The S&P And Nasdaq Are Rebuffed At 50-Day Moving Averages, But Russell Has Potential

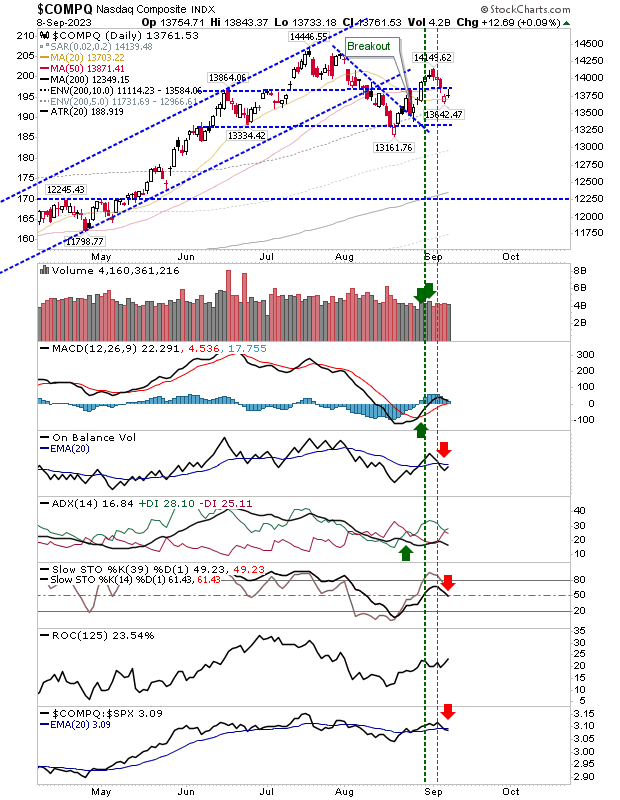

Friday's brief recovery for the S&P and Nasdaq quickly found itself running into trouble at their respective 50-day MAs. It was a little different for the Nasdaq in that it started the day at its 50-day MA, but the early rally stalled out after it closed the Thursday gap down.

The Nasdaq experienced a new 'sell' trigger in slow stochastics and an underperformance relative to the S&P, joining the earlier 'sell' trigger in On-Balance-Volume. Given that, I would be looking for some weakness early next week, but a close above Friday's doji high would negate the weakness of that candlestick.

The S&P, like the Nasdaq, closed Friday with a similar doji but did so from below its 50-day MA, adding considerable resistance pressure; stochastics now undercut the (bullish) mid-line with the ADX (trend metric) in flux. The S&P is outperforming the Russell 2000, so there is a chance it could make up this weakness on Monday, but caution is advised.

The Russell 2000 (IWM) was the only index to lose ground on Friday, but it may be in the best position for the start on the week if you are a bull. However, the selling was enough to see a new 'sell' trigger in the MACD from below the bullish mid-line for the indicator, usually a sign of worse to come.

Where we need to be careful is the weekly chart for the Russell 2000. We have a convergence of 20-week, 50-week and 200-week MAs with an ugly bearish candlestick to close the week. Should the week close (and we have until Friday before we see this) below its 200-week MA, then there is the potential for a whole lot of pain.

While Friday's trading had more bearish than bullish tones, the Russell 2000 - the most bearish of indices - looks best placed to benefit from buying given its proximity to major support of its 200-day MA. We need to be watchful of the picture on the weekly timeframe, but there are five days of trading before this comes into play.

More By This Author:

Russell 2000 Coming Up To Test Of 200-Day MASelling In Russell 2000 Undercuts Breakout Support

Important Test For Russell 2000 As Nasdaq And S&P Turn Net Bullish

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more