Friday, July 28, 2023 8:42 PM EST

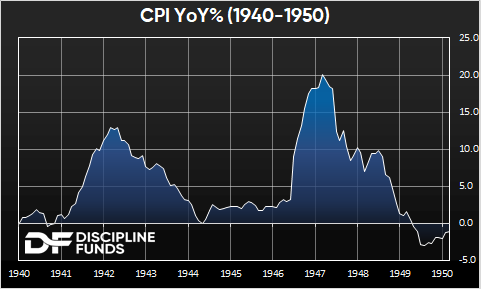

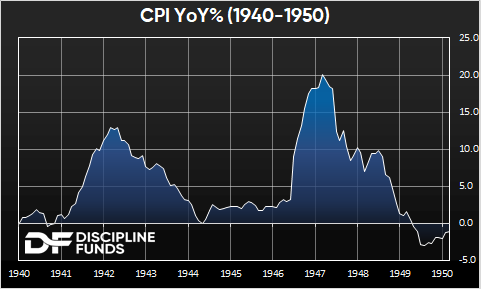

The Federal Reserve has expressed concerns about a double bump in inflation. That is a scenario where inflation surges and then jumps higher again for various reasons (such as the Fed letting off the brakes too early). The most common period of concern is the 1970s where inflation surged in the 1973-1975 period, cooled a bit, and then surged higher from 1978-1980. We’ve argued that the 1970s are a bad proxy for this period and that’s been largely right so far. But another period that is commonly cited is the double bump inflation of the 1940s. But how similar is this environment to the 1940s? We don’t think it’s very similar for several reasons.

The 1940s were a period of widespread economic turmoil and large secular macroeconomic trends including:

- Population boom following WW2.

- Broad global dependence on oil as an energy source.

- Supply chain hiccups during the war.

This was a perfect recipe for high inflation as the war disrupted supply chains, the global economy had non-diversified energy sources and populations boomed around the globe. When the global economy started to rebuild in 1946 you had a perfect confluence of events resulting in a sustained supply/demand imbalance.

In the 1940s the US population grew a whopping 15%. The current 10-year trailing growth rate is just half of that. The CBO forecasts population growth of just 0.3% per year for the next 30 years. Additionally, the population distribution by age is vastly different as the global economy gets older.

On the energy front, the global economy was non-diversified compared to today and the boom in the automobile industry following the war resulted in a huge supply/demand imbalance. The price of oil rose 100% in 1946 which was the primary cause of the double bump in inflation.

The war created the perfect environment for a high inflation and the end of the war coincided with a unique population boom, industrial boom and supply chain issues that resulted in an unusual double bump in inflation.

Today’s economy is very different from the 1940s environment. Populations are growing meagerly, the supply chain issues from Covid from are largely resolved, our energy sources are vastly more diverse and there is no post-war industrial boom to be seen. So, like the 1970s, we don’t see the 1940s as a good proxy for understanding the current risks to inflation.

More By This Author:

What Should You Do When The Stock Market Booms? Is Cash The Best Insurance Asset? What Does An Inverted Yield Curve Tell Us?

Disclosure: Past performance does not guarantee future results. The fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The statutory ...

more

Disclosure: Past performance does not guarantee future results. The fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The statutory and summary prospectus contains this and other important information about the investment company, and it may be obtained once available by calling 215-882-9983 or visiting www.disciplinefunds.com/dscf. Read it carefully before investing.

References to other securities is not an offer to buy or sell.

Investments involve risk. Principal loss is possible. The Discipline Fund ETF has the same risks as the underlying securities traded on the exchange throughout the day. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Investments in foreign securities involve political, economic, and currency risks, greater volatility and differences in accounting methods. These risks are magnified in emerging markets. The Discipline Fund is inherently “countercyclical” and may underperform its benchmark for long periods of time.

Frontier Markets Risk. Compared to foreign developed and emerging markets, investing in frontier markets may involve heightened volatility. Fund of Funds Risk. Because it invests primarily in other funds, the Fund’s investment performance largely depends on the investment performance of the selected underlying exchange-traded funds (ETFs). New Fund Risk. The Fund is a recently organized management investment company with limited operating history. There can be no assurance that the Fund will grow to or maintain an economically viable size.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.

Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. References to other funds should not be interpreted as an offer of these securities.

The Funds sub-advisor is Orcam Financial Group, LLC, doing business as Discipline Funds.

The Fund is distributed by Quasar Distributors, LLC. The Fund’s investment advisor is Empowered Funds LLC, doing business as EA Advisers.

The Funds' investment objectives, risks, charges and expenses must be considered carefully before investing. Click here for the DSCF Prospectus, and here for the DSCF SAI. All fund documents can be found at https://disciplinefunds.com/documents/. A free hardcopy of any prospectus may be obtained by calling +1.215.882.9983. Read carefully before investing.

Discipline Funds Form ADV2A

Form CRS

less

How did you like this article? Let us know so we can better customize your reading experience.