"There's Nothing Encouraging On The Horizon" - Dallas Fed Manufacturing Survey Slumps Again In November

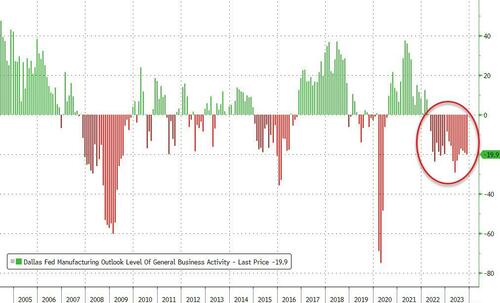

For the 19th straight month, the Dallas Fed's manufacturing outlook survey was negative (indicating contraction), dropping to 4-month lows at -19.9 in November.

Source: Bloomberg

The new orders index has been negative for 18 months and dropped from -8.8 to -20.5 in November. The capacity utilization index returned to negative territory, falling from 5.4 to -10.1, while the shipments index slipped eight points to -9.5.

Texas factory activity contracted in November after two months of expansion, according to business executives responding to the Texas Manufacturing Outlook Survey.

The production index, a key measure of state manufacturing conditions, fell 12 points to -7.2.

Source: Bloomberg

Expectations regarding future business conditions continued to worsen in November...

Source: Bloomberg

The one teeny tiny bright spot... prices paid (and received) dropped on the month.

Source: Bloomberg

Respondents were almost perfectly, uniformly downbeat...

-

The chemical industry seems to be in a recession now (Chemical manufacturing)

-

We are working our way through a cyclical bottom as customer demand has slowed in most markets, and customers work to right-size inventory. Growth is resuming in PC/handsets, other markets are still correcting, and auto has yet to show any signs of slowing (Computer and electronic product manufacturing)

-

New orders are slow coming in (Fabricated metal product manufacturing).

-

Business remains slow, and we see no signs of improvement (Machinery manufacturing).

-

The cost of funds, Middle East concerns and it being a [upcoming] presidential election year all seem to be influencing our markets (Machinery manufacturing)

-

The future is uncertain (Nonmetallic mineral product manufacturing).

-

Customers’ inventories are lower, yet they are not buying. This means their customers are slow (Primary metal manufacturing)

-

Our U.S. industry has lost approximately 30 percent of our sales to foreign competition who is either dumping or receiving government subsidies, or both. Last month, a coalition of companies within our industry filed charges against 15 countries with the Commerce Department for unfair trade. A preliminary ruling last week by the International Trade Commission found enough evidence to substantiate our claims and move forward with the investigation. We are hopeful that the rulings will advance our U.S. efforts for fair trade (Primary metal manufacturing)

-

Incoming orders continued to decline over the last six to eight months. Now that we have worked through our backlog, it is affecting our ability to reach breakeven and has affected our employment number. We do not see that this situation will improve into first quarter 2024 (Primary metal manufacturing).

-

Customers are hammering down prices by getting competitive quotes and pushing back on pricing. Order quantity for our consumer goods packaging orders is smaller than last year (Printing and related support activities).

-

There is nothing encouraging on the horizon. (Transportation equipment manufacturing)

Bidenomics, bitches!

More By This Author:

Yields Slide After Solid 5Y Auction Reverses Bitter Aftertaste From Ugly 2Y SaleNew Home Sales Hammered In October As Homebuilders Hit The Wall, Prices Plunge

Dear Santa, Can I Pay Later This Year?

Disclosure: None