Third Time Not The Charm

OK, I’ll say it: this market is officially pissing me off. I know, I know. “Trade what you see before you.” I won’t comment on that advice. I’ll simply point out the following very simple facts:

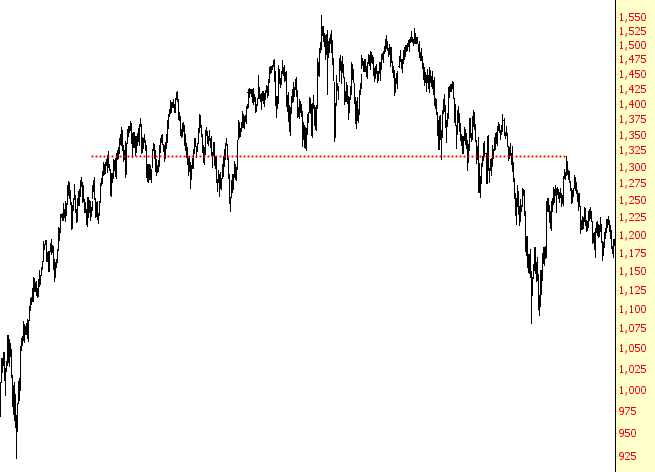

The Internet bubble that peaked in early 2000 was clean and simple. The break happened, it retraced, and it fell for years afterward:

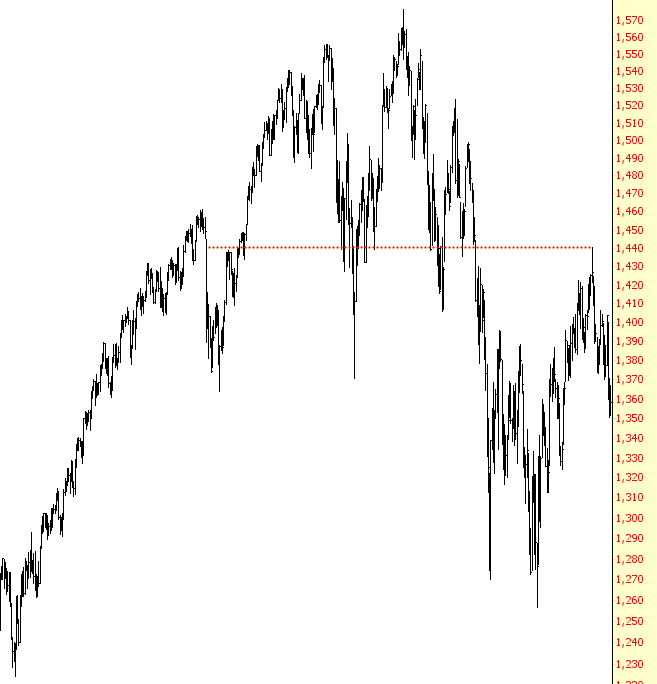

Likewise, the housing bubble that peaked in the autumn of 2007 broke, retraced, and fell for years afterward. Clean. Simple. Nice.

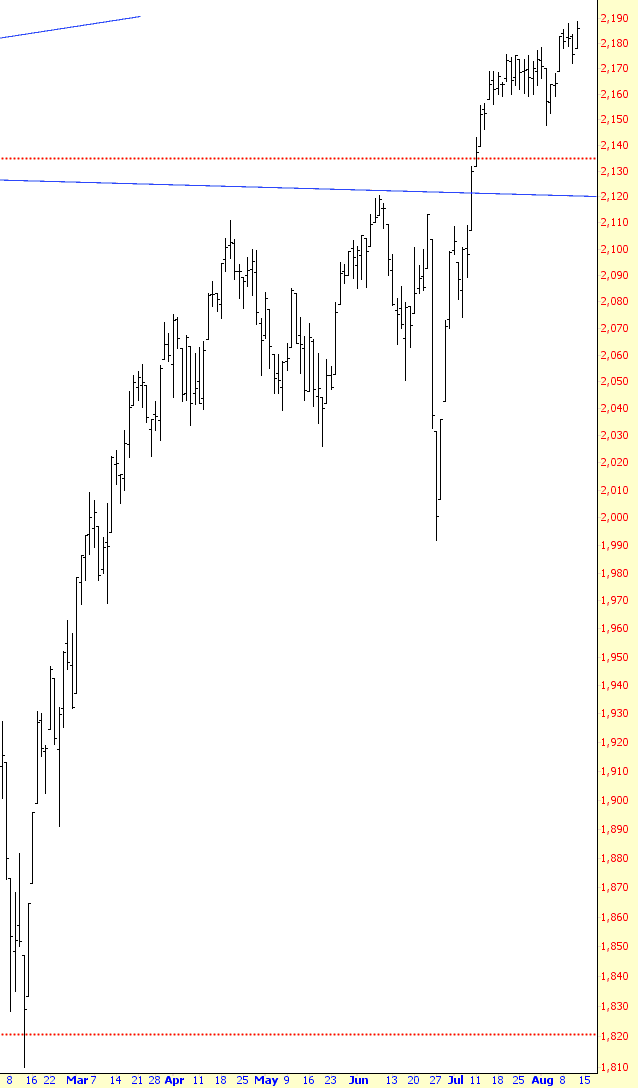

The sovereign debt bubble was similarly clean and straightforward. The hard breaks in late January/early February of this year looked like they were powerful enough to ram through support and get the long-awaited bear market truly going.

Instead, since February 11th, the bears have had a three foot iron rebar shoved right up their rectum, which continued to this very day, in which there are new lifetime highs across virtually every index in existence.

I am seeing old-time stalwarts in ZeroHedge completely throwing in the towel at this point. Elliott Wave turned bullish months ago, and I guess Tyler (and, frankly, me) are going to be the last ones to surrender.

Suffice it to say that the long-term charts made a massive bear market look inevitable, but it legitimately seems that the central bankers across the globe have completely aborted reality. Well-played, Janet.

Hey Tim - is is possible that hft/algo trading platforms are evolving so rapidly now that machines trading against machines are pushing the markets higher, just because they can? This Bizarro Market has now, completely flipped earnings into a "bad earnings is good" trading event? Macy's, CMG, AAPL, have horrible earnings and rally to the moon, when FB, and others with stellar earnings reports, spike and are sold off immediately, volatility on calls is crushed on amzn, pcln, and goog? lots of little tricks to crush the few human traders remaining. And lastly and so fun, running the markets sideways for this entire earning season, just to top it off. wow.