The Trade War That Never Stops

U.S. President Trump shakes hands with Chinese Vice Premier Liu He. China and the United States have slapped each other with hundreds of billions of dollars in tariffs since the current trade war began (Photo by Win McNamee/Getty Images)GETTY IMAGES

Over the weekend, the White House suspended the tariff increases against Chinese goods that were scheduled to be imposed on October 15th. As they say, thank God for small favors. The reality is that President Trump is “all in” on a trade war with China. The U.S. is an imperial power that is fatally attracted to trade wars. The hostilities will continue.

Ninety-five percent of what you read in the press about economics and finance is either wrong or irrelevant. That rate is even higher when it comes to the scribbling about America’s trade deficit. Politicians spew unsupported neo-mercantilist rhetoric, claiming that the trade deficit is a malady and is caused by foreigners engaging in unfair trade practices. Business leaders also embrace and repeat such unfounded views about the source of the U.S. trade deficit. In their quest for negative news, the press latches onto this nonsense. Unfortunately, a significant segment of the public gets lost in this swirl of reportage and blindly jumps on the mercantilist bandwagon. The mercantilist ideas have legs which lend support to Trump’s trade war. This is unfortunate since the trade war is a negative-sum game. Indeed, the International Monetary Fund estimates that the war’s cost to the global economy in 2020 could amount to $700 billion, a loss equivalent to the size of Switzerland’s economy.

Armed with economic principles and solid empirical evidence, Edward Li and I have been able to turn the conventional wisdom about the trade deficit on its head. We present the arguments and the facts in our article “The Strange and Futile World of Trade Wars,” which will appear in the Fall 2019 issue of the Journal of Applied Corporate Finance.

Why are modern U.S. mercantilists so misguided? Today, their view of international trade and external accounts has its roots in how individual businesses operate. A healthy business generates positive free cash flows—revenues exceed outlays. If a business cannot generate positive free cash flows on a sustained basis or take on more debt or issue more equity to finance itself, then it will be forced to declare bankruptcy.

Business leaders employ this general free-cash-flow template when they think about the economy and its external balance. For them, a negative external balance for the nation is equivalent to negative cash flow for a business. In both cases, more cash is going out than is coming in.

But this line of thinking represents a classic fallacy of composition. This is the belief that what is true of a part (a business) is true for the whole (the economy). Alas, economics is littered with fallacies. These cause businessmen and many others to confuse their own arguments about international trade and external balances beyond reason. In the end, though, many embrace mercantilist ideas and believe that the trade deficit is a problem that is caused by foreigners.

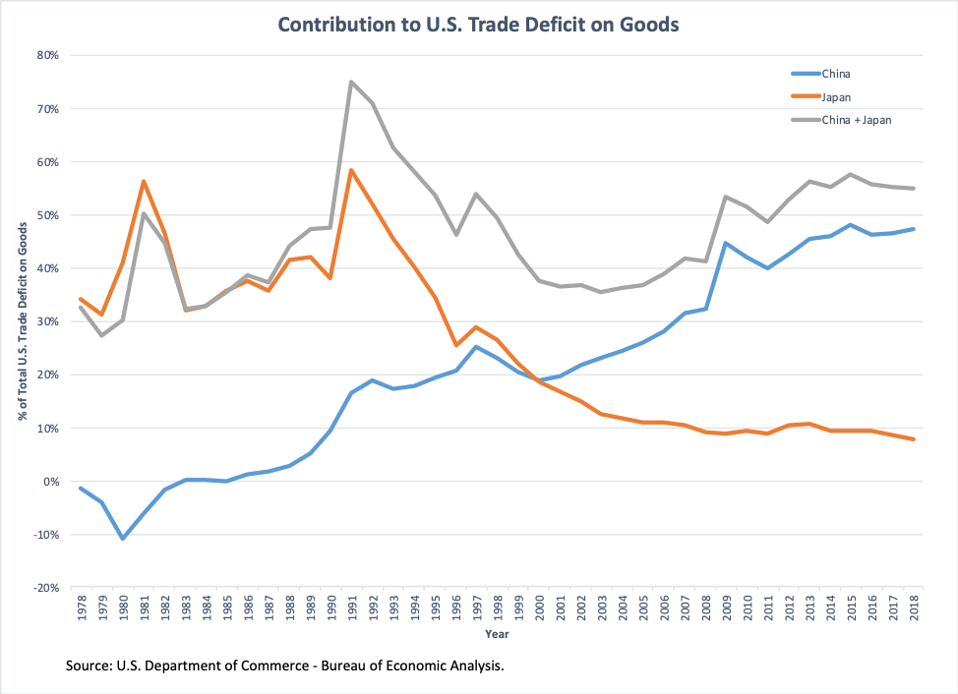

For the mercantilists, the biggest troublemakers for the U.S. in recent decades have been Japan and China, the two largest contributors to the U.S. trade deficit. As indicated in the chart below, trade with Japan accounted for the lion’s share of the U.S. trade deficit during the 1980s and 1990s, with peaks of 56.4% of the total in 1981 and 58.4% in 1991. However, since the 1990s, China has overtaken Japan as the largest contributor to the U.S. trade imbalance.

PROF. STEVE H. HANKE

Faced with those significant contributions—first by Japan and then China—the mercantilists, in an attempt to correct “the problem,” struck back. During the Reagan years, Japan was seen as an enemy that had to be dealt with—and it was. Indeed, the U.S. dealt with imports of Japanese automobiles harshly. In the face of great pressure, the Japanese agreed to a voluntary restraint agreement (VRA) to limit the export of their cars to the U.S. The Japanese VRAs on auto exports imposed costs on U.S. consumers of more than $1.1 billion per year in the 1980s, which amounted to about $240,000 for each job saved in the domestic auto industry. In Japan, however, the VRAs turned out to be a boon for Japanese companies: under the VRAs, Japanese automakers filled their U.S. export quota with higher-end cars that carried higher price tags and delivered larger profit margins.

Washington also ramped up pressure on Japan to appreciate the yen relative to the dollar. An ever-appreciating yen would, according to its advocates, reduce Japan’s contribution to America’s trade deficit. The Japanese caved under this pressure, and the yen appreciated, moving from 360 to the greenback in 1971 to 80 in 1995. But this massive yen appreciation did not put a dent in Japan’s exports to the U.S., with Japan contributing more than any other country to the U.S. trade deficit until 2000 (see chart). Moreover, in April 1995, Secretary of the Treasury Robert Rubin belatedly realized that the yen’s great appreciation was causing the Japanese economy to sink into a deflationary quagmire. As a consequence, the U.S. stopped bashing the Japanese government about the value of the yen, and Secretary Rubin began to invoke his now-famous strong-dollar mantra.

While Washington’s rhetoric towards Japan’s trade practices was one-sided and decidedly negative—Japan was presumed guilty of under-handed trade tactics—hardly a word was uttered in public about U.S. trade practices. However, there was plenty that was being uttered within the confines of the administration. I was staffing the Japanese trade portfolio at President Reagan’s Council of Economic Advisers (CEA). At every occasion possible, the CEA urged the U.S. to drop trade barriers that were actually restricting U.S. exports to Japan. Specifically, the CEA argued that the restrictions on the export of Alaskan oil to Japan and the bans on the export of logs cut on federal lands should be lifted.

At the end of President Reagan’s second term, William A. Niskanen, who was a prominent member of the President’s Council of Economic Advisers, wrote unapprovingly that: “The consistent goal of the president was free trade, both in the United States and abroad. In response to domestic political pressure, however, the administration imposed more new restraints on trade than any administration since Hoover.”

Even though Japan’s contribution to America’s trade deficit eventually began to decline, the overall U.S. trade deficit continued to expand. So, the protectionists’ policies that were aimed at Japan failed to do the trick that the mercantilists hoped for.

After the Reagan administration’s confrontations with Japan in the 1980s, discussion of international trade issues became less heated (with the exception of the rhetoric of third-party Presidential candidates Ross Perot in 1992 and 1996 and Patrick Buchanan in 2000), and policy generally favored the elimination of trade barriers.

Of course, that all changed with the arrival of President Trump and his entourage of mercantilists. By the time the Trump administration took office, China had overtaken Japan as the major contributor to the U.S. trade deficit. Today, China’s 48% share of the total U.S. trade deficit dwarfs Japan’s 7.7%. So, given President Trump’s mercantilist mentality, he has taken aim at China. The President has imposed tariffs and quotas on virtually everything under the sun. He has even gone so far as to “order” U.S. companies to stop doing business in China under the questionable cover of the International Emergency Economic Powers Act of 1977. As a consequence, the U.S. is deeply engaged in a trade war with China. Remarkably, however, this war has generated nothing in the way of reductions in the total trade deficit; in fact, the overall U.S. trade deficit has increased significantly since the arrival of the Trump administration. As the chart shows, China’s share of that increased deficit has also slightly increased.

Unfortunately, mercantilists pay no attention to history and sound economics. As long they hold sway, there will be never-ending trade wars with losers on all sides—a negative-sum game.

This article pins down the problem with Trumponomics.