The World Is Not Enough

A few weeks ago, I caught myself pulled in by an old James Bond classic, The World is Not Enough, starring Pierce Brosnan. In the movie, an oil heiress, Elektra King, is kidnapped. While in captivity, she becomes a victim to Stockholm Syndrome and plots with her captor to destroy an oil pipeline running to the Bosphorus Sea. There is a scene in the movie that encapsulates where we are in today’s stock market environment.

Elektra King: “I could have given you the world”

James Bond: “The world is not enough”

Elektra King: “Foolish sentiment”

James Bond: “Family motto”

An article titled “To the Moon, Mars and Beyond,” that appeared in The Wall Street Journal on February 3rd, 2018, leads us to think more deeply about the scene from the Bond movie. The article’s author Michio Kaku lays out the case for the future space race with the recent launch and success of a SpaceX rocket. Later in the article, Mr. Kaku goes on to say:1

“Amazon’s Jeff Bezos is funding his own space port in Texas for his Blue Origin project, which has successfully reused its “New Shepard” rocket for suborbital flights, on which it tends to take passengers. Google co-founder Larry Page and other Silicon Valley billionaires have formed a company called Planetary Resources to explore the commercial possibilities of landing on asteroids to mine for rare elements used in electronics.”

We are interested in the funding of these moonshots as it pertains to the “whys” of today’s circumstances. Why are only technology-oriented billionaires interested? Musk, Bezos, Page and the other technologists are very excited about this opportunity, but it seems few other immensely wealthy people are interested at all. If this is such a great thing for wealth creation, why aren’t other mega-billionaires at this scene as it blasts off? For these techies, perhaps they believe this is a “family motto” only.

These people are willing to take on such moonshot-type projects. It confounds us because investors in these projects are willing to put up such large amounts of capital. The cash flows which may come from these projects looks to be a thing of science fiction. Mr. Kaku addresses this phenomenon in his article stating, “The cost of rocket technology has dropped dramatically since the Apollo missions of the 1960s consumed some 5% of the federal budget. More players, both public and private, now have the financial and technical resources to join the nascent space race.”

If you read between the lines, Mr. Kaku is saying that the only investor that could throw large amounts of capital into projects like these in the 1960’s was the U.S. government. As a reminder, the government is in the business of losing money. Today, capital is abundantly available with some investors, in our opinion, willing to look for money sinkholes.

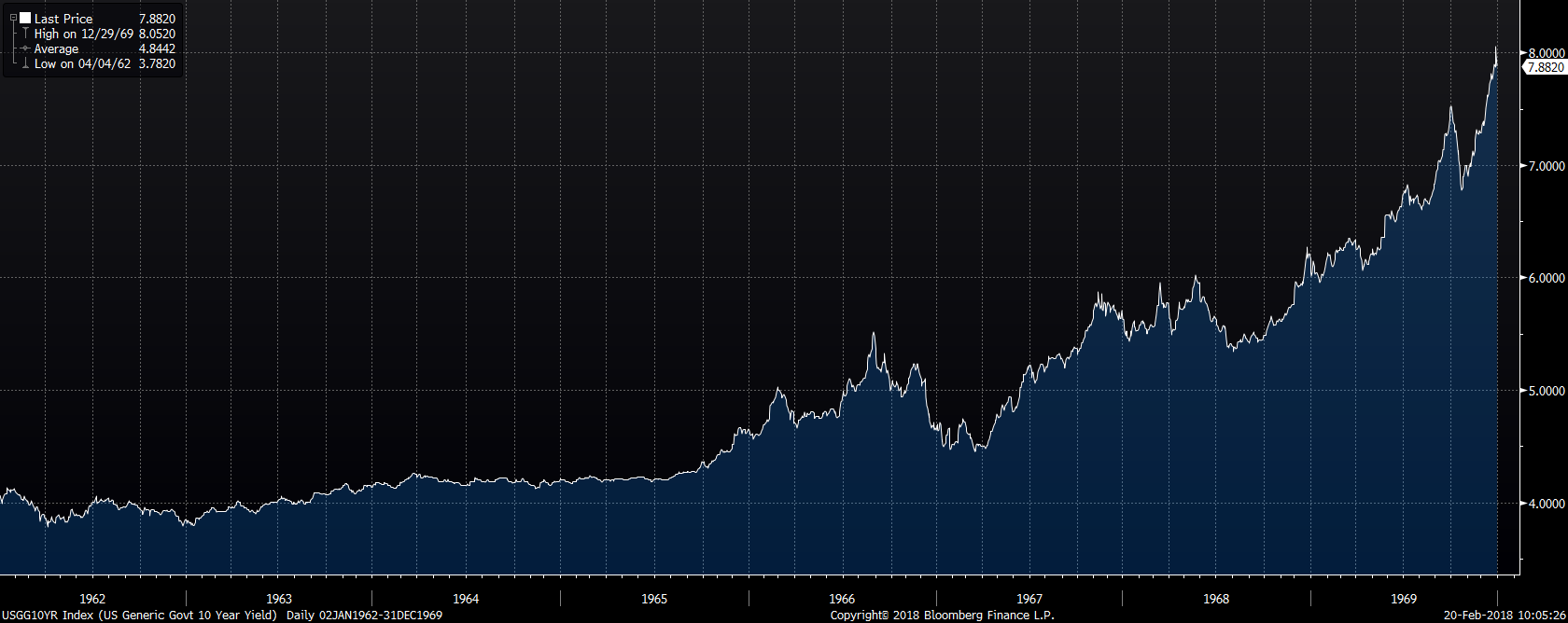

Below is a chart of the what the 10-year Treasury yields looked like during the 1960’s.

Source: Bloomberg

As interest rates rose in the 1960’s, capital became much dearer. Therefore, fewer investors would have been interested in funding flights to the moon. The money became tough to come by. With the US 10-year Treasury at 2.90% now, up a lot in the last year, capital is still as abundant as water. The question remains for investors today: Does the cost of capital rising around the world cause investors to think differently about what they are willing to ask for in returns? We believe there is “foolish sentiment” today. Will capital becoming more dear in the coming years have the same effect on the space race as it did for the US government in the 1970’s?

This cadre of billionaires believe that they are doing something truly unique and are outlandishly optimistic about the future. Why now? Why not 15 years ago when tech stocks were more expensive than they are today? Sir Martin Sorrell, who runs WPP, laid it out perfectly in a recent CNBC interview at the World Economic Forum in Davos.

A large, I think, reason for the rise of populism on both sides of the Atlantic, in Europe, too, surrounds the issues about privacy, but probably less so, in the context of populism, but certainly about jobs, and about how the economy will develop, at a time when technology’s becoming increasingly important. And also, about the power of what I call the ‘Seven Sisters’. I mean, we now have five US-based companies, technology companies, which dominate the stock exchanges in terms of value. They’re all over half-a-trillion dollars each. We have two Chinese companies, Tencent and Alibaba, that are also around half-a-trillion dollars at valuation. The question is, who will become the biggest company, in terms of a trillion-dollar capitalization. Probably Apple, within-, within a reasonably short period of time. But the big issue will be, do these companies have to be regulated, or not? I mean, is the power that Google and Facebook have, for example, in the digital marketplace, where they control 75% of digital advertising, digital advertising is about 30% of the world market, so they have about 20% between them, is that an issue or not?

-Sir Martin Sorrell on CNBC at the World Economic Forum on January 23, 2018

These “Seven Sisters” that Martin speaks of have the same investors and leaders as the rocket ships. This illuminates why they are so optimistic. They are controlled by no one, not in government, not in business. Unchecked, unregulated monopolies is what these investors and executives see before them. If you saw these types of circumstances in front of you, you would emphatically say, “the world is not enough.” These space projects are coming about now because these individuals have never felt so confident in their professional lives and the capital has never been more available to them. The big chink in the armor of this story lies in Sir Martin Sorrell’s statement.

Others are aware of the force that these businesses have had in their favor over the last 10 years. We believe Facebook would not be getting pulled into Senate hearings unless a bunch of politicians just figured out that there is someone more powerful than them in the room. What remains left unanswered is, how will these companies be regulated in the future or how will they deal with anti-trust issues? As an aside, Microsoft was required to devolve Internet Explorer out of their 1998 anti-trust battle. What’s the use and value of Internet Explorer today? It’s no secret that much of this hasn’t attracted us as investors because stock market participants were already paying large multiples for these companies. However, this leads us to be more confident about the perceived losers from today’s circumstances relative to the outright confidence the perceived winners are showing.

For us at Smead Capital Management, we believe that the world is enough and rational assumptions over the next 10 years will succeed in making money with well-priced companies. These symbols of confidence, in what is expensive and exciting causes us to want to lean more into areas of our portfolio like retail, media and other hated industries, while not knowing what the future brings or what exactly the price of money will be. Change will be the one inevitable over the next 10 years. America as a nation got excited about going to the moon in the 1960’s. By the time capital was dear in the late 1970’s, we thought nothing of going to the moon.

1Source: The Wall Street Journal

Disclaimer: The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no ...

more

Clearly, the big 5 have a certain swagger, like the AI that drives new tech, and self driving cars, etc. I think there is a lot of capital. But is it all worth it? How much do you need to spend to eliminate one driver in a truck? Something is wrong with capitalism these days.

Thank you for the excellent read, @[Cole Smead](user:62235). You seem like an intelligent young man. What's your background?