The S&P Stalls At Its 50 DMA Ahead Of A Huge Week

(Click on image to enlarge)

As I suggested late afternoon last Thursday, the most likely scenario was for the S&P to gap up to near its 50 DMA in the wake of strong Google (GOOG) and Microsoft (MSFT) earnings and then trade sideways for the rest of the day – pushing off a resolution of its current range (4950 – 5250) until this week. And that’s exactly what happened. The major indexes are flat today as the real moves won’t take place until later in the week when a huge amount of data will be released. In addition to 167 S&P components reporting earnings this week – including Amazon (AMZN) and Apple (AAPL) – there is a Fed Decision on Wednesday and the April Jobs Report on Friday.

(Click on image to enlarge)

First up are AMZN earnings on Tuesday afternoon. While AMZN has been overshadowed lately by other Magnificent 7 stocks like Nvidia (NVDA) and Facebook (META), it is still a massively important part of the global economy with a market cap approaching $2 trillion. In addition to its enormous retail operation, AMZN also has Amazon Web Services (AWS), its cloud computing division that is the crown jewel of the company. In fact, AWS accounted for two-thirds of AMZN’s entire operating profit in 2023.

(Click on image to enlarge)

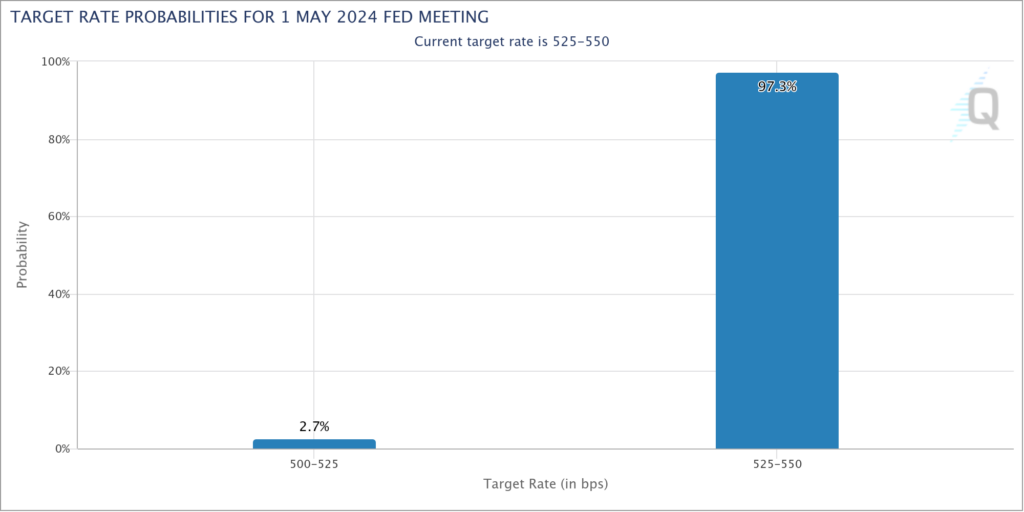

Next up is the Fed Decision on Wednesday at 2:00 pm EST. While they will hold interest rates steady, all eyes will be on Chair Powell’s press conference for any indication about how the Fed is thinking about things going forward. There is a lot of confusion about the economy, inflation, and rates at the moment so investors will be hanging on Powell’s every word as usual.

(Click on image to enlarge)

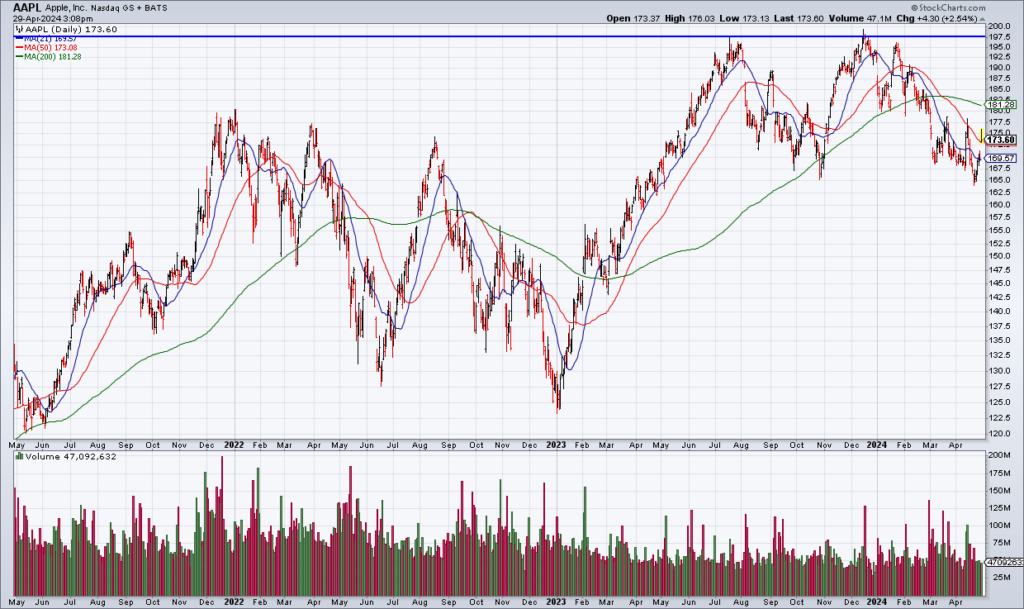

Next up is Apple (AAPL) on Thursday afternoon. AAPL got a big upgrade today by Bernstein’s Tony Sacconaghi but made a double top around $200 last year and is currently trading well below that level. Can AAPL gets it mojo back or are its best days behind it?

Last, on Friday morning the April Jobs Report will be released by the BLS at 8:30 am PST. Investors will be parsing the numbers for clues about the strength of the economy and its implications for Fed policy.

(Click on image to enlarge)

More By This Author:

Scenario Analysis For Friday’s Trading Session

GOOG/GOOGL: Blowout Quarter, MSFT: Excellent Quarter As Well

Meta Reports An Excellent Quarter – And The Stock Is -12%