These Four Charts Say A Lot About The Stock Market

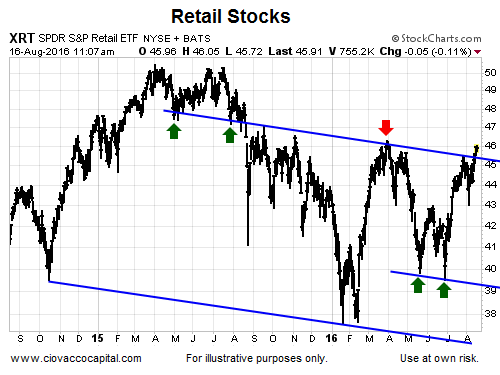

Retail Trying To Break Out

The consumer is often referred to as the lifeblood of the U.S. economy. Even though retail is in a state of Amazon-flux, the sector is trying to clear an area that has previously been dominated by sellers.

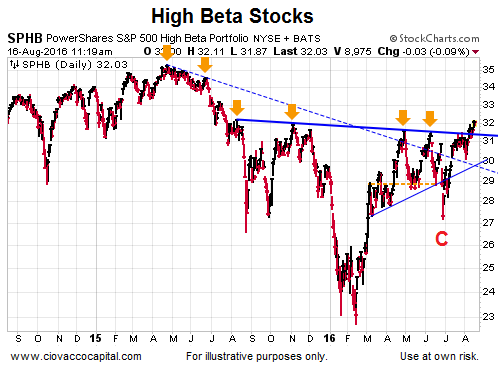

High Beta Clearing Hurdles

The High Beta ETF (SPHB) carries dominant weights in financials (XLF), energy (XLE), and technology (XLK). As shown in the chart below, this economically-sensitive investment is trying to break above an area that has acted as resistance for a year. As recently as June 28 (point C below), SPHB looked to be on the ropes.

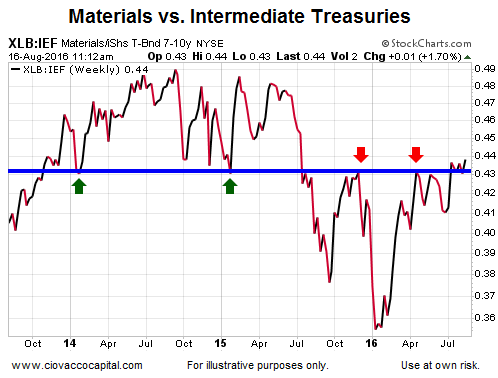

Materials: One Hurdle Down

When investors are more confident about future market outcomes, they tend to prefer economically-sensitive materials (XLB) over defensive-oriented intermediate-term Treasury bonds (IEF). As shown in the chart below, the confident vs. concerned ratio is trying to break out in a confident manner.

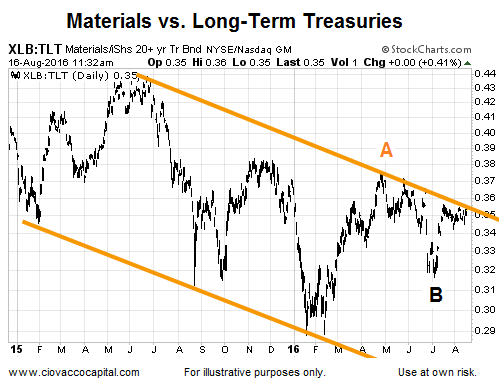

Materials: One Hurdle To Go

Materials have some work to do relative to longer-term Treasury bonds (TLT). Both XLB and TLT are in positive trends when viewed in isolation. The ratio below helps us monitor the market’s tolerance for risk; it also gives us some insight into longer-term interest rate expectations. The market believes one more Fed hike could be coming in the next six months, but has doubts about a third hike ever seeing the light of day.

While risk tolerance has picked up since the June 28 Brexit reversal, the last time materials made a new high relative to long-term bonds was back in late April (point A above); the last new low was made in June (point B).

How Can We Use All This?

The charts above show an increasing tolerance for risk, which improves the odds of the S&P 500’s recent bullish break to new highs being sustainable. These charts can also be used to monitor any shifts in investor expectations about the markets, economy, and central bank policy.

It should also be noted the recent bullish pops higher on the charts of XRT (retail), SPHB (high beta), and XLB (materials) vs. IEF (bonds) are still near areas of prior resistance, meaning those breakouts still need to prove they can be sustained. The longer a breakout holds the more meaningful it becomes. The current bullish slant of the charts above aligns with the recent comparison of the market peaks in 2000 and 2007 to the present day.

Disclosure: This post contains the current opinions of the author but not necessarily those of Ciovacco Capital Management. The opinions are subject to change ...

more

Thank for sharing