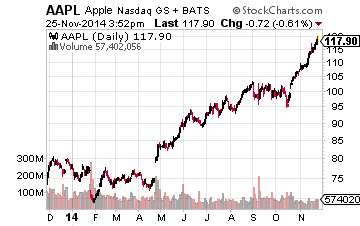

The turnaround that has created the most shareholder value in history is Apple (Nasdaq: APPL) which was on the verge of irrelevancy when Steve Jobs returned to the company he co-founded. He then went on to create the most successful company by market capitalization in the world.

Turnarounds have the unique position where investor sentiment is usually so negative on the stock and company that any piece of positive news or traction executing with the firm’s turnaround strategy can cause a significant rally in the shares.

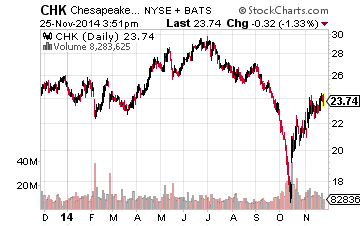

It is these types of gains I am constantly on the lookout for both within my own portfolio and as editor of The Turnaround Stock Report, a service for investors looking for long-term profitability from stocks on the rebound. Today I want to discuss a mid-major energy play I have started to accumulate and believe has substantial upside as the company starts to make significant progress on its turnaround plan. This exploration & production company is named Chesapeake Energy (Nasdaq: CHK)

History:

Under its previous founder and CEO, Audrey McClendon, the company pursued a growth at any cost strategy. This helped Chesapeake develop into one of the largest independent natural gas producers in the country. This philosophy worked great when natural gas was selling at north of $10 MMBtu but not so well when prices plunged hitting $2MMBtu two years ago.

Chesapeake had taken on a large amount of debt in order to finance its huge production expansion. When prices plummeted it found itself in a precarious position. After much conflict the company booted its founder who left the company completely last year.

The company brought in a well-respected leader from Anadarko Petroleum (NYSE: APC) to be its new CEO. At Anadarko this individual was known for his ability to optimize a production portfolio, rationalize operations and drive drilling costs down. Chesapeake hoped to execute a similar game plan under his leadership.

Turnaround Strategy:

The company’s turnaround strategy consists of selling off non-core assets to reduce its substantial debt load, become more “oily” in its production which currently is heavily tilted to natural gas and lower overall operational costs.

The company has made substantial progress in these goals over the past year. In the third quarter alone, Chesapeake spun off its oil services business as a standalone entity called Seventy Seven Energy Inc. (NYSE: SSE), sold some natural gas compression units for $135 million, as well as some non-core acreage in the Marcellus for over $300 million. This continued a major trend in reducing leverage which the company also made substantial progress against in the second quarter. These proceeds helped drive a further reduction in the company’s balance sheet.

The company then put those efforts on overdrive recently by selling almost $5.5 billion of western Marcellus acreage, a sale that is expected to close this quarter. This acreage represented 7% to 8% of Chesapeake’s overall production. However, this will allow the company to cut its remaining debt in half. I expect a rash of credit upgrades from the major credit agencies once the transaction closes. These upgrades will lower overall financing costs further and will also be a positive catalyst for the stock.

This will also increase Chesapeake’s financial flexibility which is critical as asset values in the oil patch have declined recently due to the drop in oil prices. The company should be able to do some small strategic acquisitions at lower prices than available earlier in the year in its efforts to grow the amount of overall production that comes from oil. This transaction must be viewed as extremely positive within the company as a director bought over $10 million in new shares earlier this month, a giant vote of confidence.

The new CEO, the asset sales, shedding of non-core activities, and improvement of credit ratings are all part of a domino effect seen with turnaround plays. In fact, I call it the Domino Strategy.

Net Asset Value:

Despite the recent fall in energy prices, Chesapeake has remained solidly profitable. Probably the best way to value Chesapeake over the long run is by looking at the current discounted net asset value (NAV) of its productive acreage. As the company continues to execute against its turnaround strategy, its stock price should slowly close the gap to where its sells for discounted NAV.

The company has done a marvelous job reducing leverage as well as its capital budgeting needs over the past year. It has a geographically diverse portfolio of attractive acreage and an increasing amount of its overall production will come from oil in the years ahead. The company recently estimated its true discounted net asset value is some $40 a share. My opinion is that it might take two or three more years executing against its turnaround strategy to achieve those levels. However at a current $24 a share price level, that bogey represents almost 70% upside from here, something a patient investor can surely accept.

Turnaround stocks should be in every investor’s portfolio, even if just a few, for those investors looking for the more than the occasional high double digit, even triple digit, return. Many years ago I got started with my own investing with turnaround stocks and have been able to make tremendous gains from them in the years since. In fact I was able to retire in my early 40s in part due to the gains I’d made from turnaround stocks.

To help investors who want big winners in their own portfolios I launched a turnaround stock service earlier this year with the sole purpose of delivering solid, unbiased, independent research on stocks on the way back up. I find them using the Domino Strategy I mentioned earlier.

On Friday we’re holding a Black Friday Sale where you can try my turnaround stock service for half off. Most investors will find out about the sale in an email I’m sending them on Friday, but I feel loyal readers deserve a break, so I’m letting in early birds starting today.

Disclosure: more