The S&P 500 Rises Out Of Bear Territory Again

The S&P 500 (SPX) tracked upward in the week ending 8 July 2022. The index closed the week at 3,899.38, putting it 18.7% below its all-time record high from 3 January 2022.

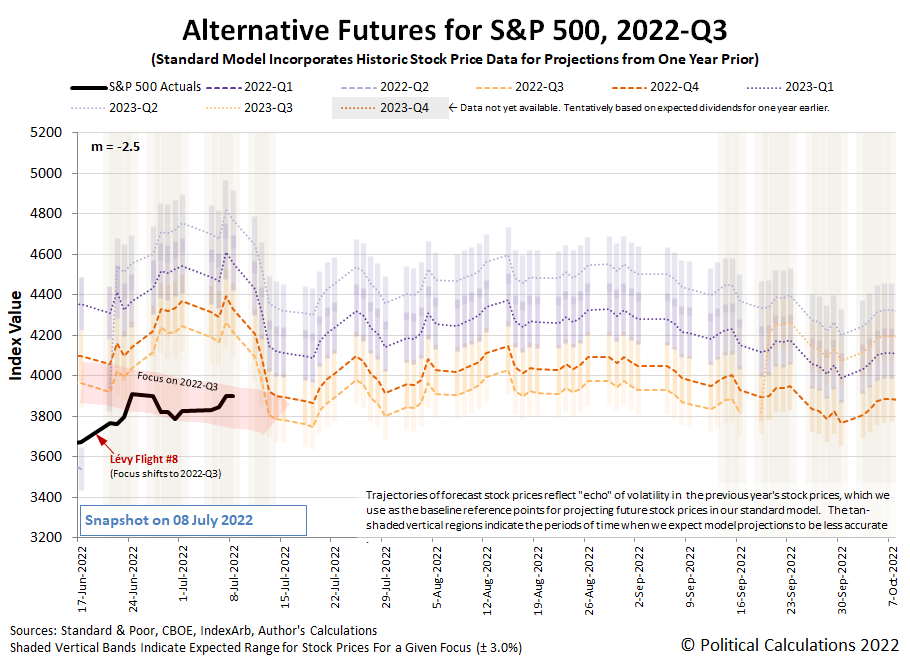

Stock price volatility was normal throughout the week, with the trajectory of the S&P 500 rising within the dividend futures-based model's projected trajectory associated with investors focusing on the current quarter of 2022-Q3:

The outlook for the index throughout 2022-Q3 has improved from what we first described several weeks ago, which still held as recently as last week. As you can see in the latest update to the alternative futures chart that now covers 2022-Q3, the level of the S&P 500 is within spitting distance of where the model projects the trajectory of the index will go after we reach the end of the latest redzone forecast range.

Here's our summary of the market-moving news headlines from the Fourth of July holiday-shortened first trading week of the 2022-Q3 calendar quarter:

Tuesday, 5 July 2022

- Signs and portents for the U.S. economy:

- Recovery signs following China lifting government's COVID lockdowns:

- Central bank minions gearing to to launch more rate hikes to face inflation:

- ECB minions face inflation-harming Eurozone economy, analysts think policy response almost certain to fail:

- S&P 500, Nasdaq end higher as investors eye economic path

Wednesday, 6 July 2022

- Signs and portents for the U.S. economy:

- Fed minions all on board with June's three-quarter percent rate hike:

- Bigger trouble developing everywhere?

- Wall Street ends up as investors absorb Fed minutes

Thursday, 7 July 2022

- Signs and portents for the U.S. economy:

- Fed minions say they want smaller rate hikes. Also say they won't cause recession, but willing to risk it:

- Bigger trouble developing in France, U.K.:

- ECB minions thinking about the bad choices they have to make:

- S&P, Nasdaq end higher as July hot streak continues

Friday, 8 July 2022

- Signs and portents for the U.S. economy:

- Fed minions starting to wonder what they'll do after big rate hikes, expect stagflation for 2022, pledge to all go down together:

- BOJ minions claim they see inflation going up, but won't stop never-ending stimulus:

- Wall Street gyrates to muted close as investors weigh jobs data in rate debate

The CME Group's FedWatch Tool now projects a three-quarter point rate hike for July 2022 (2022-Q3). That's followed by half point rate hikes in September (2022-Q3) and November (2022-Q4), then a quarter point rate hike in December (2022-Q4) to wrap up the year.

The Atlanta Fed's GDPNow tool now projects real GDP will shrink by just 1.2% for the just ended quarter of 2022-Q2, improving from the much more pessimistic -2.1% it indicated last week.

More By This Author:

Falling Affordability Trend For New Homes Slows In May 2022Dividends By The Numbers In June 2022 And 2022-Q2

The S&P 500 Trends Downward To End 2022-Q2

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more