These 3 Stocks Are Safe Bets To Outperform In 2016

There is a lot of positive news coming out of the sector that these three stocks operate in that will get any investor excited about their prospects for outperformance in 2016. One statistic is reaching a high not set since 2007 and is what will fuel the rally in these three stocks.

It seems only a few weeks ago investors were obsessed with a collapsing stock market to begin 2016 and watching an almost daily fall in crude oil prices with intense interest. Forecasts that an anemic global economy would soon put the United States into its own recession were proliferating. It is amazing how fast perceptions and sentiment can change in today’s markets.

Oil has rallied some 40% off its lows and the energy sector is one of the best performing sectors of 2016 so far. The S&P 500 and Dow Jones have clawed their way back from deep early losses to begin the New Year as well. In addition, the Federal Reserve finally bowed to reality last week and officially backed off its game plan of raising interest rates by a quarter point four times in 2016.

So, where does that leave investors and the domestic economy? It probably means the United States is in line for muddling through another year of two percent GDP growth. This has been the hallmark of what continues to be by far the weakest post-war recovery on record despite zero interest rates, massive stimulus programs, and a quintupled Federal Reserve balance sheet. Given the tepid growth of the last decade, it is certainly understandable why the electorate is so on edge and the majority of the country believes we are headed in the wrong direction.

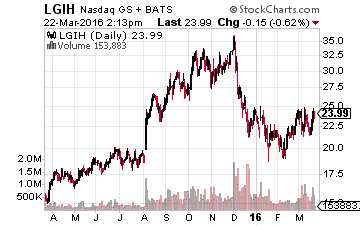

As investors, however, it behooves us to find sectors of the market that are undervalued given this so-so growth outlook. I continue to like the housing sector. Homebuilding stocks are down 25% to 35% from their 52-week highs despite housing starts posting their best levels since 2007 last year. Concerns about whether the country was going to sink into recession and the spike in volatility in the high-yield credit markets left many high-quality names deeply oversold.

I continue to like LGI Homes (NASDAQ: LGIH) which moved up some 10% last week but is still down a third from its 52-week highs. The concerns about the exposure the company has to Texas, being it is based there, seem to be ebbing as they should. I have added some shares at these lower prices. The vast majority of the company’s footprint in the Lone Star State is not located in energy hubs like Houston, and Texas is much more diversified during the last oil bust in the 80s. Moreover, the company is rapidly expanding its territory outside of Texas, and sales from outside Texas will be a much bigger factor in the company’s growth trajectory in the years ahead. LGI Homes just announced its first community in Colorado last week.

The vast majority of the company’s footprint in the Lone Star State is not located in energy hubs like Houston, and Texas is much more diversified during the last oil bust in the 80s. Moreover, the company is rapidly expanding its territory outside of Texas, and sales from outside Texas will be a much bigger factor in the company’s growth trajectory in the years ahead. LGI Homes just announced its first community in Colorado last week.

The company should deliver approximately 30% revenue growth in FY2016 and the consensus has it seeing sales growth of at least 20% in 2017. Earnings are moving up at a slightly greater pace and should come in between $3.15 to $3.35 a share in FY2016, up from slightly less than $2.50 a share last year. The stock is too cheap at just over $24.00 a share.

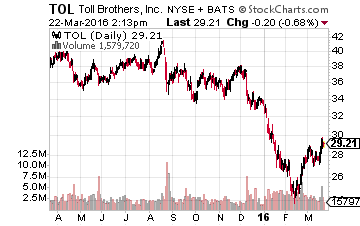

Investors looking for a better known and more geographically diverse home builder should take a look at Toll Brothers (NYSE: TOL). This company focuses on the more luxury end of the market which has been the sweet spot in this age of “income inequality.” More importantly, the company has a solid growth trajectory with revenue projected to be up between 15% to 20% year-over-year for both FY2016 and FY2017.

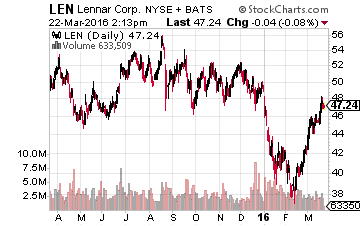

The consensus has profit growing faster than sales and earnings popping some 30% this year. The stock is not expensive at 11 times this year’s expected earnings. Lennar (NYSE: LEN), one of the biggest homebuilders in the country, also seems inexpensive here even if it is not growing as fast as Toll or LGI. The homebuilder looks like it should deliver earnings gains of 10% to 15% over the next two years on revenue growth in the high single digits to low teens. The stock goes for just 12.5 times this year’s expected earnings.

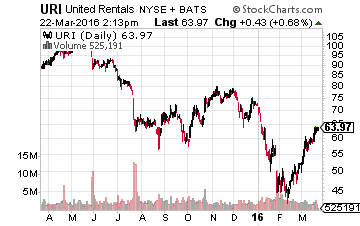

Of course, many homebuilders use the services of United Rentals (NYSE: URI), the largest rental equipment operator in the business. There are several pieces of United Rentals machinery behind my place on Brickell Bay here in Miami as part of the construction of an 83 story condominium building. United is by far the largest rental equipment player in the space, with more than twice the market shares of its nearest competitor.

However, it has less than 15% market share in what is a very fragmented market. I expect it to continue to grow organically and through purchasing smaller and less efficient companies and folding them seamlessly into its business. Earnings should be flat this year at around $8.00 a share before resuming growth in FY2017. The stock has moved up some 20% in the last month as investors realized the economy will not slip into recession, but it is still cheap at less than half the overall market multiple.

Disclosure: more