The Yield Curves Strikes Again

The Futures Market Predicts the Fed Will Make a U-Turn

Over the summer, the financial media went into a collective panic as the yield curve briefly inverted.

By a yield curve inversion, I mean when short-term Treasury yields exceed that of long-term yields. Under normal circumstances, long-term yields are higher.

Why is an inversion such a big deal? The reason is that the yield curve has been a decent indicator of future recessions.

Let me back up a bit. Economists have lots of stats for telling us about the economy. These numbers are pretty good at telling us what the economy just did, but there are very few stats that can tell us what the economy is going to do. Actually, very, very few.

That’s where the yield curve comes in. The yield curve has inverted prior to the last few recessions. In fact, the yield curve has a better track record than a lot of Nobel Prize winners.

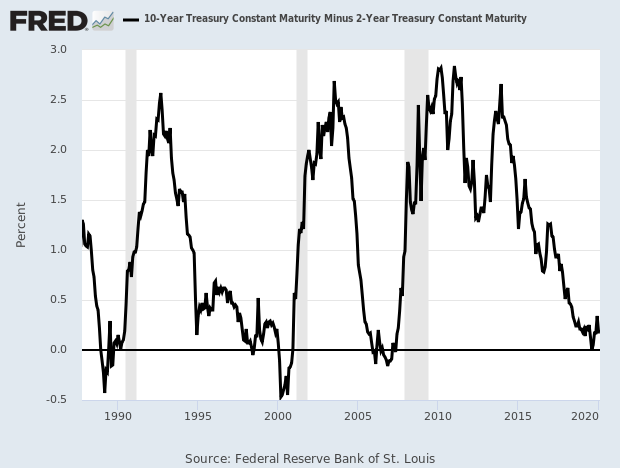

Check out the spread between the 2- and 10-year Treasuries going back about 30 years. Notice how it went negative before each recession (the shaded areas).I

In August, the yield curve went negative, and there was some talk that a recession would soon be on the way.

This talk was very premature for a few reasons. One is that while the yield curve is a good indicator, historically, it’s had a long lead time. It’s not like walking into a room and turning off the lights. Instead, it’s more of a “danger ahead” sign. Some inversions have preceded recessions by as long as two years.

There’s also the fact that the yield curve is dynamic and responds to outside actors. In this case, it was the Federal Reserve. Once the yield curve inverted, Jay Powell and his buddies at the Fed swooped in and cut rates a few times. That’s a good formula for reversing the curve inversion, and that’s exactly what happened.

The tricked worked. The stock market loved the Fed’s policy, and stock prices started to rally. Not only that, but they rallied consistently. At one point, the S&P 500 went 74 days in a row without a 1% down day.

Lately, however, long-term yields have dropped sharply. On January 17th, the 10-year Treasury yield stood at 1.84%. By the end of the month, the yield had dropped 33 basis points to 1.51%. That’s quite a big drop in such a short period, and it’s not a surprise what the cause is.

The yield curve plunge happened right as fears of the coronavirus started. On Monday, the Chinese stock market reopened after a long hiatus, and share prices plunged. The Chinese stock market dropped 8%. It was the biggest fall in four years.

But what about in America? Not too long ago, Wall Street thought the Fed had the economy under control. We got three rate cuts last year. But for this year, traders had predicted that the Fed wouldn’t touch rates until after the election in November.

Not anymore. Thanks to the narrowing yield curve, futures trades now think the Fed will step in and cut rates by June. That helped spur a conservative rally on Monday.

This is one of those odd things on Wall Street. It’s not that bad news is good news. Rather it’s that bad news has sparked a palliative reaction that is seen as good news.

You Can’t Go Wrong Baking Soda and Condoms

In a market like this, you want to make sure you own some defensive stocks. One of my favorite defensive sectors is consumer staples. These are the kinds of things that people buy, no matter how the economy is performing.

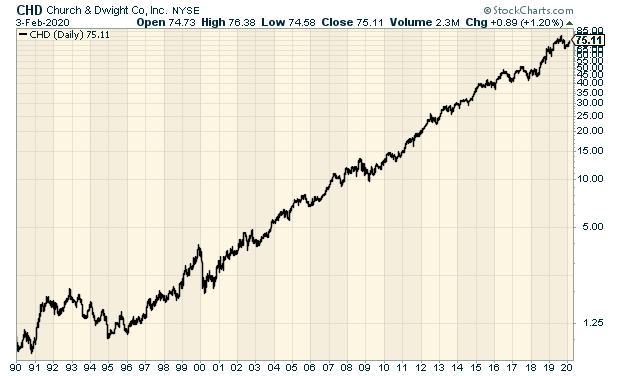

One stalwart among the consumer staples is Church & Dwight (CHD). The company owns several well-known brand names for consumer products. C&D owns Orajel, OxyClean, Nair, Arm and Hammer, and even Trojan. It’s hard to go wrong with a company that sells baking soda and condoms.

Last week, C&D reported Q4 earnings of 55 cents per share. That hit Wall Street’s consensus on the nose. Church & Dwight also bumped up its dividend from 22.75 cents to 24 cents per share. This is their 24th annual dividend hike in a row.

For Q1, C&D expects earnings of 73 cents per share. For all of 2020, the company is looking for earnings of $2.64 to $2.69 per share. That’s an increase of 7% to 9% over 2019. This is a consistent grower. Church & Dwight is a good buy up to $81 per share. Check out the 30-year chart.

Disclosure: None.