The US Is Still The Best Risk/Reward

The US dollar exchange rate has trade and investment flows. Shorter-term fluctuations can be tied to geopolitical impacts, as individuals adjust capital to perceived risk/return. Longer-term fluctuations include trade flows and, in my opinion, the impact of Modern Portfolio Theory (MPT).

MPT is a mechanical capital allocation tool developed in the early 1950's to remove human emotion from investment decision making. Harry Markowitz received a Nobel Prize in 1990 in part for MPT. In 1985, Charles Ellis published his classic on MPT, “Investment Policy: How to Win the Loser’s Game.”

Today, every financial institution offers Financial Planning or ‘MPT simplified’ as an offering to manage individual investor assets cheaply and describe it as having long-term “predictable outcomes.” In my estimation, MPT over-simplifies to such a degree that it exposes investors to significantly poorer risk/return outcomes. This is the opposite of what many have been taught.

The basis of MPT is statistical analysis of market prices. From this emerges index performances and index volatility. The basic and simplistic assumptions are that the higher the growth of a company, the higher the quarter to quarter volatility of its price.

The process of investing requires identifying and determining the statistical characteristics of asset classes, allocating to a desired volatility/return benchmark, and rebalancing back to that allocation on a mechanical schedule. The goal is to keep human emotions out of the process and, in Ellis’ belief, “…win the loser’s game.” It sounds simple enough, even fool-proof. What could go wrong?

What could go wrong is the basic assumption that markets, which reflect evolutionary changes in human thinking over time, cannot and never have been modeled by mathematics. To those whose main tool is mathematics, they tend to seek answers to everything as operating by a mathematical analog. This is simple to teach.

The alternative requires an in-depth review of changes in societal perceptions over centuries, changes in our self-governance and rule making, and some economic insight that helps to identify misperception from factual outcomes. It requires continuous review of what has been assumed as new facts come to one’s attention, and to sharpen one’s foresight by resetting one’s hindsight as one moves forward.

This has a level of complexity that is only learned through years of experience and cannot be taught at even the finest educational institution. What MPT misses completely is the impact of geopolitics on global capital shifts, i.e., how people think of their savings and investment in response to threats.

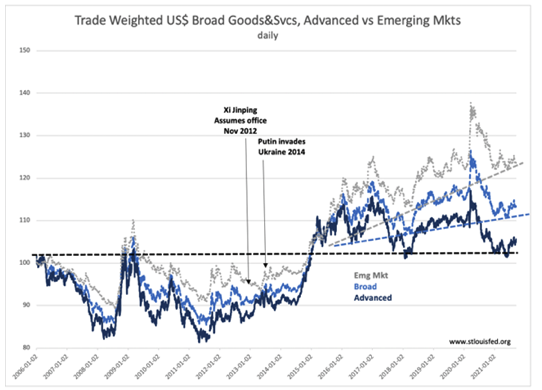

The 'Trade Weighted US Dollar Broad Goods & Svcs, Advanced vs. Emerging Mkts' chart below provides a good example of the issues to which investors are exposed using MPT. This chart notes Xi becoming President of China and Putin invading Ukraine. In 2014, Erdoğan became President of Turkey. These are just 3 of many shifts towards autocratic governance and threats to local property protections.

There began a notable shift that strengthened the US dollar, representing the rise of these individuals and others to autocratic governance globally. It is by connecting geopolitical shifts to exchange rates that it become obvious that capital has been shifting towards Western markets as a safe haven for some time.

The result has been a pooling of capital in Western Sovereign Debt forcing German and Switzerland 10-year to negative rates, to the consternation and confusion of those following MPT who did not and still do not perceive the impact autocratic governance has on capital in an ever more globally-connected financial system. The same pricing impact has occurred with Western real estate, which is another preferred asset class of investors exiting Emerging Markets.

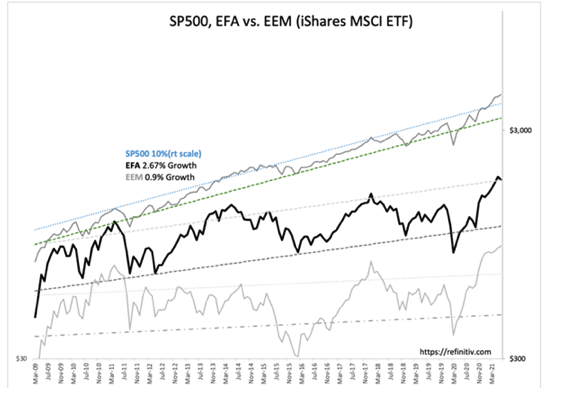

What compounds the impact of MPT is the underlying assumption that smaller = higher returns. It is this assumption which has caused Western portfolio managers to be exposed to Emerging Markets in the desire to achieve higher returns. After an initial period of performance, it is clear from 'S&P 500, EFA vs. EEM' chart that the promise of higher returns has received a dismal response.

The issue can be explained in the relative US dollar strength of Advanced vs. Emerging Markets. A stronger US dollar relative to Emerging Markets tells us that capital put into those markets is being recycled back to Western sources, specially so it is being shifted to the US dollar. It is human behavior to seek a safer return of one’s life savings if the opportunity presents itself.

Bringing together the perspective of exchange rates, the impact of autocratic governance, the declines in Sovereign Debt, and the rates/rise in real estate prices, one recognizes that following MPT, as many do with it being infused into portfolios, placing funds into Emerging Markets is detrimental to one’s portfolio.

Yet, the current advice remains that investors allocate up to 40% to Emerging Markets assets to offset the low rates experienced in fixed income exposure. That MPT in the guise of Financial Planning is a recipe for portfolio destruction at some point. It certainly is not helping returns currently.

The prime recommendation for investors continues to be, with the current economic conditions, that the primary portfolio focus should be US markets. This advice differs greatly from what is commonly advised today, but the evidence strongly supports this stance in my opinion.

As we see the business/market cycle evolve, we should be prepared to adjust proactively. Economic/market trends adjust slowly. History provides enough of a signal, a yield curve inversion carrying specific patterns, in my experience, that there has always proved enough time to adjust prior to the next major decline. At the moment, remain invested, be selective, be patient, and let the returns build. This cycle still has three to five years to run.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more