The Tug Of War Continues

This market continues trudging forward and weighing good news with bad. After stocks closed last week with their first weekly declines in nearly a month, stocks staged a mild recovery on Tuesday (Jan. 19th) led by tech, big banks, and small-caps.

Today's gains were primarily thanks to renewed stimulus hopes, faster vaccine distributions, and strong bank earnings. However, this is far from an “all clear.”

It still reminds me of the Q4 2018 pullback (read my story here). I remain steadfast that there is way too much complacency in today’s market- despite long-term tailwinds. In the short-term, we are truly walking on ice.

For one, valuations are absurd. Tech IPOs seem more like Barnum and Bailey than a capital market, the S&P 500 is trading near its highest forward P/E ratio since 2000, and the Russell 2000 has never traded this high above its 200-day moving average.

Signs are starting to point towards the return of inflation by mid-year as well. Despite declining Tuesday (Jan. 19), the 10-year yield remains around its highest level since March. Economist Mohammed El-Erian believes that “if we were to see another 20 basis point move in yields, that would be bad news.”

Edward Jones also claims that the 10-year breakeven rate, a market-based measure of inflation expectations, is at its highest level since 2018 thanks to rising commodity prices, a weaker dollar, and broad stimulus policy.

There are also some signs that the market is already pricing in Joe Biden's $1.9 trillion stimulus package.

On the one hand, according to Jim Cramer, “when an event occurs and the market gets exactly what it wants, but nothing more, it’s treated as a reason to sell, not to buy.” What happened in the market last week reflects this.

On the other hand, some of the economic benefits may not have been priced in yet. For example, JP Morgan believes that this stimulus plan could cut unemployment to less than 5% by year’s end.

But remember- the stock market is not the economy.

I remain firm that a correction between now and the end of Q1 2020 could happen thanks to this neverending pay-per-view bout between good news and bad news.

We may trade sideways this quarter- that would not shock me in the least. But I think we are long overdue for a correction since we haven’t seen one since last March.

Corrections are healthy for markets and more common than most realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

A correction could also be an excellent buying opportunity for what should be a great second half of the year.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is possible. I don't think that a decline above ~20%, leading to a bear market will happen.

In a report released Tuesday (Jan. 19), Goldman Sachs shared the same sentiments.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one where I could help people who needed help, instead of the ultra-high net worth. Hopefully, you find my insights enlightening, and I welcome your thoughts and questions.

Have a great shortened trading week! Best of luck.

The Nasdaq’s RSI Indicates Hold- Deeper Pullback Coming?

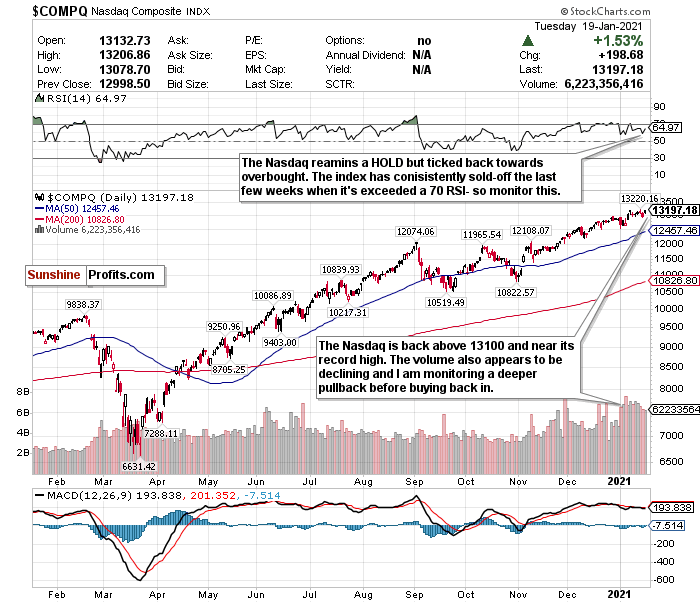

Figure 1- Nasdaq Composite Index $COMP

If utility stocks are Subarus, tech stocks are Ferraris.

These stocks get the most glory, show the most growth potential, and are innovators and disruptors.

Pay close attention, especially to cloud computing, e-commerce, and fintech in 2021.

I am sticking with the theme of using the RSI to judge how to call the Nasdaq. An overbought RSI does not automatically mean a trend reversal, but with the Nasdaq, I always keep a close eye on this.

Over the last several weeks, the Nasdaq’s RSI has indicated a consistent pattern.

The Nasdaq pulled back on December 9 after exceeding an RSI of 70 and briefly pulled back again after passing 70 again four weeks ago. We also exceeded a 70 RSI just before the new year, and what happened on the first trading day of 2021? A decline of 1.47%.

The last time I changed my Nasdaq call from a HOLD to a SELL on January 11 after the RSI exceeded 70, the Nasdaq declined again by 1.45%.

Despite ticking back up on Tuesday (Jan. 19), the Nasdaq is still no longer technically overbought. But the tech IPO market screams dot-com bubble to me.

Last week, Lender Affirm nearly doubled in its public debut, while Poshmark surged by over 130% during its world premiere.

I have no other words to describe it besides a circus.

I still love tech and am generally bullish for 2021. But I need to see the Nasdaq have a legitimate cooldown period and move closer to its 50-day moving average before considering it a BUY.

I also have some worries about how full Democrat control could affect tech stocks thanks to higher taxes and stricter regulations. A Blue Wave is better for small-caps than tech.

For now, because the RSI is still a HOLD, I’m keeping my HOLD call.

If the RSI ticks back up above 70, I’m switching back to SELL. The Nasdaq is trading in a precise pattern.

For an ETF that attempts to directly correlate with the performance of the Nasdaq, the Invesco QQQ ETF (QQQ) is a good option.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be ...

more

Good stuff.