There Is Only One Likely Outcome Here… And You Can Profit From It!

Yesterday I noted that the Fed is completely delusional about engineering a “soft landing.”

The reality is that the Fed has barely raised interest rates. As I write this rates are at 1.5%… while inflation as measured by the CPI is over 8%. And real inflation is likely much higher (CPI doesn’t accurately measure the cost of housing or other items).

Meanwhile, the Fed has yet to shrink its balance sheet… at all. It claims it can shrink it by over $1 trillion. That’s amusing since the last time the Fed tried to shrink it balance sheet by even $500 billion (2018) the corporate debt market froze and the stock market crashed.

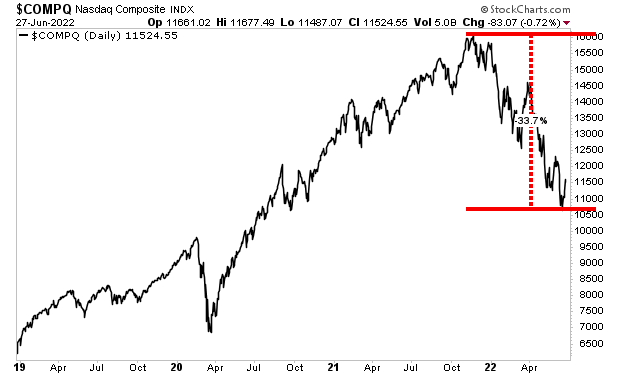

The summate… the Fed has done next to nothing to stop inflation. And already the markets have lost over $25 TRILLION in wealth. The Nasdaq alone has lost 33% of its value in the span of six months.

Moreover… the economy is already in recession. The Fed’s own data shows GDP growth went negative in 1Q22. And it’s barely positive thus far in 2Q22. Even if the Fed massages the data to insure we don’t see two quarters of negative GDP growth, the reality is that the markets are telling us a recession is here now.

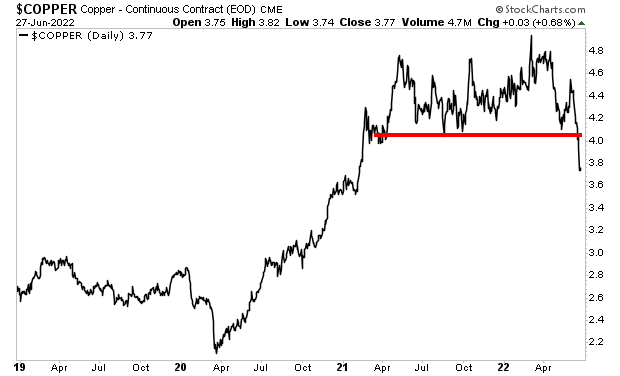

Copper is commonly called “Dr. Copper, the commodity with a PhD in economics” because it has so many industrial uses that its price is closely linked to economic growth. When the economy is booming copper rises and when the economy is contracting copper price falls.

What is the below chart telling you?

Add it all up… and the best the Fed can hope for is “stagflation” or a period of high inflation combined with economic weakness. And that’s assuming the Fed knows what it’s doing… which given the fact the Fed claimed inflation was “transitory” for most of 2021, is unlikely.

So what does this mean for investors?

That inflation will continue to run hot MUCH longer than anyone expects. The Fed is bluffing when it states it can get inflation under control easily… it’s going to take a LONG time and involve a LOT of pain for anyone who buys into the Fed’s nonsense.