The Top Of The Wealth Effect

Week two of August. Schools start back soon. Last chance for summer vacations. Football and fall return. The Dow reaches 22,000 this month, proving the “wealth effect” has worked…right?

Yet, cognitive dissonance abounds as we watch global markets and world news.

North Korea Says Guam Strike Plan Ready Within Days, CNN, Aug 10 ‘17

Chinese Daily Turns Outright Hostile, Says Countdown to India-China War Has Begun, The Economic Times, Aug 9 ‘17

Will these headlines turn into events that impact financial markets across the world? Will computers continue their game of “everyone follow the crowd”?

One of the many signs that continue to warn everyone is Newton’s third law of thermodynamics; for every action there is an equal and opposite reaction.

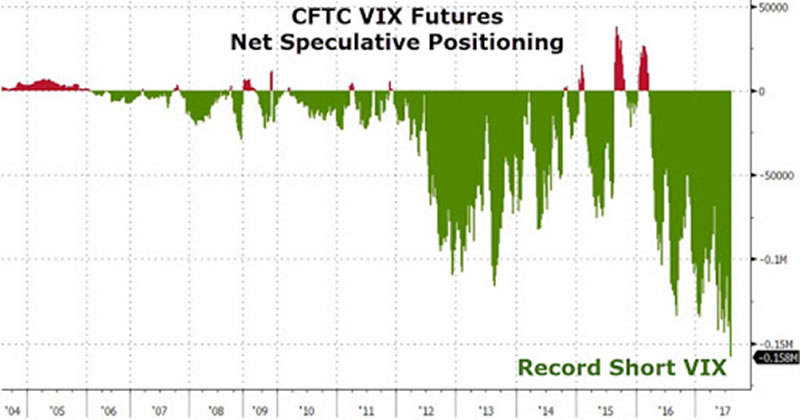

[Source – There Has Never, Ever Been This Many Trades Betting on VIX, Zero Hedge, Aug 9 ‘17]

Without HFT computer programs playing millisecond day trading games, the public’s view of “peaceful rising stock market” would have never developed this strongly. Without trillions in new debt (QE) pouring into global markets for 9 years, the public’s faith in the actions of central banks would not be so tenacious.

The problem with focusing on how individuals FEEL from investing in a calm rising market, is that our senses continue to disconnect from what science teaches about compression.

What if August 2017 turns out to be the final top in the current global stock bubble that began in 2009? What tools should we all consider? How will the individual “investing” with the money flood into ETFs this year at record highs FEEL when the boom becomes a bust?

Click here to join the readers of the Investor’s Mind? Start reading my longest newsletter since starting it in January ...

more