The Time For Caution

Image Source: Pexels

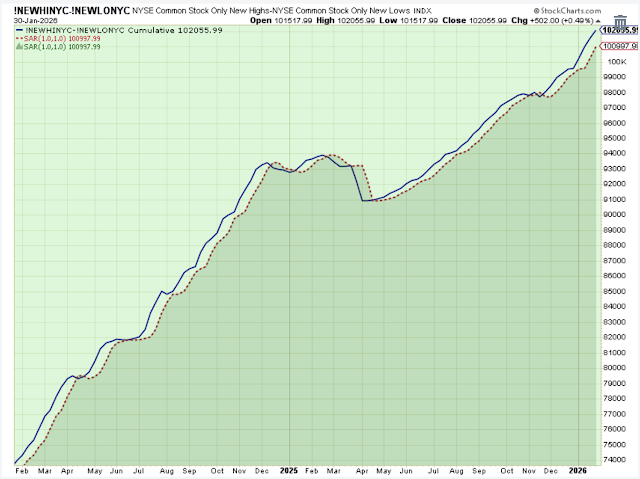

The SPX has been unable to make much progress into higher price levels for a couple of months. It seems ready for a price consolidation, which means it is likely time to be a bit cautious towards stock prices in the longer-term. Also, the number of new 52-week lows is slightly elevated, which adds strength to this cautious view.

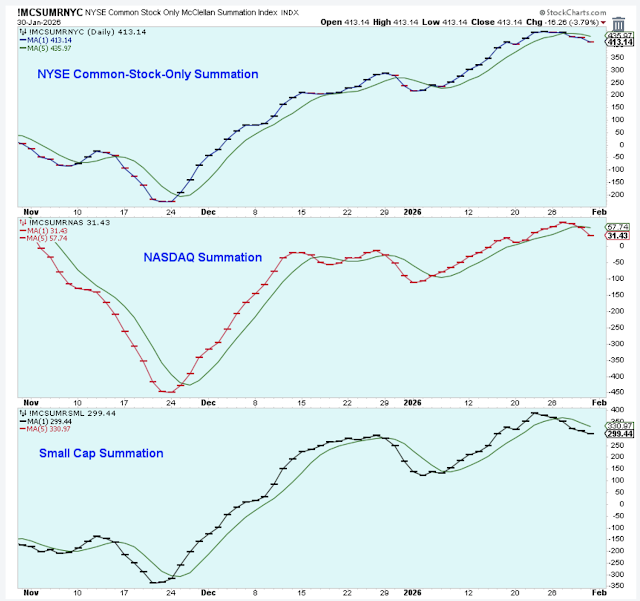

The summations are now pointing lower in a reasonably convincing fashion, which also adds to my cautious view. I would consider this chart to be a short-term view of the market, whereas the previous chart provides a longer-term look.

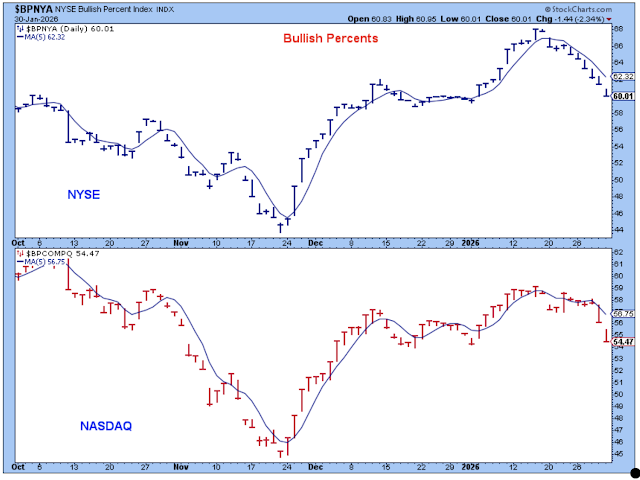

The bullish percents are pointing lower as well, which is another caution signal for the short-term.

It is time to be cautious towards stocks, but just how cautious?

This chart of the junk bond ETF may help answer that question, and at the moment, it isn't showing any weakness, meaning there is no reason to rush out and sell all our stocks. However, if the price of this ETF turns negative, I'd probably take a strong defensive stance in my accounts.

Bottom line: I am about 90% invested in stocks, but I'll be ready to bring that percentage way down when the indicators turn negative, as I suspect they will.

Shown below is my favorite indicator regarding the medium-term direction of stock prices. At the moment, it is pointing decisively higher rather than lower, another indication that there is no reason to rush to sell.

Oil prices have been on the rise. Higher oil prices are a headwind for technology stock prices, and this is trouble for anyone expecting the Fed to be accommodative to the stock market.

The price of oil may have rallied recently, but it is still way below this downtrend.

This commodity ETF is really pointing higher now.

Energy stocks are just starting to make their move into new highs. The explorers, not yet.

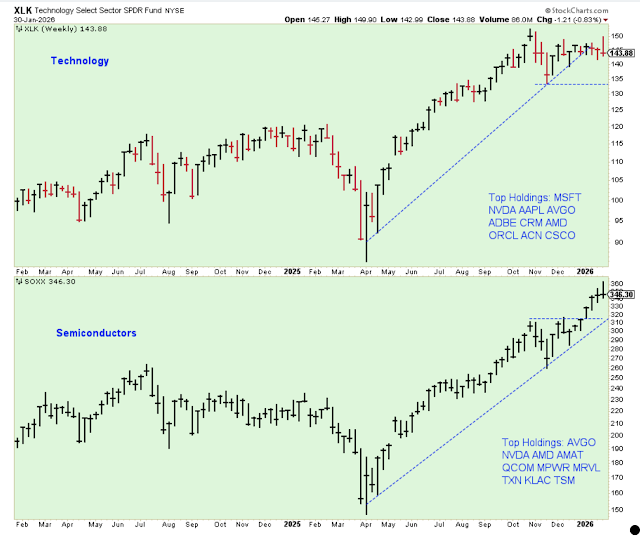

The technology ETF is starting to look like it could roll over, but the semiconductor ETF has continued to show strength. I believe that the stock market needs the leadership of technology to continue to move higher.

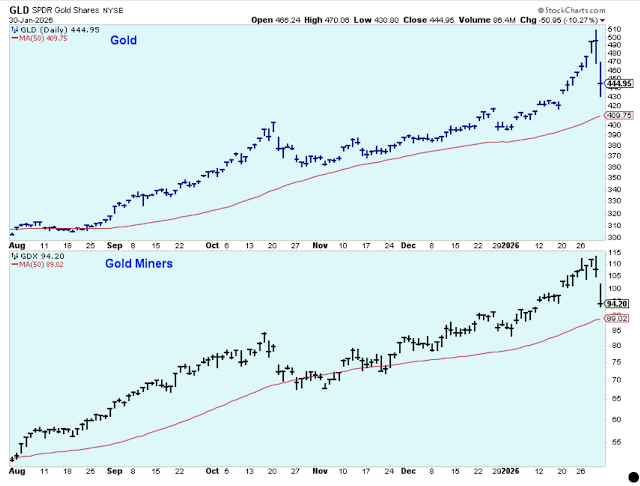

Gold and the precious metals took a big hit last week, but prices were so extended that the decline just brought prices down to reasonable levels.

The negative divergence of the Nasdaq and Bitcoin continues. Not that much is being made of it in financial media, which surprises me. My take is that Bitcoin is highly speculative, and that speculative stocks are the first to sell off in the late stage of a bull market.

It is more evidence that the bull market is mature and that the late-stage sectors will continue to outperform, such as telecom, materials, staples, and blue chip stocks with strong balance sheets and a history of dividend payouts.

This ETF showed some very nice strength last week.

Consumer Staples are starting to outperform. This hasn't broken out yet, but my guess is that it will.

Telecom has been outperforming for quite a while. This ETF is also very defensive and often does well in the late stages of a bull market.

Outlook Summary

- The short-term trend is down for stock prices as of Jan. 15.

- The medium-term trend is neutral for Treasury bond prices.

More By This Author:

A Healthy And Steady Market14 Charts Headlining Thie Week

A Mixed Market To Start The Year

Disclaimer: I am not a registered investment advisor. I am a private investor and blogger. The comments below reflect my view of the market and indicate what I am doing with my own accounts. The ...

more