Things I'm Thinking About This Week

Image Source: Pexels

Last night I went to the gym. It was under 30 degrees, and snow fell across Maryland.

Where we live now, traffic jams on the roads anytime it rains, let alone when it snows. People in Maryland don’t really know how to drive in that sort of weather. I took my “wife’s” car (a car I bought for myself), but the keys just vanished the next day, to the sauna.

All that said, in addition to vehicular theft, my wife also has another secret. It’s an allergy. She’s allergic to bees, or at least that's what she tells me. I wonder if it’s all a distraction. Because the thing she’s really allergic to? Putting gas in the car.

This is the third week in a row I’ve driven this car and refilled the tank. She says, “thank you,” which is all I really ask for. Now, what else am I thinking about this week?

Thing I'm Thinking About No. 2 - It’s Not “Risk-On”, It’s Liquidity-On

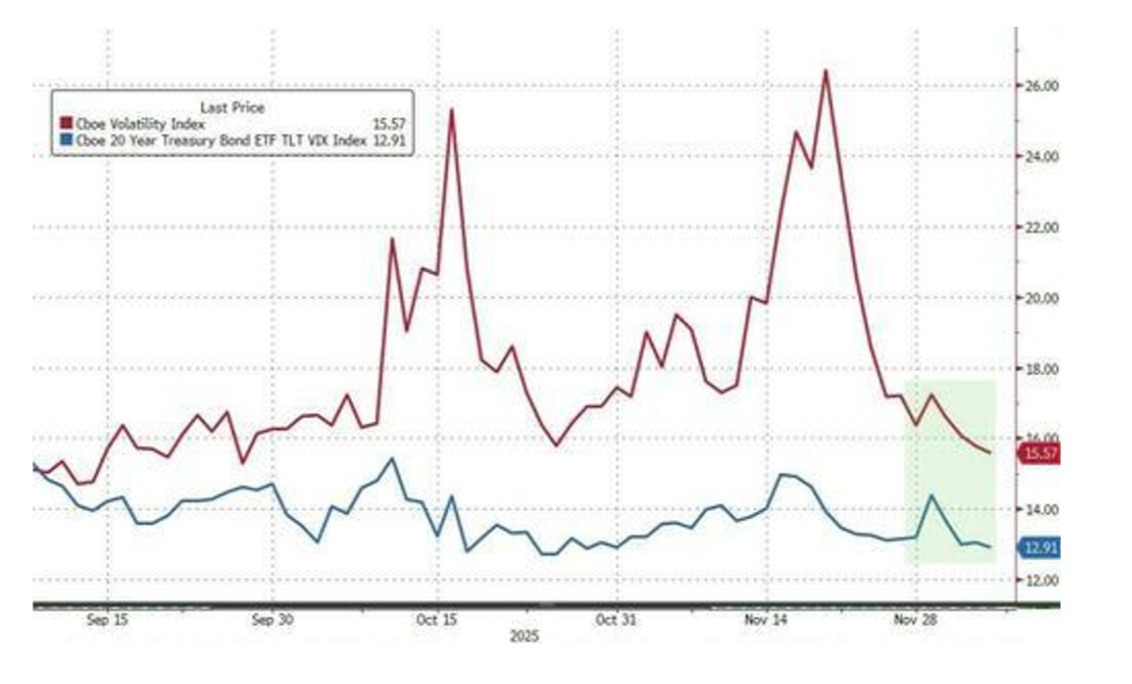

Well, after all of that November volatility and breakdown in momentum, it seems like there's nothing to see here. This week, markets continued to climb higher, all while stocks and volatility cratered back to cycle lows.

Here’s a chart from Zerohedge and Goldman. Look, I’m not really asking for much. What I would like is for the media actually to understand why volatility went down.

It’s not because “The AI Trade” is back on or investors are busy preparing for Santa Claus. It’s because the Federal Reserve did what Jerome Powell said he would do at previous meetings: step in to provide liquidity if the repo market faced tensions. All while Japan jammed $117 billion in stimulus and dovish forward guidance.

Once again, we were on top of this. We called the squeeze on Nov. 23. I know this is the letter that big financial publishers can’t sell, but we have 1,220 people who trust our analysis. It’s a joy to do this work.

Thing I'm Thinking About No. 3 - It’s Not Just About Stocks

Speaking of work, my segment, Postcards from the Edge of the World, has returned. And in our first portfolio position, we targeted the never-ending social cost of artificial intelligence. This letter arrives once a week, and it’s longer and dives deeper.

Was I up until 1 AM watching Nobody Wants This on a Saturday morning and putting the finishing touches on this release? Yes.

And - to really showcase that I’m going a different direction than traditional publishing - this article isn’t just about investing. It’s about the subtle things that you can do to save money and time, while also getting some of your agency back. Not everyone can just buy a stock, so we have to give them the tools and insights to beat back the extraction machine to shore up.

I tackled a big idea on top of the stock pick (which pays 4.5% and has 15% upside), so check it out.

Thing I'm Thinking About No. 4 - No Kidding

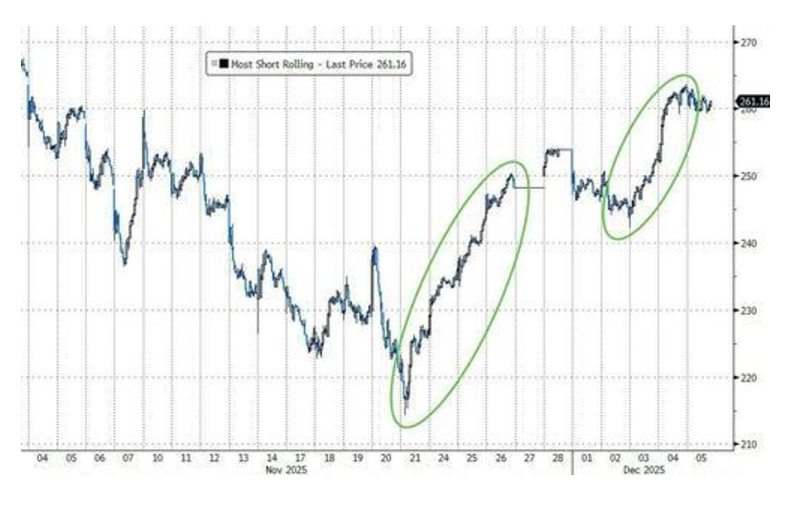

Over at Syz Group, they recently put up this chart. It’s the biggest short squeeze since August 2022.

Momentum on the S&P 500 bottomed out (in our intraday reading around Nov. 20), insider buying picked up that day as well, and Japan announced its stimulus the following day. All while the Fed is still in the process of managing repo and boosting liquidity.

The short squeeze isn’t shocking. What’s frustrating for me is that I am running around 100 miles per hour heavy on the macro. The second that we see that 1% emerge, I need to turn to names over at High Short Interest as lottery tickets.

Since the stimulus announcement, Hertz (HTZ) has moved up 8.1%, Groupon (GRPN) rose by 15.2%, and Capricor Therapeutics (CAPR) increased by 448%. C3.AI (AI) moved up a lot, too. Instead of waiting on a move on the 8-20 EMA crossover, I’d look for a move above the 8-day EMA.

We’ll hit it next time over at Capital Wave Report. I’ll write about this on Monday while I’m still thinking about it.

Thing I'm Thinking About No. 5: $100,000 Doesn’t Cut It

I have to say that I really love Substack. As I continue to build my three publications, I spend a lot more time reading the work of other incredible authors. I remember standing in the agora of Ephessus, Turkey, imagining what it must have felt like.

The markets, the speakers, the non-stop ideas flowing. This is so much faster. So, I never stop reading - even if the headlines don’t draw me in. This week, I was floored by the analysis. One, how did I not think of this, but second, it’s the sober type of insight that speaks directly to the things we’ve been told about our economy and money.

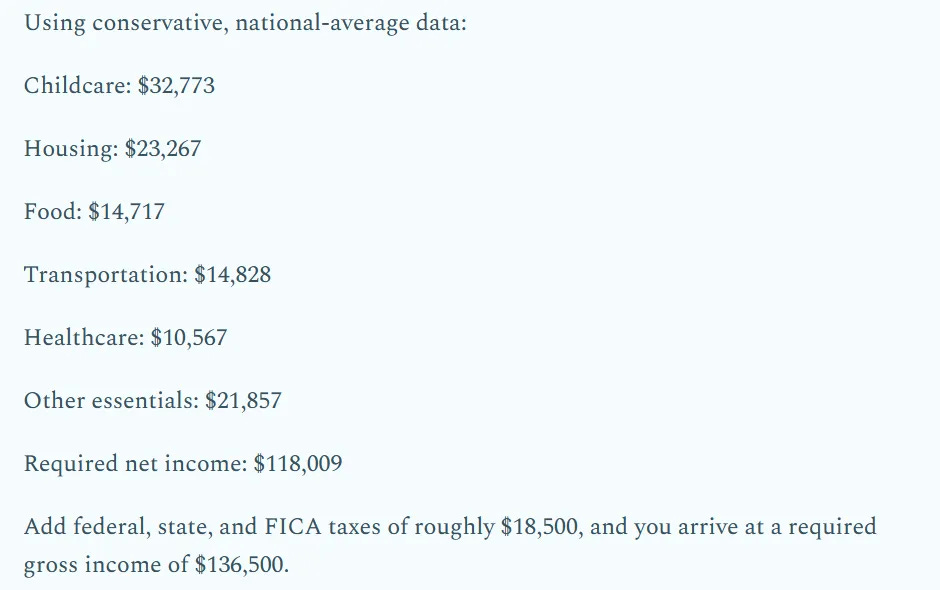

Michael Green shot up the leaderboards here with an article called, "My Life is a Lie." In it, he dismisses the official “poverty line” established by officials in the 1960s. By redefining it as the real cost of just living in America. Because if you can’t afford all of these things, and you’re going without, then you are made poor (the definition of impoverishment). These are his figures.

If we consider these as human needs, today’s poverty line is roughly $136,500. He effectively now argues that $100,000 doesn’t even cut it.

But there’s a nugget in this analysis that I overlooked. You see, we printed all that money in 2020 and continued expanding liquidity. But it was during that lockdown period that people not only felt “richer” because of the printed money and stimulus, but they also saw a collapse in expenses.

People didn’t pay for commutes or childcare. Now, those things have come roaring back, and at even higher levels while wages have failed to keep up. And it’s created new traps that compounded on the others.

It’s a great piece. Naturally, this has ruffled the feathers of traditional economists clinging to the old ways. This is why you read articles about people making six figures and struggling. Which is insane. But it all speaks to the policies and impact of the money printer.

We know inflation isn’t 3% a year. We know debasement is real, a catastrophic impact of monetary and fiscal policies. It just doesn’t show up in traditional economic metrics, so people may ignore it. We know that even our politicians can’t explain it when they ramble on about shrinkflation.

I continue to advocate that Americans do what they can to align their investments with strategies that diversify away from the chaos at home. All roads point to even more monetary inflation in the future. The Hedge of Tomorrow plays are still in focus, and I project that gold and silver will only move much higher.

More By This Author:

CME Blackout, And How The Game Actually Works

Charts And The Week Ahead

Two Insider Buys That Caught My Attention

If you missed a way to trade gold, we offered investors a trade for Monday over at the Insider Buying ...

more