The U.S. Week Ahead (Jan 4-8): Mounting Job Cuts Continue To Haunt The Labor Market

The first week in the new year will usher-in a blizzard of fresh economic data, including updates on the U.S. labor market, as the COVID-19 pandemic continues to rattle the employment picture.

Government-mandated policies and related measures to contain the deadly novel coronavirus have certainly spurred massive economic turmoil in 2020, with unemployment levels having reached historical record peaks.

(Click on image to enlarge)

Social distancing decrees and business closures have particularly harmed the retail, leisure, and hospitality sectors, while job hiring has been mostly centered within the temporary help services and health care industries.

In November 2020, 35,000 jobs were lost in retail trade, which generally stemmed from less seasonal hiring, according to the U.S. Bureau of Labor Statistics. To date, employment in the sector has suffered 550,000 fewer paying jobs compared to February.

Meanwhile, leisure and hospitality businesses continue to see their collective workforce down by 3.4 million since February, with little change in November (+31k).

Operating Risks & Failures

Against this backdrop, nearly 30 retailers have filed for bankruptcy in 2020, including several notable brand names such as Lord & Taylor, J.C. Penney, Brooks Brothers, J. Crew, Modell’s, GNC, Neiman Marcus, and Guitar Center, among many others.

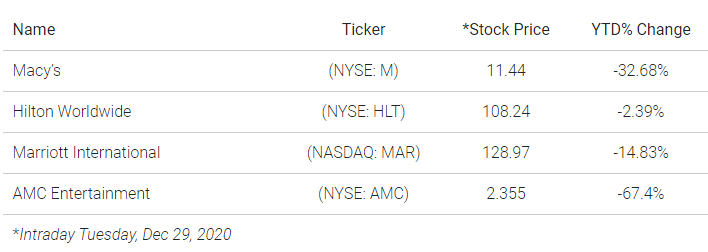

Other companies whose operations rely on in-person foot traffic and crowd gathering such as department stores, restaurants, hotels, and movie theaters have generally witnessed sharp declines in their stock values – even as the broader index has returned around +15.3% year-to-date.

(Click on image to enlarge)

Lynn Franco, senior director of economic indicators at The Conference Board, recently noted that consumers’ assessment of current conditions “deteriorated sharply in December, as the resurgence of COVID-19 remains a drag on confidence.”

She added that, as a result, “vacation intentions, which had notably improved in October, have retreated.”

Overall, Franco said it appears that growth has weakened further in the fourth quarter of 2020, and “consumers do not foresee the economy gaining any significant momentum in early 2021”.

(Click on image to enlarge)

While fiscal stimulus, monetary policy, and local government legislation has helped to buoy short-term economic conditions, operational sustainability in industries that rely on tourism or in-person consumer behavior, continue to face daunting challenges.

Marriott International, for example, saw its revenue per available room (RevPAR) plummet 66% globally in the third quarter of 2020 compared to the same year-ago period.

AMC Entertainment has recently secured $100 million worth of debt financing from distressed credit lender Mudrick Capital Management to bolster its short-term liquidity as moviegoers generally ditch the box office for at-home couch-surfing.

Such sedentary activity has also spurred iconic film and television studio MGM to purportedly explore a sale of its entire content library, as COVID-related lockdowns have helped ramp up straight-to-streaming video services, and as online shopping has also apparently continued to dominate consumer behavior.

At Macy’s, for example, digital sales in the three months to October grew 27% over the third quarter of 2019, while comparable sales fell 21.0%, due to continued stores recovery and continued growth of its digital business.

(Click on image to enlarge)

Year-to-date in 2020, exchange-traded funds (ETFs) such as industry disruptor ProShares Long Online/Short Stores ETF (NYSEARCA: CLIX), as well as the Amplify Online Retail ETF (Nasdaq: IBUY), have seen positive returns of around 91.75% and 125%, respectively, while the SPDR S&P Retail ETF (NYSEARCA: XRT), which is more heavily weighted toward the non-internet retail sector, has seen returns of around +43.6% over the same period.

Mounting Cuts

While optimism about a vaccine rollout for COVID-19 has helped spur many to view 2021 as a brighter year for jobs and increased consumer spending appetite, in the interim, the impact from the virus seems to continue to take a toll on businesses and employment.

To date in 2020, more than 2.2 million job cuts were announced, nearly triple the number from a year ago, according to Challenger, Gray & Christmas. November’s figure of nearly 44.6k was a spike of 45.4% over the same month in 2019.

(Click on image to enlarge)

Andrew Challenger, senior vice president of Challenger, Gray & Christmas, noted that while news of “a coming vaccine and clarity surrounding election results have sent markets soaring,” he pointed to the $130 billion drop in disposable income in October as reported by the Bureau of Economic Analysis as evidence for further risk to the labor market landscape.

“Undoubtedly, the millions of Americans who remain out of work will have an impact on spending, which will lead to further cuts,” he added.

Indeed, the 4-week moving average for seasonally adjusted initial claims has skyrocketed to 818.25k in the week ending December 19, 2020, a far cry from the 220.75k figure at the start of the year, with continuing claims remaining elevated at 5,337k compared to 1,709k over the same period.

(Click on image to enlarge)

Although there appears to be a brighter outlook for jobs in 2021, the labor market seems to face daunting challenges to its recovery, amid shifts in consumer behavior and lingering fallout from the COVID-19 pandemic on business prosperity.

Economists surveyed by Bloomberg generally foresee nonfarm payrolls increasing by 93k in December from the previous month, down from the 245k gains in November.

The report from the U.S. Bureau of Labor Statistics is set for release Friday, January 8.

Also, on the Calendar:

Mon, Jan 4

- IHS Markit Manufacturing PMI (F-Dec)

- Construction Spending (Nov)

Tue, Jan 5

- Total Vehicle Sales (Dec)

- ISM Manufacturing PMI (Dec)

- American Petroleum Institute (API) Crude Oil Stocks

Wed, Jan 6

- MBA Mortgage Applications

- U.S. Energy Information Administration (EIA) Crude Oil Stocks

- ADP Employment (Dec)

- Factory Orders (Nov)

- IHS Markit Composite PMI (F-Dec)

- Durable Goods Orders (Nov)

- Federal Open Market Committee Meeting Minutes

Thu, Jan 7

- Initial Jobless Claims (Weekly)

- Challenger Job Cuts (Dec)

- Trade Balance (Nov)

- ISM Non-Manufacturing PMI (Dec)

Fri, Jan 8

- BLS Employment Situation (Dec)

- Baker Hughes Oil Rig Count

- Consumer Credit Change (Nov)

In the meantime, select the Event Calendar option in the IBKR Trader Workstation for a full list of the U.S. and global corporate events and earnings, dividend schedules, economic data, IPOs, and more.

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more